Open Interest in the gold and silver markets has collapsed, but take a look at this…

Within hours the audio interview with legend Pierre Lassonde will be released! In the meantime…

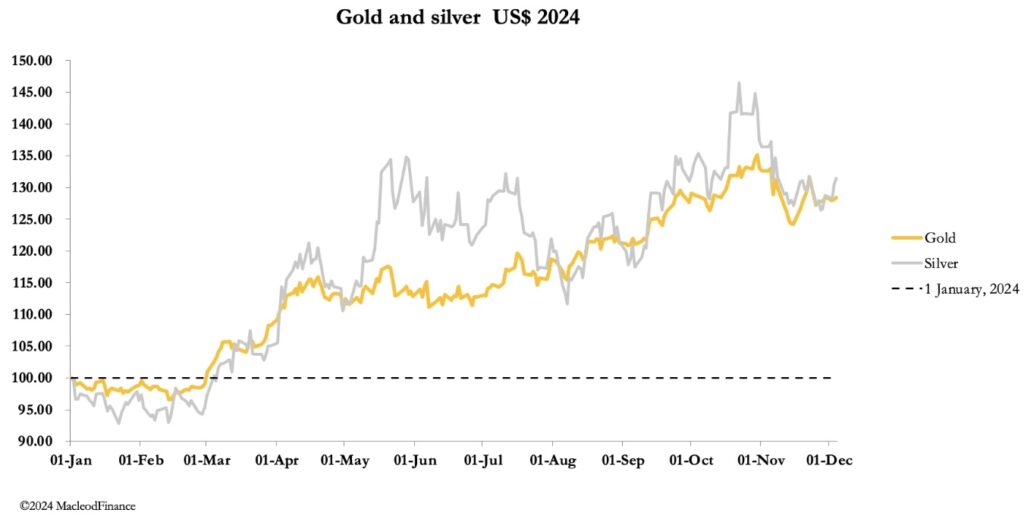

December 6 (King World News) – Alasdair Macleod: There is an underlying firmness in precious metals prices as we approach the year-end. The downside now appears limited with next year looking bullish.

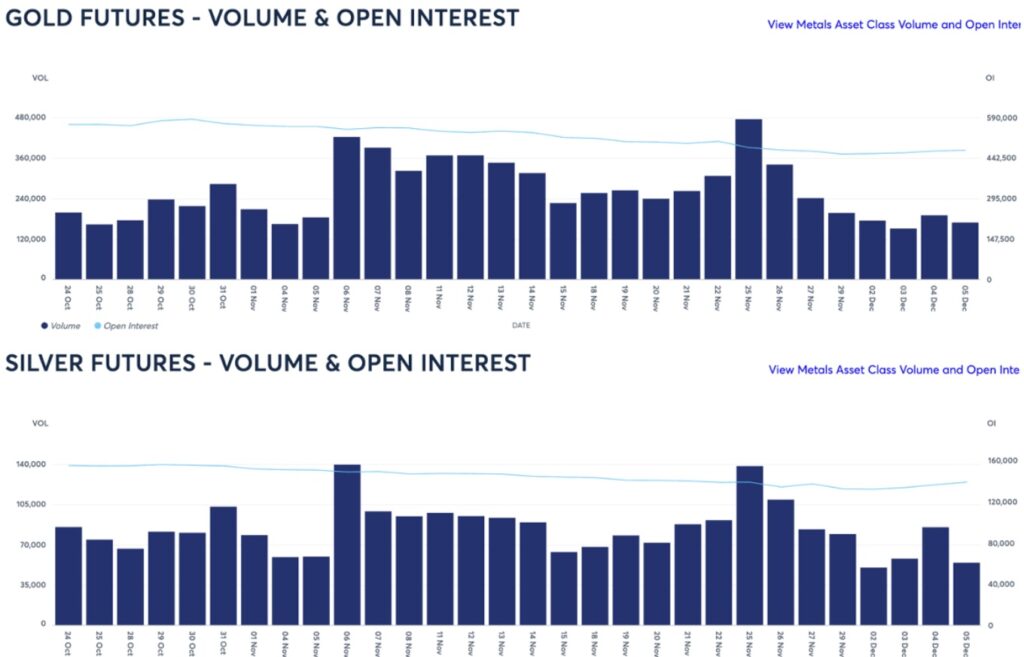

Gold consolidated in a narrow trading range this week, while silver gained some ground. In early morning European trade, gold was $2642, $3 up on balance from last Friday’s close, and silver was $31.30, up 81 cents on the same timescale. Comex futures trading was light, as the following screenshots show for gold and silver respectively:

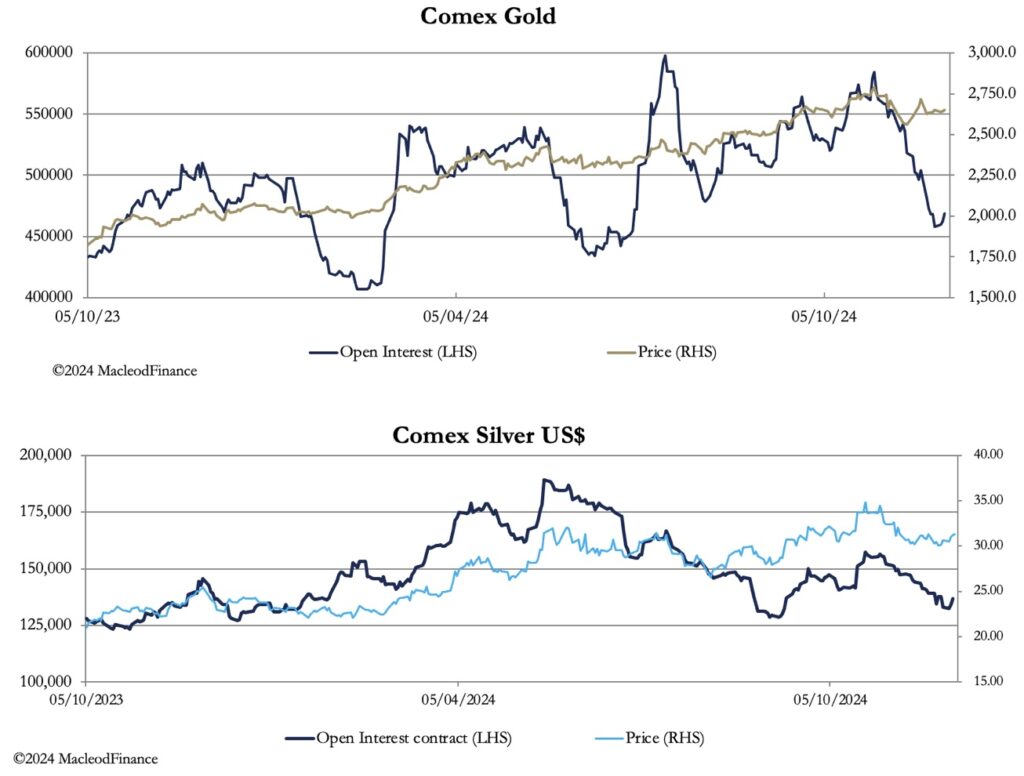

These declining volumes indicate is that selling pressure is light, which coupled with the substantial decline in gold’s Open Interest confirms that gold is in oversold territory:

Silver’s OI is also relatively low, but the dramatic collapse on OI has been in gold, indicating weak holders have been shaken out. Silver’s rise in quiet conditions indicate a gentle bear squeeze, and in gold bullish speculators being currently absent will return to buy…

ALERT:

Look at which company has positioned itself to become the next K92 high-grade gold powerhouse! CLICK HERE OR ON THE IMAGE BELOW.

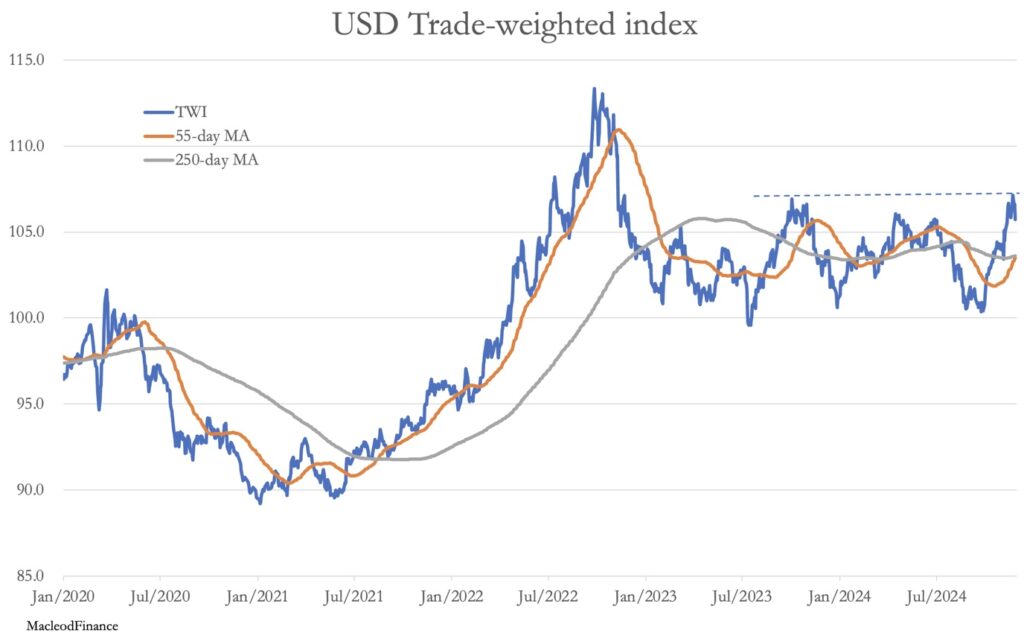

Undoubtedly, gold and silver have been hit by the unexpected surge in the dollar, following Donald Trump’s election as the next US president. But the momentum behind that surge appears to have evaporated for now. As an indication, the dollar’s trade-weighted index is up next:

With a golden cross under it, the chart looks bullish for the dollar, but it probably needs to consolidate, back testing the 104 level. Its future from there is unclear, given that it has failed to break out of a two-year long consolidation.

Evidence of underlying support for gold was seen in the stands-for-delivery on Comex, which totalled 16,501 contracts (51.32 tonnes) in the five trading sessions since Thanksgiving. This compares with the excitement behind the discovery that China recently took 60 tonnes out of the UK in September according to UK customs figures. But few seem to notice the deliveries from bullion banks on Comex into other hands.

So far this year, 457 tonnes have been stood for delivery on Comex, and 6,016 tonnes of silver of which 1,047 tonnes are since Thanksgiving. These are enormous figures for a market where the concept of delivery was purely notional…

ALERT:

To learn about one of the greatest gold & silver royalty companies in the world CLICK HERE OR ON THE IMAGE BELOW.

There are mounting problems facing in EU which may benefit gold and silver next year. The German coalition government collapsed recently, and elections are called for 23 February. Until then and only if there is a clear outcome, Germany is politically rudderless, when a growing military crisis in Ukraine needs Germany’s full support. And this week, the French government was also in crisis, with Prime Minister Michel Barnier having failed in his attempt to get his budget through and was forced to resign.

Bond market analysts are monitoring closely the spread between French and German bonds, concerned that they could signal a funding crisis for France’s government, which is heading for a budget deficit of 7% next year. The fact is that government finances in the entire G7 are in debt traps (excepting Germany which has other problems) without the political resolve to take the necessary action. This is bad for currencies and good for gold, which is why central banks are selling G7 currencies to buy gold.

In conclusion, gold and silver’s consolidation phase may not be over yet, but selling pressures appear to be minimal while Chinese (and other central banks, wealth funds, and governments) continue to drain physical liquidity out of markets. The squeeze on the shorts is set to return, driving gold and silver higher in the coming months.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.