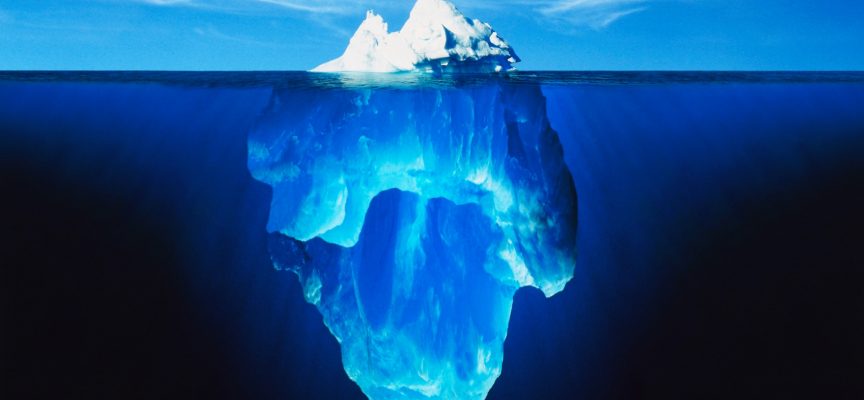

Today one of the greats discussed collateral damage and icebergs that are dead ahead.

Icebergs Ahead

By Bill Fleckenstein President Of Fleckenstein Capital

September 17 (King World News) – The stock market opened with a thud, led lower by the Nasdaq, which fell 1%, while the Dow and S&P had much smaller losses. It would appear that the decline was associated with the latest ratcheting up of Chinese tariffs by Trump, but that is just a guess because, to state the obvious, nothing thus far has managed to derail the number one beneficiary of worldwide money printing, that being the U.S. stock market.

Unsinkable?

However, we can’t lose sight of the fact that there are many large icebergs ahead, and while we may be able to reiterate the problems that we think we know about, there are always those that are unknown. What we do know is that the world is swimming in red ink, as debt creation, particularly on the part of governments, has been deemed to be the solution to the last crisis, which itself was caused by too much debt and wild speculation…

BONUS INTERVIEW:

To listen to billionaire Eric Sprott discuss his prediction for skyrocketing silver

as well as his top silver pick CLICK HERE OR BELOW:

To further complicate things, there are the unknowable outcomes of the current trade wars, the path of the current economy, the acceleration rate of inflation, or the number of variables that Trump injects into so many arenas on a regular basis.

Collateral Damage

I find it sadly ironic that, despite a host of TV shows and articles regarding the so-called Great Financial Crisis, almost none have been focused on trying to understand what really happened. Instead, the blame usually falls on Lehman Brothers, when Lehman was just a consequence of policies that led to runaway speculation, which combined with incredible leverage on the part of banks and brokerage firms to blow up the financial system.

While the banks aren’t liable to be the epicenter of the next crisis, government debt almost certainly is. Of course, almost everyone has learned there is a printing press with which to “solve” these problems (just look at Japan), but at some point, the psychology on inflation will change and that option will become much more complicated to use. The fact is, the world is headed into a very tricky period and it is really difficult to see how it will play out, except to say that the chances for a benign outcome to all of the recklessness we have seen over the last decade is about as close to zero as it can be.

Turning back to the action, in the afternoon, the market weakened some more, led lower by Nasdaq, which fell 1.5% on the day, while the S&P gave up around half that. (After the close, Trump is supposed to announce more tariff news, so we will have to see how that gets digested tomorrow.)

Not Exactly a War of Wits

Away from stocks, green paper was weaker, I’m sure to the surprise of all those who think that trade wars and anything else we do in America is supposed to be bullish for the dollar. Fixed income was flat, and the metals bounced: silver by about 1% to gold’s roughly 0.5%, eradicating most of Friday’s swoon, which may have been related to expectations around what Trump may do on trade, given it would appear that so many seem to think an escalation of tensions means buy dollars and U.S. stocks and sell gold. Not that such thinking makes any sense, but it has been at work for some time now.

***KWN has now released the powerful and timely KWN audio interview with Andrew Maguire and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

***To subscribe to Bill Fleckenstein’s fascinating Daily Thoughts CLICK HERE.

ALSO JUST RELEASED: Legend Says The World Is On Fire As Gold Surges And Trade Wars, Currency Wars And Financial Wars Heat Up CLICK HERE TO READ.

© 2018 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.