We are now looking at one of the best set ups ever as the gold sector sentiment is flashing capitulation! Plus Miner merger mania and all is not well with the world.

One Of The Best Set Ups Ever

December 9 (King World News) – Graddhy out of Sweden: Again, contemplating this text will be one of the best spent moments of your investment life. I have posted on all the commodities sectors moving, and general equities might be starting a final blow-off here, including lagger area small companies. Let this sink in, today. Said for 2 years that we are in for inflation and not deflation. Many are catching on. Main drivers: – QE, debt and broke nations – failing monetary system – supply shortages – rising commodity prices – emerging fossil fuel energy crisis – green energy talk without infrastructure…

To find out which silver company just made a major acquisition that will

quadruple their production click here or on the image below

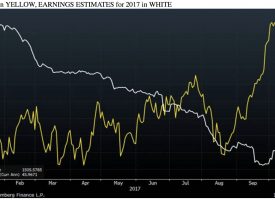

PM SENTIMENT

Graddhy out of Sweden: This chart caught September big low to the day, as posted; purple circle. At major lows, sentiment has to be bearish for a turn to happen. Here is one way to measure sentiment. It is now down at blue dots level, i.e. sentiment is where pm has turned many times before.

THE GIVE UP PHASE:

Bullish Contrarian Alert…

Mining Sector Sentiment Flashing Capitulation!

All Is Not Well

Albert Edwards: A ll is not well. Real 10 year yields are plunging in Germany (now -2.1%) and especially UK (-3.5%). Incredible! We’re getting a misleading impression of real yield stability in recent weeks watching the US market. And who would have thought Japan would end up the high yield market (see below).

ALL IS NOT WELL:

This Can’t Be Right…

Is Japan Now The High Yielding Market?

This Will Surely Change

Fred Hickey: While there’s little investor interest in gold miners (for now), sure has been lots of deal activity recently with AEM acquiring Kirkland Lake, Newcrest buying Pretium, Northern Star with a potential 50% stake in Osisko Mining’s Windfall project and Kinross buying Great Bear.

These deals have one thing in common – with the exception of Kirkland’s Fosterville mine (in Australia), all the mines acquired are located in geopolitically-safe Canada. As I’ve been saying for some time, these well-located, good economics mines/projects deserve higher multiples.

The biggest miners have noticed and are taking action (while prices are still low). Just one problem for me: one-by-one, some of my biggest positions are being taken away from me.

***ALSO JUST RELEASED: Shocking Video, Plus More Stunning Charts As The Monetary Madness Continues CLICK HERE.

***ALSO JUST RELEASED: Central Banks, Gold And The Metaverse CLICK HERE.

***ALSO JUST RELEASED: Gold, Commodities And Even More Inflation As We Near The End Of 2021 CLICK HERE.

***ALSO JUST RELEASED: Gold In A Paper Storm As Fear And Inflation Begin To Grip The World CLICK HERE.

***ALSO JUST RELEASED: A Look At Some Truly Stunning Charts, Plus Silver, Global Madness And A Modern Day Paul Volcker CLICK HERE.

© 2021 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.