Here is a look at the new normal for gold as mining stocks remain catastrophically undervalued.

Silver & Gold Rush

October 20 (King World News) – Email from King World News reader Grant W: G’day KWN, there is noises coming out of China because of massive supply shortages, massive demand and sky-rocketing premiums that silver spot has reached $125 p/o U.S, yes you heard that right $125, if true this is absolutely astonishing and a clear indication that the herd has spooked, and are piling in at any cost, won’t be long before it spreads.

Grant W

The New Normal For Gold

Email from King World News reader Charles P: This is gonna be the ‘New Normal’ for a while, at least.

Being 74, I suffer from Geezer Insomnia Syndrome, so I was up and watching in the wee hours this morning.

The MINUTE China went home for the weekend [on Friday]……. out came the Long Knives, and the carnage that has persisted the rest of the day.

But ‘they’ can’t keep this up forever, and as soon as China lights the trading turrets Monday morning, they’ll be back in control.

It’s also worth noting the CRIMEX trotted out their usual “slow the mo’ “ trick by raising margins, for all the good it will do them now, since physical is obliterating them. But just as the 300 Spartans at Thermopylae, they’re all going out on their shields.

Keep up the good work!

Charles P.

Crazy Thing About Gold Stock Rally

Peter Schiff: The crazy thing about the gold stock rally is that despite stocks doubling or tripling, many are cheaper now than they were before the rise. Not only has the gold price surged, but the oil price has dropped. So profits will likely rise by larger percentages than the stock prices.

Scared Out All Weak Longs

Peter Schiff: GLD just hit a new record high. But due to Friday’s gold sell-off that scared out all the weak longs in precious metals mining stocks, the GDX and GDXJ are still about 7% below last week’s highs. Far from a bubble, the gold trade is still ruled by fear, not greed. It’s early!

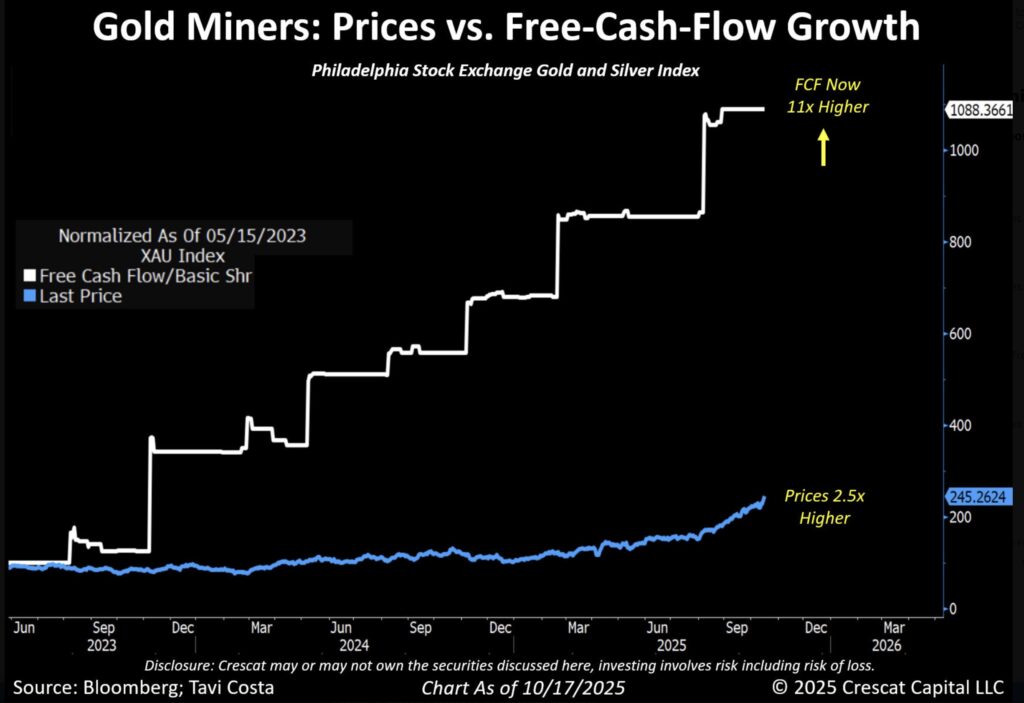

Mining Stocks Remain Catastrophically Undervalued

Otavio Costa: Mining stocks are likely overreacting today [Friday], in my view.

Put loosely, these companies are effectively printing money at current gold prices.

Yes, mining stocks have performed incredibly well recently, but the aggregate free cash flow of the Philadelphia Gold and Silver index has surged 11x.

KING WORLD NEWS NOTE: Massive Chasm Between Free Cash Flow Growth (WHITE LINE) and Mining Stock Share Prices (BLUE LINE) Is Unsustainable. Look For Mining Share Prices To Move Aggressively Higher In Coming Quarters

In short, fundamentals have far outpaced the rally, leaving these stocks even more undervalued than before.

KWN Gold Special!

In this KWN Gold Special interview listen to the man who correctly predicted that 2024 and 2025 would each be a Golden Year For Gold gives listeners an update on what to expect with gold, silver and miners CLICK HERE OR ON THE IMAGE BELOW.

Friday’s Pullback In Gold & Silver

To listen to Alasdair Macleod discuss Friday’s pullback in gold, silver and the mining stocks as well as what to expect next CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.