Here is a look at what is happening behind the scenes in the war in the gold and silver markets.

Alasdair Macleod’s audio interview has now been released! The audio interview with Nomi Prins will be released within hours! Until then…

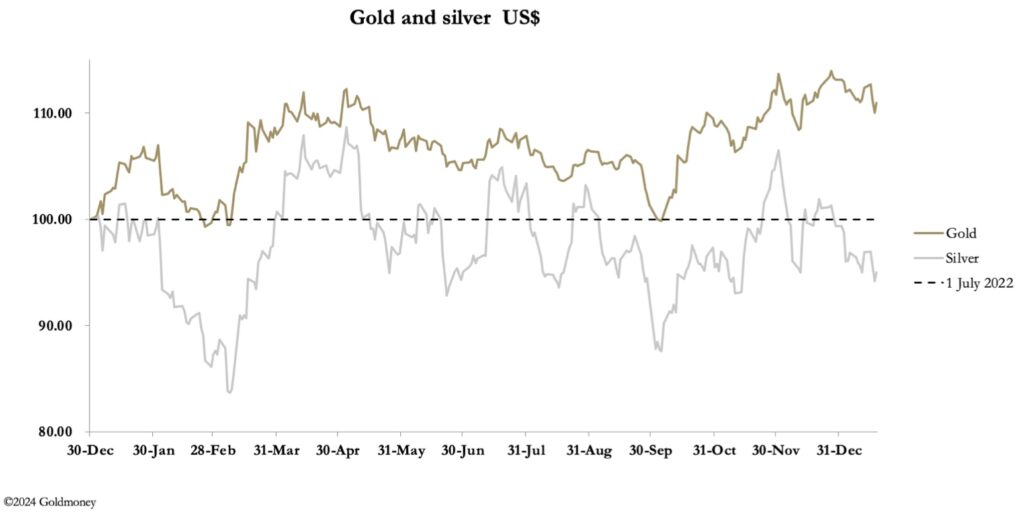

January 19 (King World News) – Alasdair Macleod: Following last week’s brief rally, gold and silver declined this week. In Europe this morning, gold traded at $2028, down $20 from last Friday’s close. And silver was $22.78, down 30 cents over the same timescale.

Comex volumes were moderate though declining as the week progressed, indicating perhaps that selling pressure is moderating.

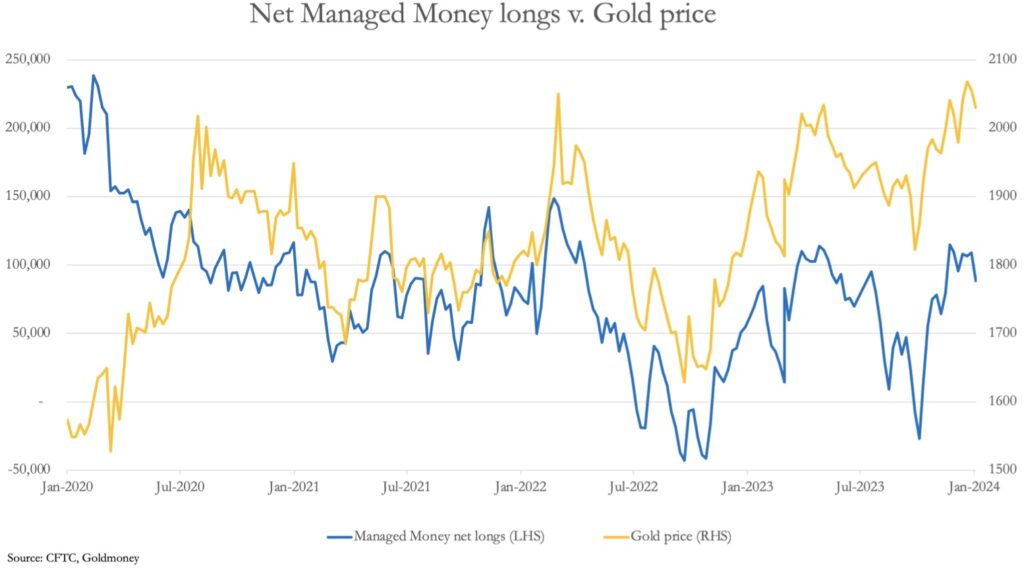

Indeed, there is an air of general disinterest in gold and silver, not helped by the Martin Luther King holiday on Monday. In gold, Comex Open Interest declined by over 23,000 contracts. Undoubtedly, this represents a modest reduction in hedge fund net longs from 9 January, the most recent Commitment of Traders report. This is our next chart.

This indicator is far from overbought (the long-term average net long is 110,000 contracts), but all else being equal there is room for further liquidation before the gold contract is oversold.

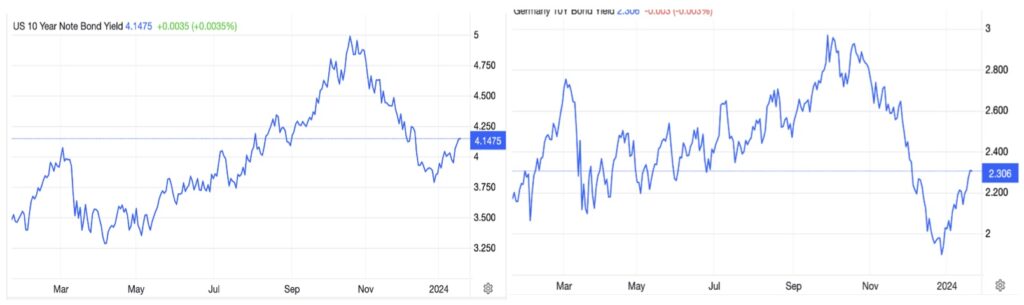

The macro story is one of growing doubts that the Fed will cut interest rates as soon as currently discounted, not helped by the closure of the Red Sea to marine traffic. Economists warn of inventory shortages and supply chain disruption likely to put upward pressure on consumer prices. Accordingly, the yields on the 10-year US Treasury Note and the 10-year German Bund have increased sharply so far this month. These are our next charts.

Reflecting higher Treasury yields, the dollar’s trade-weighted index has recovered 2.5%, retracing about one-third of its fall from early-November. The recovery in bond yields and the dollar’s correction clearly has more potential on a purely technical basis, which could see gold break below the psychological $2000 level. Gold’s technical position is next.

If gold does drift back under these conditions, support is likely at the 12-month moving average, currently $1951. A move to this level would certainly shake out speculative longs, in which case gold would be well positioned for a successful move into new high ground.

For now, market participants subscribe to the erroneous view that higher US interest rates are bad for gold, because of the increasing yield penalty. When the dollar is stable and the need to hedge out of it is minimal, this may be true. Indeed, in the 1980s gold was shorted in favour of long treasury bills, when it was clear that gold was no longer rising against the dollar. But today, this carry trade hardly exists with a short yen or euro and long dollar being a far better proposition. Furthermore, with central banks and presumably sovereign wealth funds also accumulating bullion, we have the extraordinary situation of gold being within whiskers of all-time highs in all major currencies, shortages of free supply in size, and the general public disinterested and uninvested.

Last week, the World Gold Council announced that in December global bullion ETFs sold down a net 10 tonnes of gold, completing a seventh consecutive monthly loss. In short, central banks realise the need for gold reserves clearing out supply, while the investment establishment along with the general public are bearish. Common sense tells us that the central banks know better than us. To listen to Alasdair Macleod discuss the big surprise in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.