As we kickoff trading to start the week, look at what just hit all-time highs.

March 24 (King World News) – Peter Boockvar: In light of the press reports on what the April 2nd tariffs might look like (targeted maybe but only in terms of the number of countries the tariffs will be applied to rather than targeted in terms of overall dollar size), whatever it looks like and regardless if one agrees with the application or not, let’s hope that it’s then done so businesses, households and investors can at least have some visibility from all of this and can plan around them.

Not much of a US dollar response as the DXY is down .15% and is still near giving back all of its post election gains. Specifically, the Canadian dollar and the Mexico peso are up a touch while the Chinese offshore yuan is flat in response today. Since the election, the Canadian dollar and Chinese yuan are really the only two currencies that are notably down vs the US dollar. The rest are mostly flat, including the Mexican peso.

I’ve argued that the real moves in the US dollar index have been more influenced by the foreign flows in and out of the Mag 7 stocks as they became a global reserve asset. In case you didn’t see, on Friday in the BoA Flow Show, Michael Hartnett said while US stocks saw the biggest inflow of 2025 ($34.1b); “but note past 2 weeks have seen biggest foreign selling of US stocks since Mar ’23” and that with Europe stocks: “biggest inflow since May ’17, and 4th largest ever ($4.3b).” Investors have discovered other choices.

We continue to have specific international equity exposure in Europe, Japan, Hong Kong, Singapore, Vietnam and most recently Brazil. Emerging market local currency bonds we own as well. And there are plenty of cheap, value stocks in the US that have been kicked to the curb that we own and like, including commodity stocks in oil/gas, uranium, precious metals, ag and industrial metals.

Bottom Line

Bottom line, that playbook that worked so well over the past few years by mostly owning 7 US stocks and some other ones here and there (like utility and electrification stocks that were a play on AI), throw it in the garbage as a new one is being written. There should be nothing profound about that by the way as changing cycles and leadership in markets has been going on since the history of markets.

With inflation on the services side, “Both input costs and selling prices are rising at a slower pace compared to recent months. Lower input cost inflation points to less pressure from wages which are a key ingredient of input costs in the labor intensive services sector.” In manufacturing, “price increases for both selling and purchasing remain moderate, helped along by declining energy costs.”

Fed Hurting Savers

I will add this as we debate what the Fed will do with short term interest rates. Savers, particularly baby boomers, have benefited hugely from higher interest income with higher rates. That has gotten chipped away somewhat by 100 bps since last September and if the Fed starts cutting again, while good for some borrowers, will negatively impact interest income.

Take $1mm of savings as an example, when the fed funds rate was at its peak prior to the September 50 bps rate cut, it was generating about $50k of pre-tax income. That is now about $40k. Further cuts could be the price of a cruise and a canceled vacation.

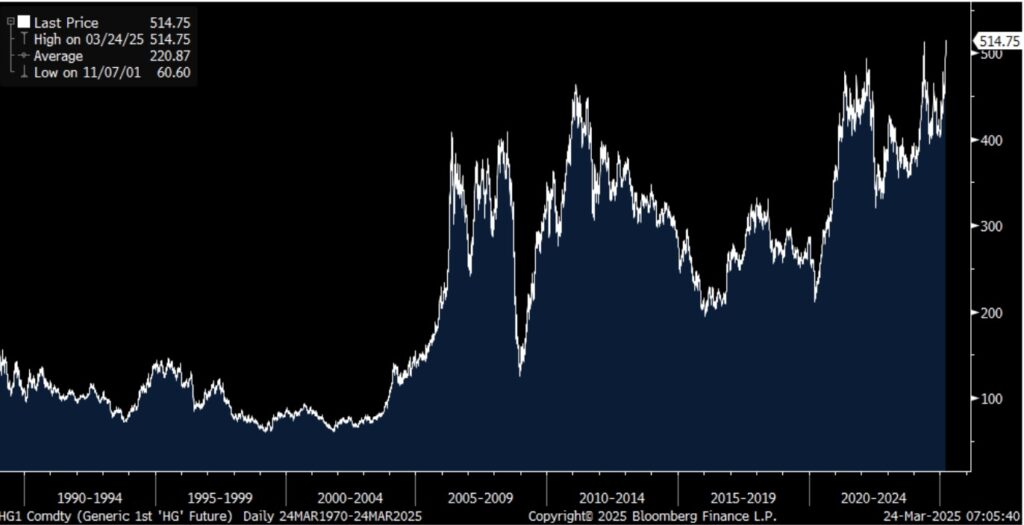

Lastly, here is a fresh chart on copper for the continuous contract and is at a fresh record high today.

Copper Hitting All-Time Highs

BUCKLE UP: Expect Brutal Bear Market In US Stocks

To listen to Rob Arnott discuss what could be a brutal bear market in the US stock market as well as what to expect from stock markets around the world, and much more CLICK HERE OR ON THE IMAGE BELOW.

JUST RELEASED! Gold Closes The Week Above $3,000

To listen to Alasdair Macleod discuss the gold and silver markets and more CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.