Here is a look at Euphoria, China and crude oil.

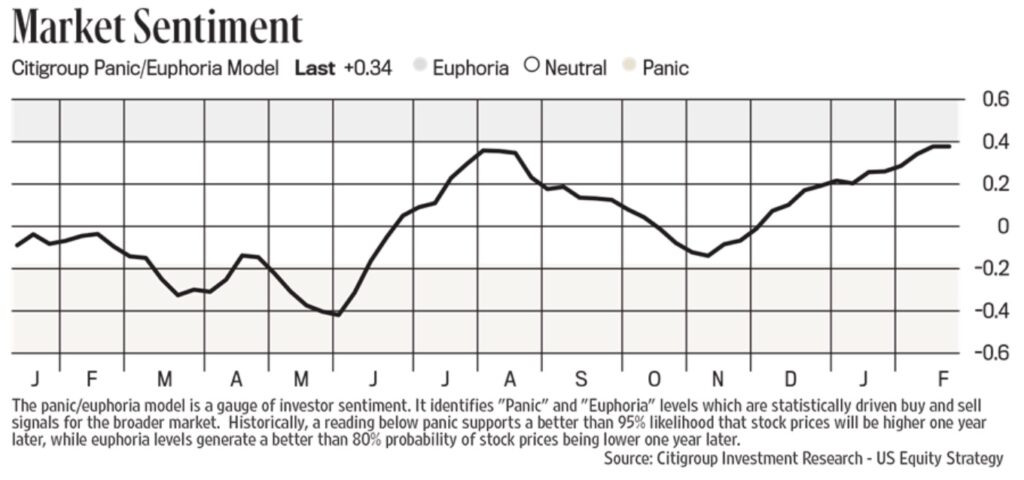

February 20 (King World News) – Peter Boockvar: Again, it’s important to be aware of one’s investing surroundings, particularly when it comes to sentiment when it gets extreme. The updated Citi Panic/Euphoria index is on the cusp of entering euphoric territory. What does it mean if it gets there? According to Citi, “euphoria levels generate a better than 80% probability of stock prices being lower one year later. Currently the reading at or above .41 indicates euphoria.” It closed at .34 vs .30 in the week before. That’s the highest read since mid January 2022.

CAUTION: Euphoria In Stocks

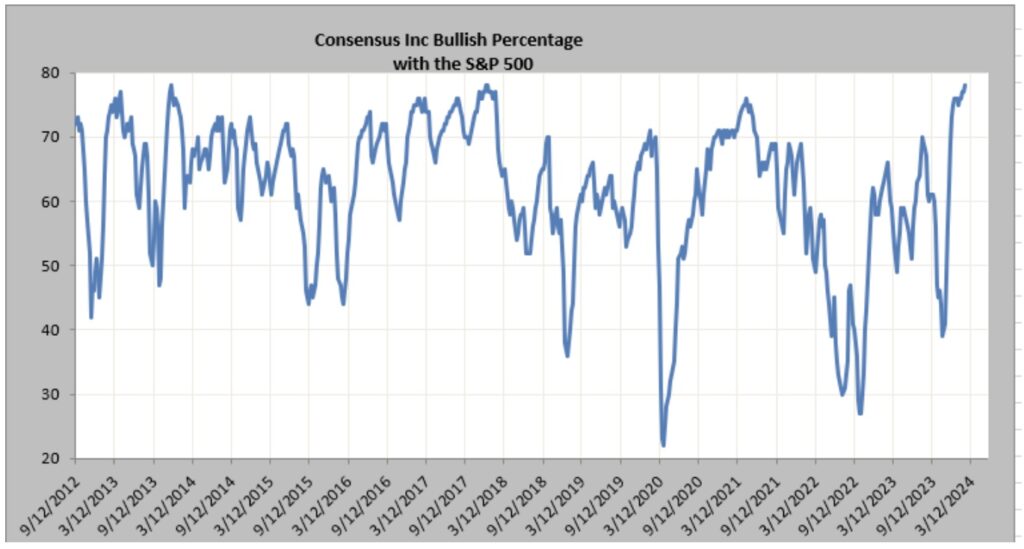

Also, the Market Vane Consensus Bulls reached 78, a level last seen in December 2013, h/t to my friend Helene Meisler. “The Bullish Consensus measures the futures market sentiment each day by following the trading recommendations of leading Commodity Trading Advisors.”

Also, the Market Vane Consensus Bulls reached 78, a level last seen in December 2013, h/t to my friend Helene Meisler. “The Bullish Consensus measures the futures market sentiment each day by following the trading recommendations of leading Commodity Trading Advisors.”

CAUTION: Euphoria In Stocks

Crude Oil Pessimism Continues

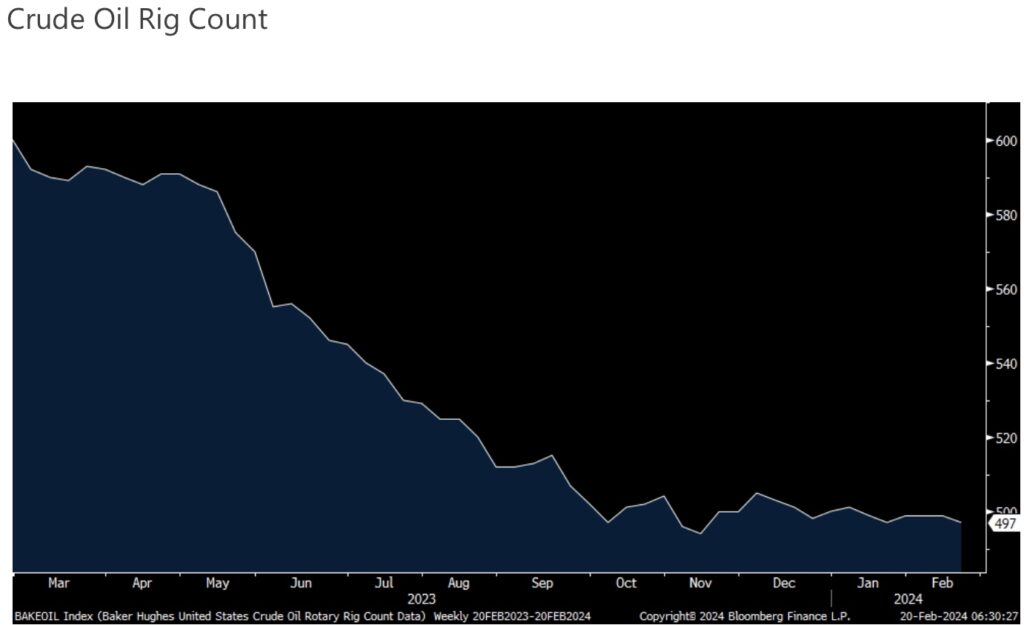

Though crude oil is now trading near $80 again, there was a decline in the Baker Hughes Rig Count of 2 rigs to 497. With an incredible increase in the efficiency of existing wells in 2023 that brought US production to record highs in the face of a continued decline in rigs used, at some point production will have difficulty increasing from here unless the rig count rises. We remain bullish on long energy stocks.

Oil Rig Count Remains Collapsed Until Oil Prices Rise

Chinese Love To Travel

The China Lunar New Year travel numbers are rolling in and the Chinese love to travel like we all do. The Macau Government Tourism Office said the holiday averaged 169,725 daily visitors vs 173,355 during the 2019 holiday, so just about fully back. Gross gaming revenue is well above its 2019 levels. China’s culture and tourism industry said there were 474mm domestic trips during the 8 day holiday which is up 19% from 2019. According to Trip.com, a stock we own, trips in Singapore, Malaysia and Thailand grew by 30% from its 2019 levels. Hong Kong also saw a greater number of visitors when compared to 2018 but slightly below the 2019 pace. Lastly, according to an article in the China Daily citing data from the Civil Aviation Administration of China, a new high was reached for daily passenger trips handled at 2.25mm. On the international travel side, it got back to 70% of the 2019 levels.

Bottom line, consumer spending on experiences has been the bright spot of the Chinese economy, though on a per capita spend during the holidays, it was still below the 2019 levels. The Hang Seng has cut its year to date losses in half over the past few weeks and the Shanghai comp is almost back to unchanged, down 1.8% ytd.

We also saw the PBOC cut its 5 yr loan prime rate by a larger than expected 25 bps to 3.95% and this is the reference rate for mortgages and is an obvious attempt to bring in more apartment buyers. The expected cut was 10 bps and the 1 yr rate was left unchanged at 3.45% where a 5 bps tweak lower was forecasted.

Home Depot & Walmart

Under the hood of Home Depot’s comp decline of 3.5% (US drop was 4%), ‘customer transactions’ fell 1.7% y/o/y and the ‘average ticket’ was lower by 1.3% y/o/y. We await more details in today’s earnings call.

Walmart in its earnings release said “Sales strength led by grocery and health & wellness, while general merchandise sales declined modestly.” So more of the same here in terms or prioritization of consumer spend.

They also said, “Share gains in grocery and general merchandise, primarily among higher income households.” So, mentioning again the higher income trade down in their stores.

On inventory, they “declined 4.5% with higher in stock levels.”

To listen to Alasdair Macleod discuss what is happening behind the scenes in the war in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.