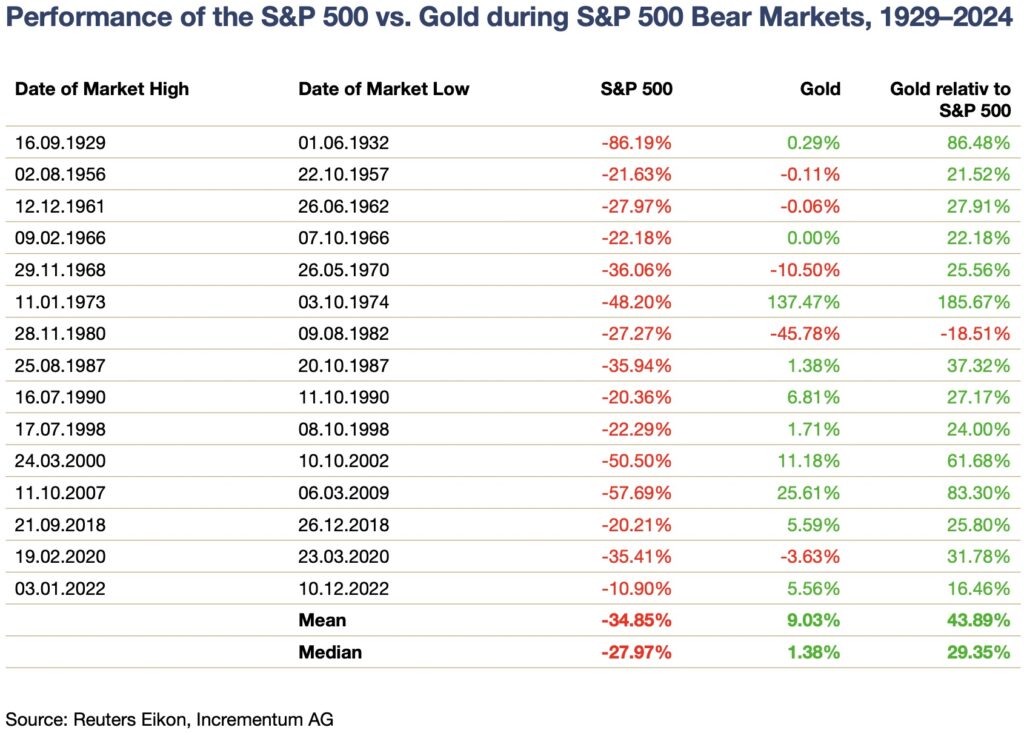

Look at what happens to the price of gold when the stock markets collapse.

“The next major leg up in the gold price will prove to be a religious experience for those people unfortunate enough to find themselves short.” — Paul Mylchreest

When Stocks Collapse What Happens To Gold?

May 25 (King World News) – Roni Stoferle at Incrementum: In the event of a weakening stock market, the opportunity costs would be low from the perspective of a potential gold investor. A slide in equity markets would probably be expected in the event of a significant slowdown in the US economy, and even more so if the US slipped into recession. Conversely, history has shown that gold has typically been an excellent portfolio component during recessions.

Gold Soars vs S&P 500 During Bear Markets

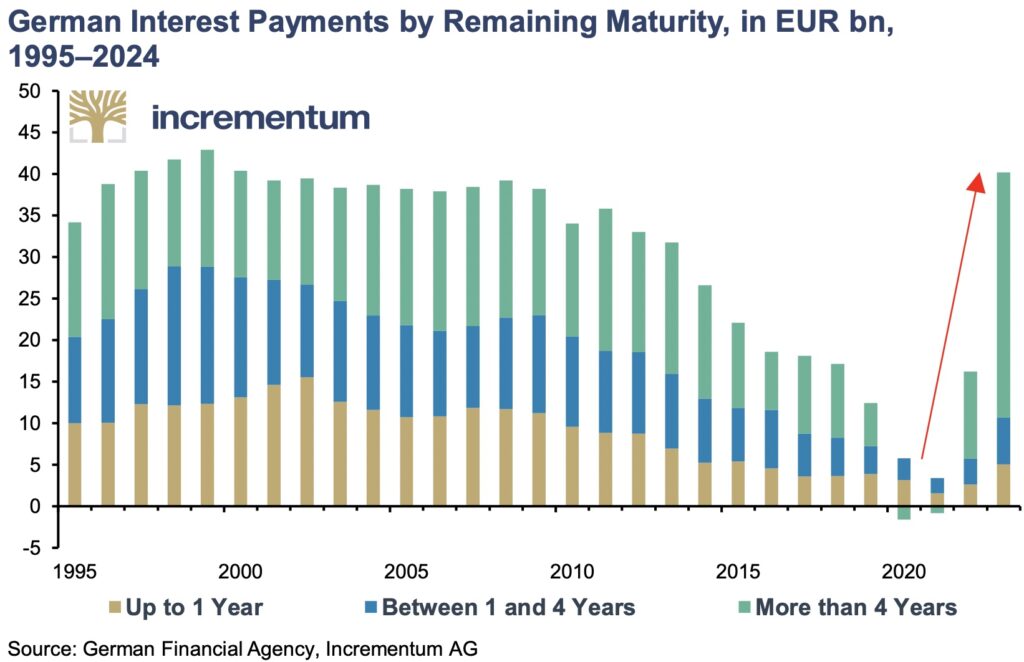

Even if counterparty risk is generally ignored when investing in Western government bonds, the sharp rise in government interest payments in particular is causing growing unease. Any remnants of budgetary common sense have been completely thrown overboard, most recently in the context of Covid-19 policy.

“The only way you can finance a deficit is by inflation. You cannot raise this amount by genuine borrowing. … A large government deficit is a certain way to inflation.” — Frederich von Hayek

This monetary climate change – as we called it in the In Gold We Trust report 2021 – has continued even after the end of the pandemic. However, this budgetary nonchalance is now taking place in an environment of sharply rising interest rates and no longer one of low or even negative interest rates. Around 10 times as much had to be spent on interest payments for German federal debt in 2023 than in 2021.

German Interest Payments Have Been Going Vertical

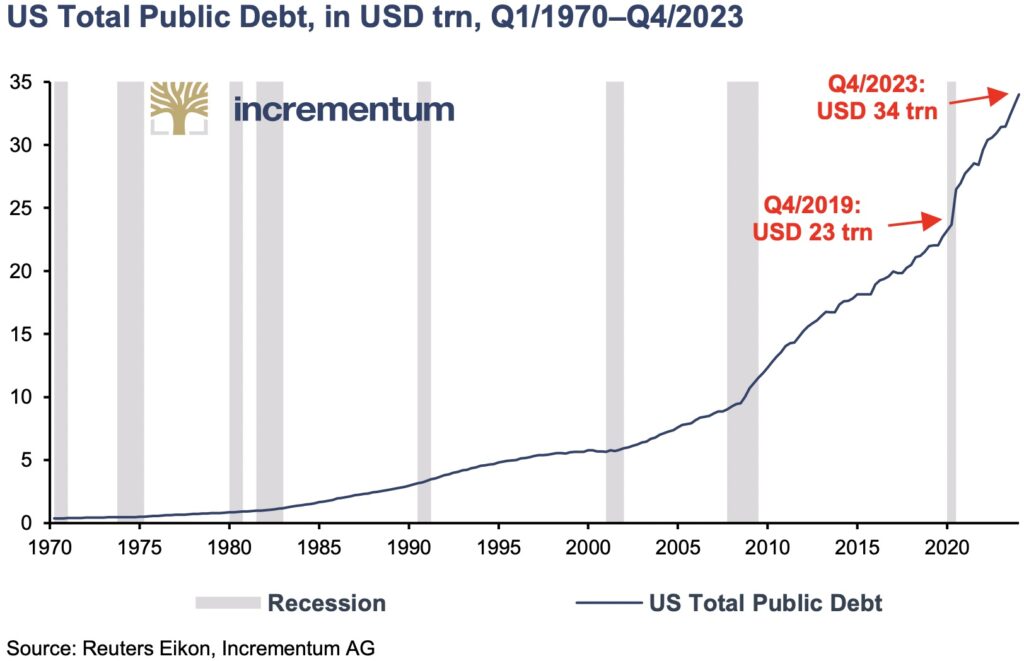

In addition, the already precarious budgetary situation of many countries is deteriorating due to the recent surge in interest rates. The significant increase in national debt in the wake of the Covid-19 pandemic and the energy crisis must also be digested. Compared to Q4/2019, i.e. the eve of the pandemic, US debt has risen by USD 11 trillion – and thus by around a third.

Total US Debt And Interest Payments Is Skyrocketing

Historically, over-indebtedness has usually led to government financing by central banks, increased financial repression, and the use of inflation taxes. If this were to happen, real interest rates would fall again due to a new wave of inflation and, obviously, all the arguments would then speak in favor of investing more in gold.

A Much Higher Price Of Admission

Because Western financial investors in particular have not yet realized that there is a new version of the gold playbook, gold remains on everyone’s lips but is far from being in all portfolios. It seems that Western investors initially turned down the invitation to the gold party. Now that the party is gaining momentum, they do not want to admit they were party poopers. It could therefore happen that they will only come to this party when it is already in full swing, and then at a much higher “price of admission”.

Ultra-Wealthy Moving Into Physical Gold

To listen to Egon von Greyerz discuss the ultra-wealthy moving into gold and how that will impact the gold market CLICK HERE OR ON THE IMAGE BELOW.

Silver Shorts Are Desperate And Trapped

To listen to Alasdair Macleod discuss the silver shorts being trapped and what to expect from gold and silver in the coming weeks CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.