On the heels of the Chinese devaluing the yuan, today one of the greats in the business sent King World News a fantastic piece discussing china's gold accumulation and their plans for the yuan, plus a bonus Q&A that covers precious metals, the Gartman curse and much more.

By Bill Fleckenstein President Of Fleckenstein Capital

August 11 (King World News) – Yesterday I closed my column by asking what the motivation was for the PBOC to let us know it was buying more gold, and last night perhaps we got a partial answer, as China changed its method of pegging the yuan, and also let its currency slide a couple of percent….

Continue reading the Bill Fleckenstein piece below…

Advertisement

To hear which company investors & institutions around the globe are flocking to

that has one of the best gold & silver purchase & storage platforms

in the world click on the logo:

Welcome to the Clubbing, China

I believe that both of those reactions are related. It would seem safe to conclude that the Chinese are in the process — however long it may take — of letting its currency eventually float, but they also want it lower, along with virtually every other country on the planet, even though that is bad for their citizens over time. So perhaps China wants us to know it is accumulating gold so it can control the downside to some degree.

At some point there may be some variation of a gold-backed yuan. However, whether that actually comes to pass and how long that may take is anyone's guess, and probably has no actionable consequences, at least until we see China go through several months of continued gold accumulation.

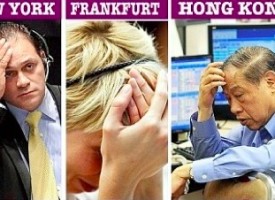

The net effect of that action saw Chinese equities slightly lower and European stocks a couple of percent lower (though bond markets in Europe were stronger, thanks in part to further progress to kick the can in Greece, as Greek yields dropped nearly 100 basis points). The action here saw the market lose about 0.75% in the first couple of hours, which I thought was interesting. When we had yesterday's nonsensical Stan Fischer-inspired stock rally (assuming his comments triggered it), I thought it would be important to see if that rally had legs, and if it might be reminiscent of so many quarters over the last seven years when the no-news period saw the market ramp higher thanks to QE. Obviously, QE is not in effect anymore, but the fumes could still be.

No News Is Old News

In any case, today's decline makes yesterday seem like a one-day wonder, which would be important news if today's drop in U.S. stock prices was a function of the fact that the market was really ready to go down. (In addition, it doesn't take a genius to figure out that the Chinese wouldn't be doing this if its economy weren't quite weak.) That early weakness led to more, as the market lost 1% or so. Now the critical question is whether the decline is ready to accelerate.

Away from stocks, green paper saw a wild ride last night, as it was initially stronger versus the euro, then weaker. Versus other currencies the action was sort of mixed, and by the end of the day the dollar index was slightly higher. Fixed income apparently liked the chaos and the rally in Europe, as it was higher, while the metals traded on both sides of unchanged before closing with 0.5% gains.

Included below are three questions and answers from today's Q&A with Bill Fleckenstein. The questions are from his subscribers and they get to read Fleckenstein's answers every day.

Bonus Q&A

Question: Comments from Peter Bookvar. I get this through another service, If you can post it, please do. A well stated viewpoint and a good morale boost the the troops. BTW even Bookvar didn't think the Chinese would devalue just now. (Peter Bookvar's comments are below)

"The technicals of gold have certainly sucked for a while, but the fundamentals for owning it in the world of monetary mayhem have never been more compelling, I continue to believe. Is the bear case on gold strictly because the Fed may raise rates for the first time in nine years by a whopping 25 bps? I think it's solely due to that, and I think that is a pretty flimsy reason in light of the current global monetary and economic backdrop.

Firstly, the rate hike will likely be a one and done, especially on the heels of China's news. Secondly, gold doubled the last time the Fed went on a rate-hike cycle (425 bps in the mid 2000s) as a reminder. Thirdly, the treatment of fiat currencies has now reached a new low. And lastly and maybe most important, the grand experiment of modern-day central banking I believe has now entered into a very dangerous phase. There are moments in time to own gold and there are moments not to own gold. This is one of those times to own it, especially after a four-year bear market and a 40% decline when most everyone hates it and the fundamental back drop as an anti-fiat currency has never been better."

Answer from Fleck: "I wholeheartedly agree with Peter, now we just need others to agree. 🙂"

The Gartman Curse

Question: Bad news ! 🙁 Dennis Gartman has declared the bottom in for gold! You can bet your bottom oz. that gold will head lower in short order, until the Gartman says he was mistaken.

The guy is a curse!

Answer from Fleck: "LOL, when did he say that? Editor's note – Of course Fleck wasn't watching Bubblevision yesterday when Gartman was on after the close…"

Question: Hi Fleck, I think the final low in commodities & gold is in December/January 2016. In the 2008 crash, gold and commodities went along for the ride as the first shoe dropped. But when the second shoe dropped on the market in first quarter 2009, I remember that precious metals bounced upwards fast. Same playbook this time around?

Answer from Fleck: "No, I don't see any reason why that should be a good analogy…nothing is the same."

***To subscribe to Bill Fleckenstein's fascinating Daily Thoughts CLICK HERE.

***ALSO JUST RELEASED: A Remarkable Look At The War In The Gold, U.S. Dollar And Crude Oil Markets CLICK HERE.

© 2015 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.

If you are interested in purchasing physical gold and silver for delivery you can call Steve Quayle or his staff at (406)586-4842, or you can email them at tyler@safetrek.com or info@sqmetals.com

The audio interviews with Rick Rule, Gerald Celente, Bill Fleckenstein, Dr. Paul Craig Roberts, Robert Arnott, Eric Sprott, John Mauldin, Stephen Leeb, Egon von Greyerz, Nomi Prins, Andrew Maguire, Michael Pento, David Stockman, Chris Powell, Dr. Philippa Malmgren, Marc Faber, Felix Zulauf and Rick Santelli are available now and you can listen to them by CLICKING HERE.