With the crude oil market tumbling along with bonds, today James Turk sent King World News one of the most stunning charts of the last decade and asked the all-important question: Is history about to repeat in the silver market?

Silver Breaking Out To The Upside

James Turk: “A lot of the excitement we have seen in gold and silver over the last couple of months is disappearing, Eric, which is actually a good thing. It allows the precious metals to regroup and build support after their recent rallies…

SPECIAL LIMITED TIME OFFER FOR KWN READERS & LISTENERS:

All KWN readers and listeners who sign-up and fund a BitGold account will receive an

additional 5% bonus (up to $100.00) added to their Bitgold accounts.

Sign up today by email – CLICK HERE OR ON THE LOGO:

James Turk continues: “We have to keep in mind that so far this year gold is up 28% and silver 48%. This is a spectacular performance by any measure, and while I expect there is a lot more to come as we move toward the end of the year, a quiet spell in the precious metals over the next few weeks does nothing to diminish the prospects for gold and silver.

Is History About To Repeat In The Silver Market?

Is History About To Repeat In The Silver Market?

Today’s circumstances actually remind me of August 2010. At that time silver was trading at roughly $18 per ounce. You will recall that you and I were both extremely bullish about silver’s near-term potential, but August in that year was as dull as watching paint dry. Yet only eight months later silver had soared to nearly $50, near its all-time record high. Maybe history will repeat.

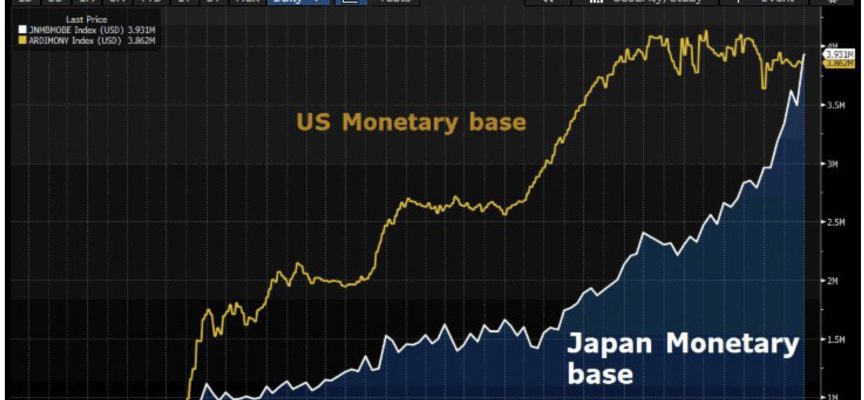

In the meantime, I would like to share with you the following chart a friend sent to me recently when the yen was Y100 to the dollar. This chart was an eye-opener for me (see US Monetary Base vs Japan Monetary Base below).

Stunning Chart Shows Japanese Monetary Base Eclipsing That Of The U.S.

Keep in mind that since October, the yen strengthened from Y124 to Y100, and is currently about Y102.

There is no doubt that the strength in the yen over that 8-month period was in part due to short covering and unwinding of yen carry trades. But compare that to the tidal wave of money printing and other steps taken by the Bank of Japan to debase the yen, including the announcement last week that their EFT purchases will now double to Y6 trillion.

An Upside Down World Where The Yen Strengthens On Massive BoJ QE

One has to ask, why isn’t the Bank of Japan winning the battle to debase the yen? Why did the yen strengthen in the face of all that money printing?

We all know that markets don’t move in a straight line until you get to the blow-off phase. And a blow-off into oblivion with destruction of the yen’s purchasing power is no doubt in the cards for the yen when reality strikes and people wake up to see what the Bank of Japan has done to the country’s currency. So counter-trend downdrafts are to be expected. But 20% appreciation over 8 months is no doubt astounding given gargantuan efforts to debase the yen.

Seeing money printing on the scale undertaken by the Bank of Japan, yet having the yen appreciate, I had to ask myself whether it is possible that everything I have learned over the last 50 years no longer applies? It still does, of course, but it can sometimes be hard to see in historic bubble.

Is The Yen Headed Into The Abyss?

Is The Yen Headed Into The Abyss?

Today’s bizarre conditions are like a spinning top that, despite running out of momentum and beginning to wobble, somehow manages to defy gravity and right itself one last time before falling over for good. I think the yen had righted itself to rally one last time. Is the yen finished for good? I think so.

I’ve been describing the money debasement by central banks as a horse race. Would it be the dollar, euro, pound or yen winning the race and being destroyed as currency. It looks like the yen is ready to take the lead and be the first currency to fall into the abyss.

But regardless of whether the yen wins this race that no one wants the dubious distinction of winning, central bank debasement of national currencies is a fact of life today. It will ensure that gold and silver continue to climb higher in the weeks and months ahead.” ***To listen to the jaw-dropping audio interview with Michael Belkin, the man who advises the most prominent sovereign wealth funds, pension funds, hedge funds, and institutional funds in the world discussing the historic run in the gold & silver markets, what to expect next for gold, silver and the shares and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2016 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.