The price of silver has surged $3 in the past 12 trading days because India is creating a short squeeze in the silver market. This is a demand driven situation that threatens to send the price of silver soaring in the short-term. And take a look at what is happening with gold…

Alasdair Macleod’s latest audio interview has just been released! Link below.

Silver Stars

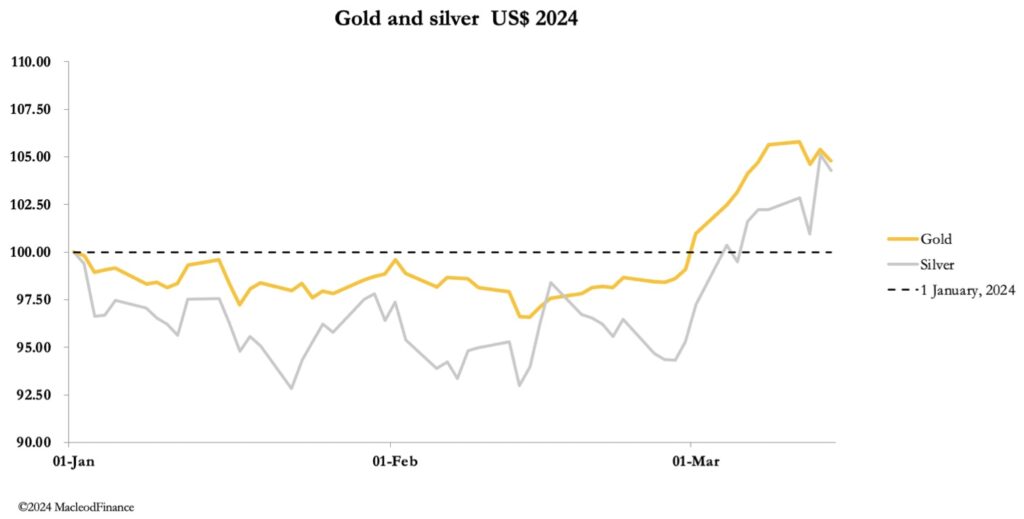

March 15 (King World News) – Alasdair Macleod: After a powerful up-move last week, this week gold had a minor correction. Silver’s upward momentum continued through to Wednesday before it ticked off the top. In European trade this morning gold traded at $2168, down $11, and silver at $25.05, up 65 cents.

Comex Hemorrhaging Physical Gold & Silver

The feature of these markets is the extraordinary extent to which bullion is leeching out of Comex. So far this year, 95 tonnes of gold have moved from establishment hands presumably into the Other Reported category. But the real surprise is silver, which by this morning had 1,201 tonnes stood for delivery. Normally, these deliveries are merely the shuttling of ownership in Comex-registered vaults. However, the evidence suggests that silver is actually being transferred with a view to being physically delivered outside the vaulting system.

India Creating Short Squeeze In The Silver Market

They key to this activity is India. The Indian government introduced a solar production linked incentive scheme. Reliance Industries, among others, are investing heavily in photovoltaic production, and is commissioning the first 5 giga-watt phase of a 20 GW manufacturing facility scheduled for opening this month. I am informed by industry sources that being unable to source sufficient silver from refiners, Reliance has been buying what it can in silver markets, including Comex. It is almost certainly Reliance which is taking the bulk of that 1,201 tonnes and the acceleration of deliveries this month reflects the commissioning of Phase 1 in Jamnagar.

Shorts Losing Their Grip On Silver

It seems extraordinary that with the massive increase in global ESG-related demand that the silver price has not yet risen significantly. But as I explained in a post to my Substack subscribers this week, China has deliberately suppressed the silver price while importing significant quantities to bolster its photovoltaic production. Now that India is rapidly developing its output under government schemes, China is likely to lose its grip on price.

The chart below reveals that silver has been in a three-year consolidation following the surge in price in 2020, incorporating a bullish reverse head and shoulders pattern. With China losing her grip on prices, it appears that the consolidation phase is ending.

MASSIVE 3 YEAR CONSOLIDATION:

Silver’s Short-Term Breakout Target = $40

From the breakout, which is near current levels, pattern analysis suggests a move out reflects the move in, giving a price objective of $40.

Gold

Short-term momentum traders jumped on board the Comex gold contract, so profit- taking after a $100+ rise this week comes as no surprise. These traders are simply dealing in paper gold versus the dollar, and the dollar’s trade weighted index recovered modestly from sub-103 levels, as the chart below indicates.

The yield on US Treasuries also firmed, making gold relatively less attractive in some traders’ minds.

The inflation numbers are ticking higher in the US on a monthly basis, and key commodities prices, such as copper and oil have been rising. Clearly, the inflation story is not over. Short-term, this could bring more pressure on the gold price, but ultimately there will be a switch from worrying about relative interest rates between gold and Treasury bonds to concerns about persistently high interest rates destabilising the entire fiat currency complex.

After all, that is the real reason for escaping from currencies and other forms of credit into real money without counterparty risk, which is gold. Alasdair Macleod’s latest audio interview discussing the short squeeze in the silver market has just been released CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.