Today the gold HUI Gold Mining Index had a single day 6%+ crash as investors in the sector continue to climb a “wall of terror” in this historic bull market. But take a look at this…

November 11 (King World News) – Email from King World News reader Luke Clements from Australia: G’day Eric, I think the fears for long-term gold mining stock investors are very real. We haven’t had anything like an explosive rise in gold mining stocks at multiples of the gold price in this gold bull run. It’s been an incremental ascent at best. Slowly climbing the stairs (of the Trump Hotel fire exits perhaps) just to plummet down the lift again in the last ten ten days. But there was no moon shot or excitement in the mining shares.

NEM (Newmont) got killed on a record profitable quarter and increased buybacks, because it missed (over-inflated) “market expectations” and a short-term blowout on costs. Meanwhile Micro Strategy flys high on record losses, record dilutive offerings, and record debt offerings…cause, bitcoin.

The “round-trip” fear is the one that lurks in the back of my mind. I’ve been in gold and the gold stocks since 2000. I’ve seen this movie before! Thankfully I’ve held some of these things a long-time and even with the latest mauling, sit on reasonable profits and dividend ratios. WPM has been held for over 9 years and was fantastically cheap back then. It’s been a beautiful slow rise up to the right hand corner of the screen, but again nothing silly or particularly blow-off about it’s price. It just hasn’t come yet for these stocks in general.

There has to come a time where I take hundreds of percent gains off the table. But I thought it would be when the Uber drivers and barbers are talking about these things, which is a long way it seems from happening. I don’t want to be holding WPM at $19 again!

Thanks for all you do Eric.

Cheers,

Luke Clements

Tamborine Mountain, QLD. Australia.

King World News note: Luke, bull markets typically climb a “wall of worry,” but instead this bull market in mining stocks is climbing a “wall of terror.” The fear is palpable in the sector. For example, when gold weakens significantly, the bids disappear and the HUI crashes 6.11% on a day like today! Can you imagine if the Dow crashed over 6% in a single day? That would mean the Dow would collapse 2,658 points in a single day!

HUI Gold Mining Index 6+% One-Day Crash!

But despite today’s brutal takedown in the HUI, you can see from the chart below that the miners are still up about 25% this year.

Despite Pullback, HUI Still Up 25% This Year

It is also important to remember that even with gold futures trading at $2,630, the HUI Gold Mining Index is well over 50% below its 2011 peak when gold was only trading at $1,920. This is a sector that has been totally abandoned by the public, and the participants who are left in the trade hold on precariously in fear as this bull market continues to climb the “wall of terror.” If you have held on for this long, continue to remain patient and do not let the wild trading fool you. Regardless of the tremendous fear and volatility, this bull market will culminate in a mania, even as the bull continues to shake off riders.

The Most Important Big Picture Chart For Gold

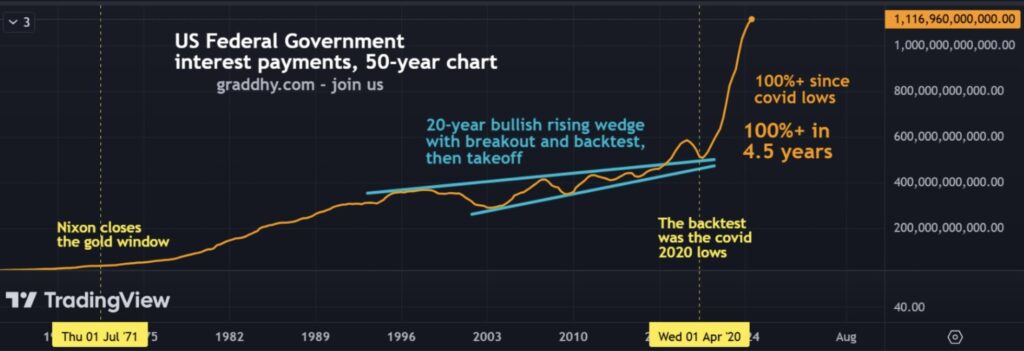

Graddhy out of Sweden: US Federal government interest payments are going ballistic.

US Interest Payments Have Skyrocketed!

That chart is not even parabolic, that is vertical.

From covid lows, everything changed, and technicals anticipated it.

Personally, I do not think Washington has raised the debt ceiling 79 times, frequently changed CPI definition, printed many extra trillions, inflated Fed balance sheet astronomically etc, in order to start fighting inflation in a real way. That is highly unlikely.

Governments change CPI and PPI definitions continuously for many reasons, one of them being trying to protect the present monetary system. One could look at ShadowStats which give more accurate numbers. But reality is that measuring inflation correctly is actually very difficult when you really look into it.

So what’s the answer? As I see it, the real measure of true inflation is the expansion of the currency supply. And government interest payments is more or less a function of the expansion of the currency supply. And knowing this, the chart below becomes pretty scary. It shows that the covid lows was an historical inflection point where the US government interest payments went vertical, literally.

GOLD always catches up with government debt and currency supply. And gold is now responding. Both gold and silver have broken out hugely, and are both now in a resumed bull market.

This commodities bull is the largest financial opportunity we will ever have. And the largest financial threat we will ever face. Make sure you get the most out of this bull market.

To listen to the jaw-dropping gold and silver price predictions that Nomi Prins just made CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.