The historic short squeeze in the gold and silver markets intensified on Friday as the price of silver soared over 8% closing the trading day at nearly $78 an ounce on the futures market.

Precious metals squeeze intensifies

December 26 (King World News) – Alasdair Macleod: The squeeze in silver is now creating headlines in the media. If this leads to a wider recognition of why silver continues to rise, it could spark additional ETF demand.

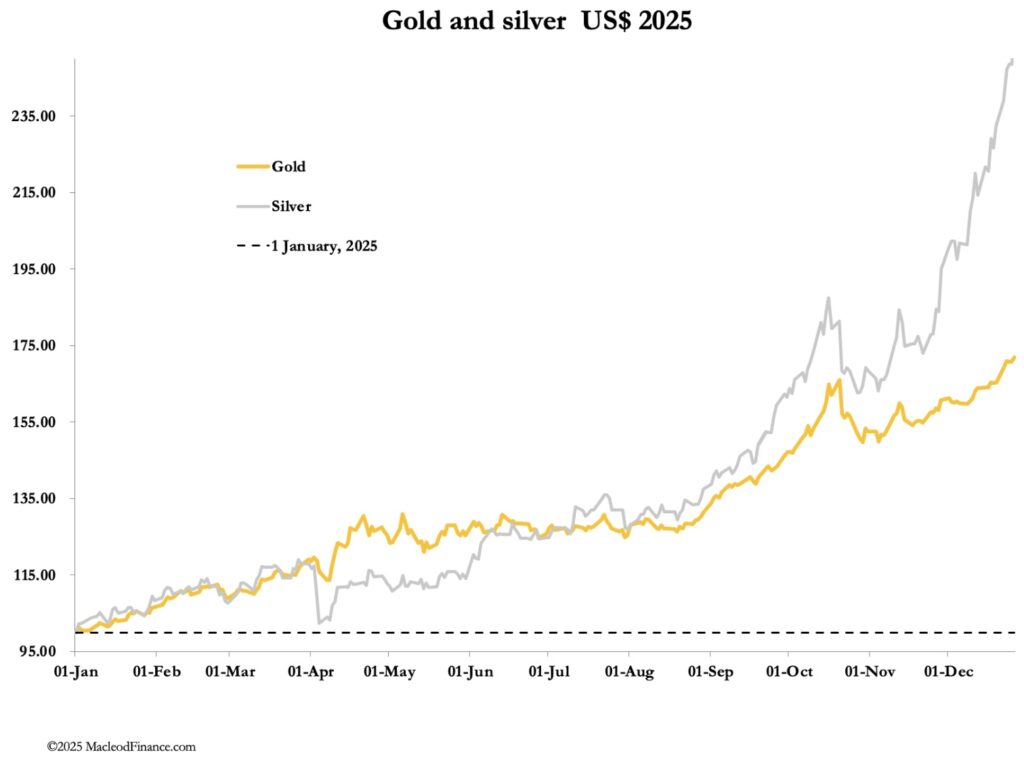

Christmas week has been particularly dramatic for silver and platinum, marginally less so for palladium while gold quietly sails into new unchartered territory. Our headline chart below says it all…

Christmas week appears to have intensified the squeeze on silver and platinum, with dramatic moves higher in Shanghai, silver even challenging the $80 level at one point last night. In European trade this morning, silver was $74.80, up $7.80 from last Friday’s close, and gold at $4518 was up $187 over the same timescale. Predictably in a holiday week with London closed yesterday and today (Boxing Day holiday), Comex volumes were light.

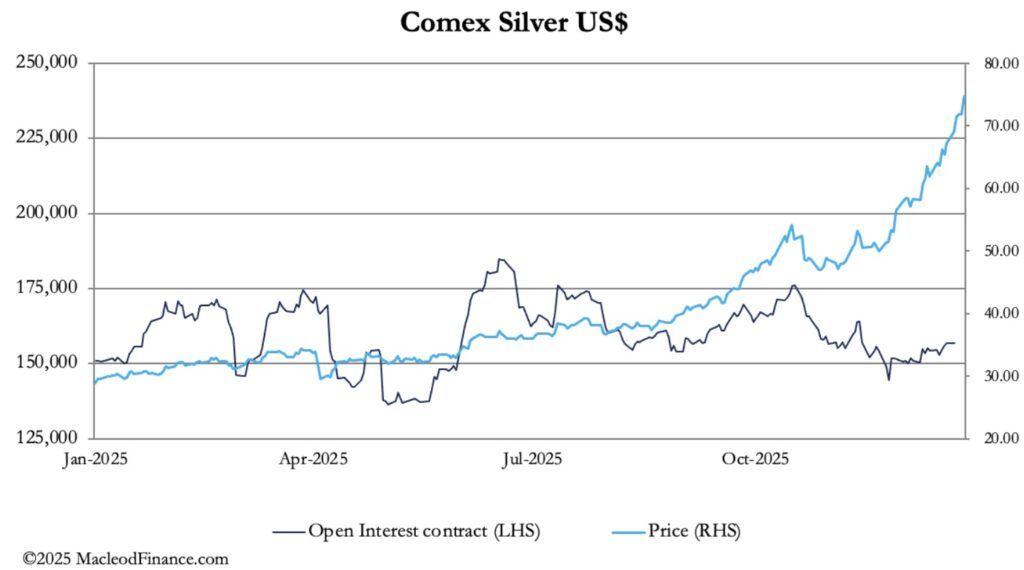

Our favourite chart of silver and Comex open interest illustrates how little speculator participation there is in this rally:

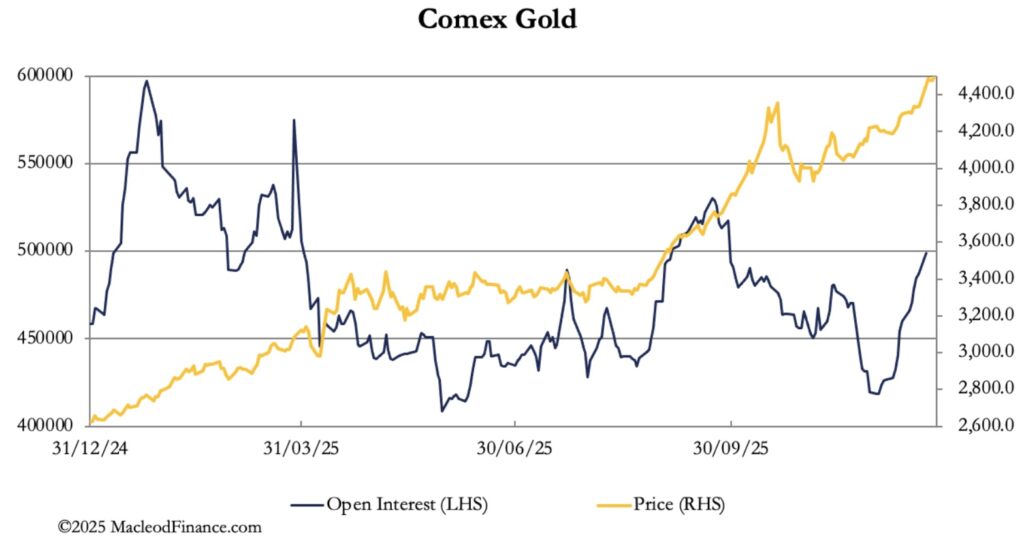

The entire rally from 13 November has seen a decline in open interest while the price rose 50% from $50, evidencing the severity of the squeeze on the shorts. Inevitably, genuine producers are no longer hedging for fear of being called, increasingly throwing the short burden on the bullion banks in the swaps category. At the same time, speculator interest is remarkably subdued, likely to become an additional problem for the shorts if and when they join the party. The background of gold gently moving into new high ground is an additional problem for silver, because of the signal it sends. Meanwhile, stand-for-deliveries continue apace, totalling 14,808 tonnes of silver this year so far, and 1,237 tonnes of gold. Comex is truly the largest gold and silver source in the world.

We should concentrate on gold, which is the primary market indicating that the problem is an early stage of a fiat currency crisis. To observers of the debt-cum-credit bubble, the reasons should be obvious. Furthermore, with the exception of the Bank of Japan, G7 central banks are easing interest rates and in the case of the Fed openly moving towards money printing in the form of QE. It stands ready to finance both the government deficit and its debt refinancing totalling over $9 trillion by QE in an attempt to put a lid on bond yields.

Undoubtedly, foreign central banks see this as vindication for doing away with the dollar and will not pause in their acquisition of gold both as reserves and for wealth funds. And this is before we even talk of investor and speculator demand when the consequences of monetary policies become more widely understood by domestic investors. The Comex numbers indicate that open interest is beginning to pick up and will have further to go. This is evident in the chart below:

Thus, the setup for 2026 is emerging. A crisis in paper markets created by undeliverable silver as they move towards a cash basis, and at the same time accelerating moes for all commodity categories and wholesale prices generally will be the unpleasant surprise in 2026. To continue listening to Alasdair Macleod discuss the short squeeze in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED!

An Astonishing Christmas Prediction From Legend Richard Russell CLICK HERE.

EXPECT WAR: Early Days For Gold & Silver Bull, Especially The Miners CLICK HERE.

Hansen – This Is What Is Really Happening With Gold Market CLICK HERE.

$15,000 TARGET: Volatile Gold & Silver Trading But Look At What Is Coiled To Skyrocket CLICK HERE.

As Soon As The Markets Opened For Trading, Silver Bolted Out Of The Gate CLICK HERE.

This Is Why The Price Of Silver Is Skyrocketing CLICK HERE.

Nomi Prins – Expect $6,000 Gold In 2026 But Silver Will Be The Big Surprise CLICK HERE.

Silver & Gold Hit All-Time Highs. Take A Look At What’s Propelling Prices To Record Levels CLICK HERE.

Look At This Year End Price Target For Silver CLICK HERE.

Look At This Shocking Inflation Over The Last 5 Years CLICK HERE.

Look At This Jaw-Dropping Setup For Silver & Gold CLICK HERE.

Silver Futures Hit $67 All-Time High As Gold Closes In On Record High CLICK HERE.

This Will Send Gold & Silver Mining Stocks Screaming Higher CLICK HERE.

This Sums Up The Situation In The Silver Market Beautifully CLICK HERE.

This Is Why The Price Of Silver Is Poised To Skyrocket CLICK HERE.

Michael Oliver – Historic Breakouts Will Now Send Gold & Silver Prices To Levels That Will Shock The World! CLICK HERE.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.