Here is where things stand on Fed rate cuts.

To Cut, Or Not To Cut, That Is The Question

June 12 (King World News) – Peter Boockvar: As has been the case this year, the FOMC statement was little changed in wording from the prior one which was left mostly unchanged from the one before that.

With its commentary on the economy and inflation, they tweaked the inflation wording. On May 1st they said:

“there has been a lack of further progress toward the Committee’s 2% inflation objective.”

They took out ‘lack’ and added ‘modest’ to say “there has been modest further progress…”

They left this wording in:

“The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%.”

I’m sure Jay will be asked and/or will say what his current status of ‘confidence’ level is…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

On to the economic projections vs the March ones given:

They kept their 2024 GDP forecast at 2.1% and their unemployment rate estimate stays at 4%, which we know we’re currently at so magically it will just stay here.

They raised their headline and core PCE inflation forecasts to 2.6% and 2.8% respectively from 2.4% and 2.6% given in March.

As for the median dots, it is at 5.1% from 4.6% given in March and in 2025 they expect a fed funds rate at 4.1%, median measure, from 3.9%. They also raised their ‘longer run’ fed funds rate projection, aka, they raised their R* estimate to .80 from .60% via a 2.8% fed funds rate vs 2.6%, and assuming an eventual long term return to 2% in inflation.

In terms of count, 4 Fed members want no rate cut this year (I’m guessing Bowman, Schmid and maybe Logan are 3 out of the 4 and would be interesting if Powell or Waller was another). Seven expect one cut and 8 forecast two. So, 11 members total don’t expect 2 cuts vs 8 that do.

Bottom Line

Bottom line, I do believe the Fed members did incorporate today’s CPI in their discussion and dots and likely not much changed on just a one tenth deviation from estimates. The Fed is certainly leaning with an easing bias but at least for now, we are NOT on the cusp of some easing cycle with a multitude of cuts UNLESS the unemployment rate jumps higher. So, unless we get that, a rate cut or two would be just a tweak that would take some of the edge off current rate levels with inflation slowly slowing. But that’s a far cry from the slash and burn of rates we got used to and its way to zero and reinforces that higher rates (though maybe less high) is still the new reality for a few years to come at least.

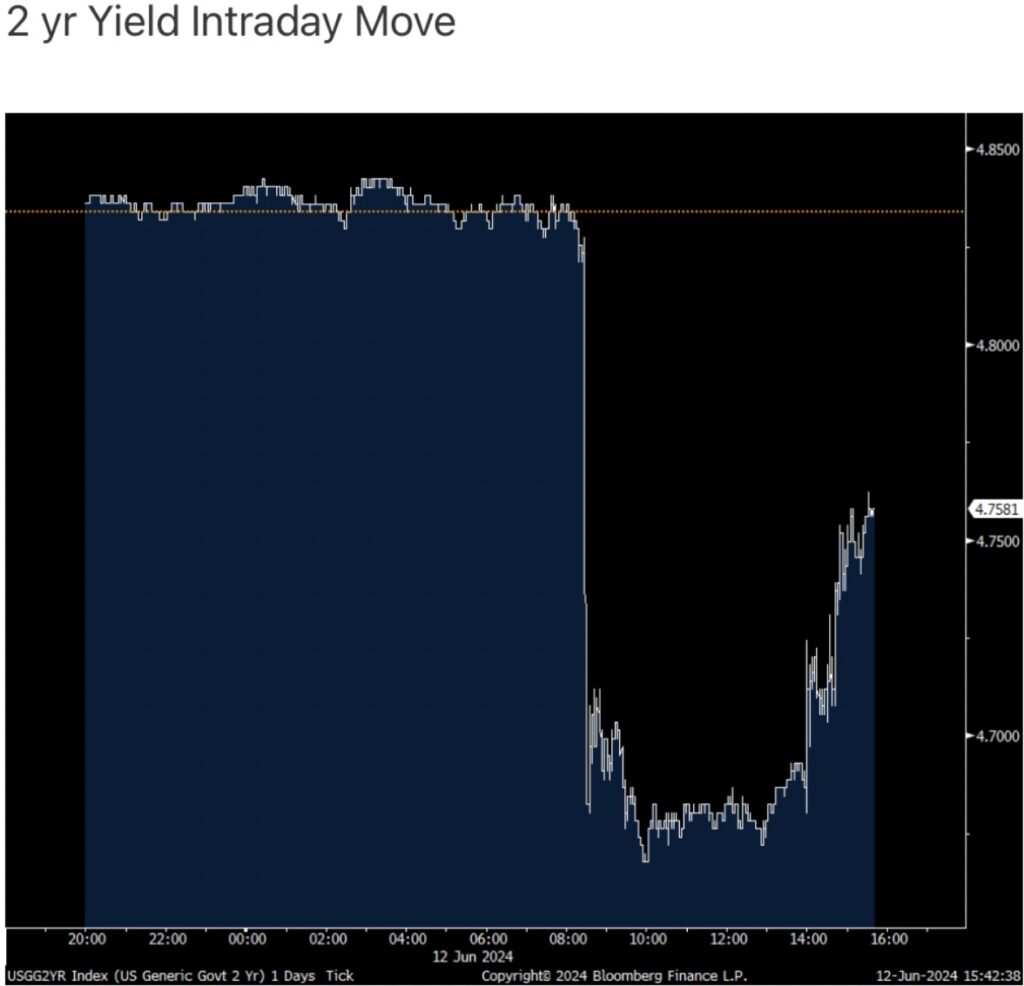

The 2 yr yield was at 4.39% right before CPI, was at 4.69% just prior to the statement and now stands at 4.76%.

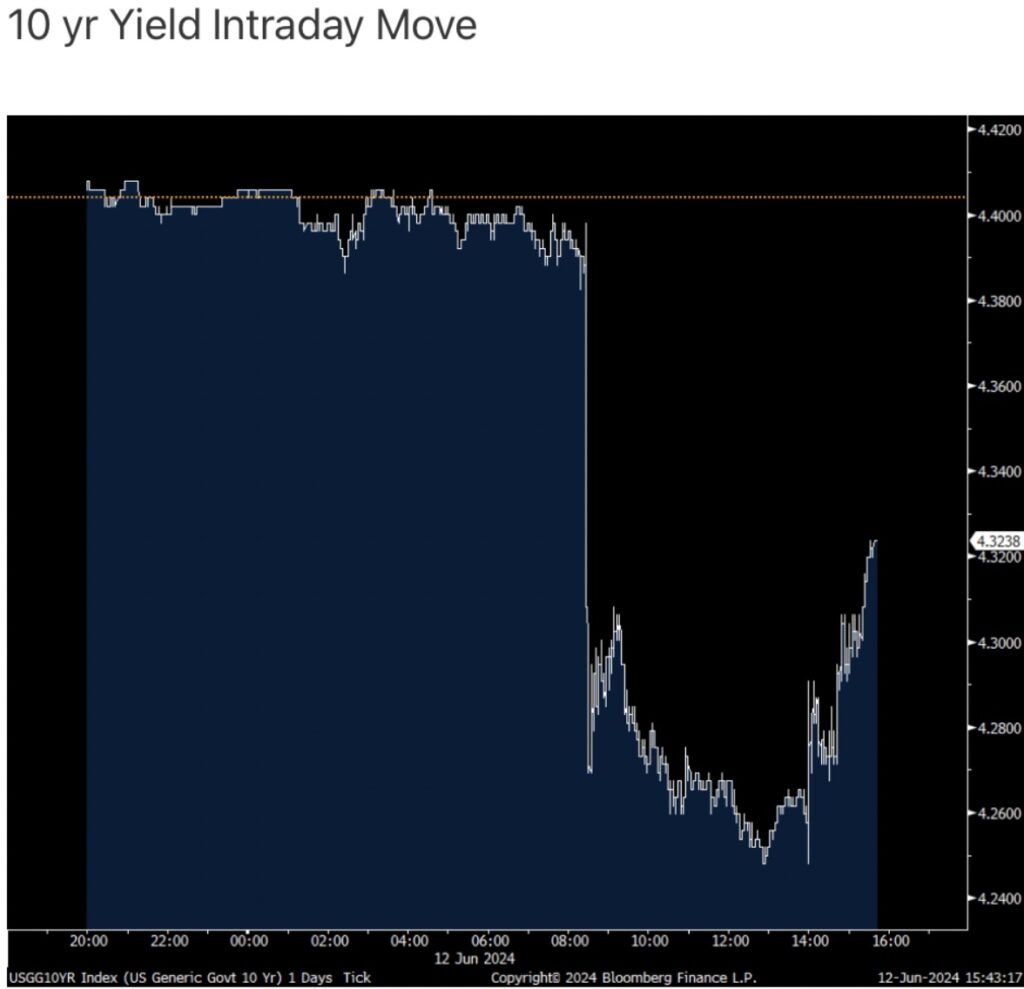

The 10 yr at 4.32% is up 2 bps from 1:59pm est and vs 4.39% at 8:29am est.

Rate cut odds for two this year have been all over the place today. We started the day at 38%, then went to 88% and are now back to 64% post statement and dots.

Friday’s Gold & Silver Takedown

To listen to James Turk discuss Friday’s orchestrated $82.50 takedown in the gold market and $2.20 in silver CLICK HERE OR ON THE IMAGE BELOW.

Friday’s Gold & Silver Takedown

To listen to Alasdair Macleod discuss Friday’s orchestrated gold and silver takedown as well as what the Chinese are up to and more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.