As we continue to kickoff what promises to be a wild 2023, “Got Gold?” Because you will need it as madness in world bond markets continues ahead of the global reset.

Open Madness in Global Bond Markets: Got Gold?

January 15 (King World News) – Matthew Piepenburg, Partner at Matterhorn Asset Management: The slow but steady implosion of global bond markets is no longer a debate but fact. Knowing this, investors can better brace themselves for the policy and market reactions to come.

Below, we once again follow the patterns of math and cycles (as well as the open failure of policy makers) to foresee the direction of risk assets, currencies and gold…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

The End of Negative Yields: Anything but a Good Sign

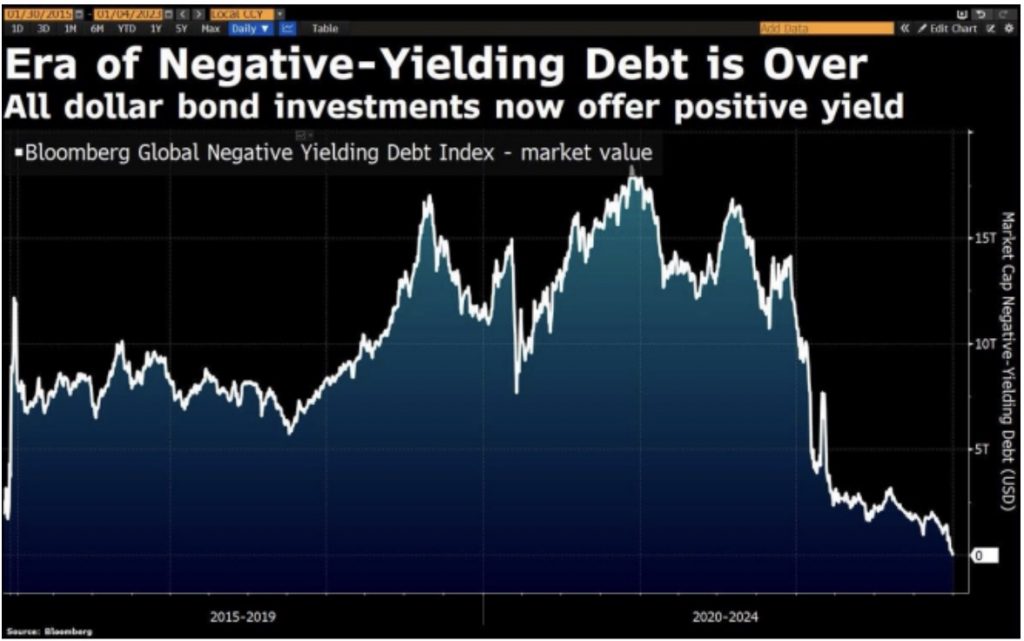

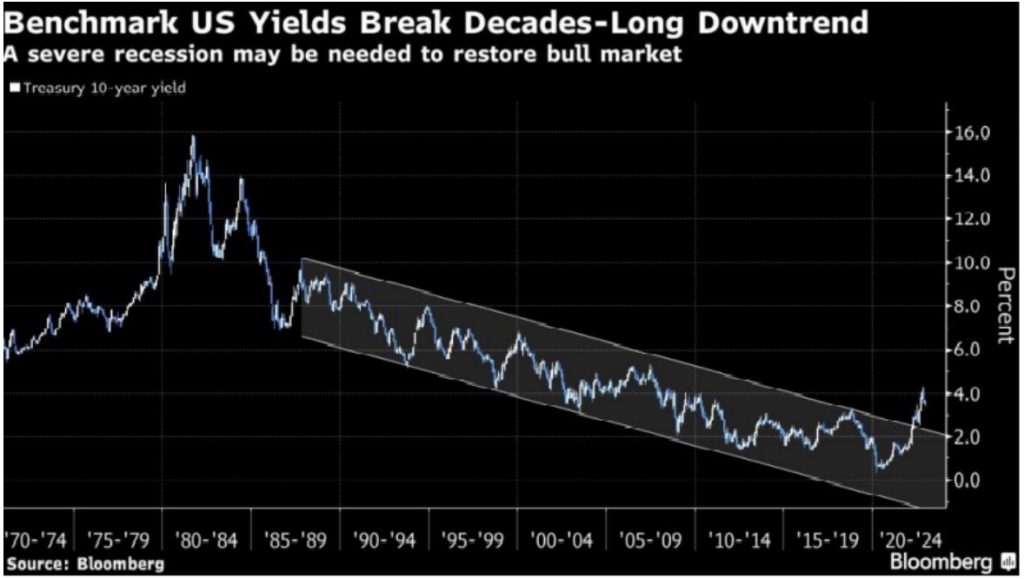

Recently, Bloomberg happily announced that the era of “negative yielding” (which technically means “defaulting”) USD bonds is over as yields are now “nominally positive.”

“Great news!” they tell the huddling masses.

Nothing, however, could be further from the truth.

Let me repeat that: Nothing could be further from the truth.

Yields are only outpacing already embarrassing inflation metrics because bond prices, which move inversely to yields, are tanking in a world which no longer wants or trust USD-based IOUs.

In other words: This so-called “return to normalcy” in positive nominal yields is in fact a neon-flashing sign (or needle) pointing toward the end (and bursting) of a global debt bubble in government bonds.

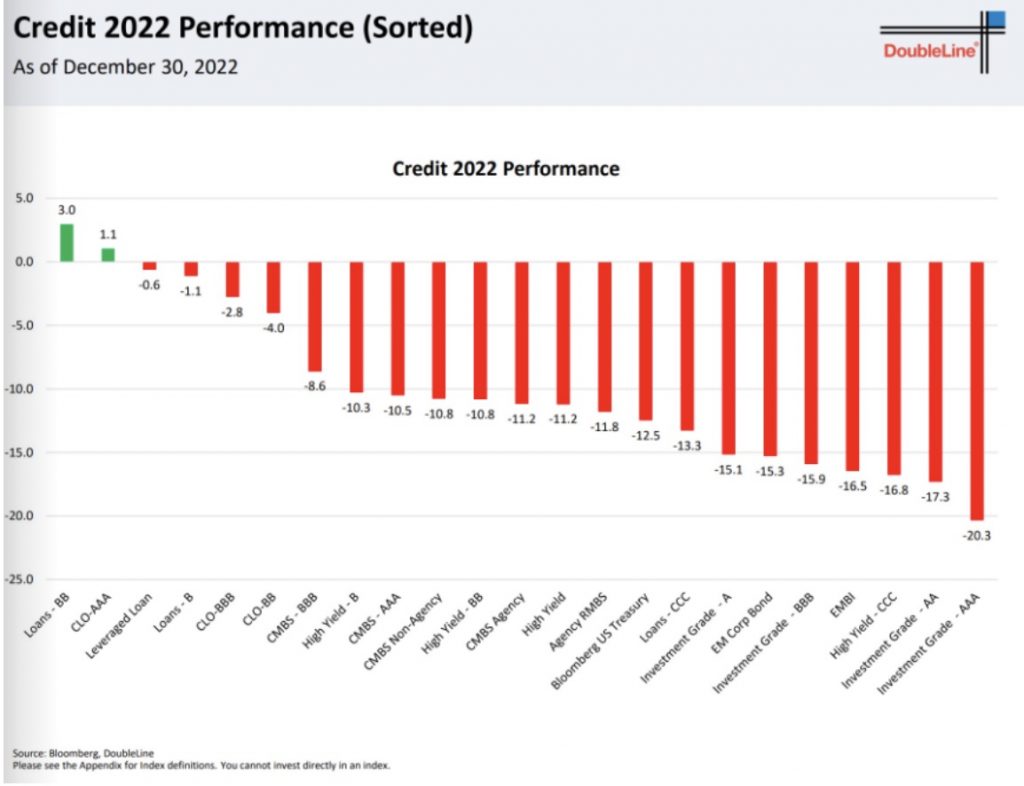

But as the following graph makes objectively clear, it’s not just sovereign bonds that are tanking, but the entire credit asset class, from CMBS to Investment Grade. Just see for yourself:

These are appalling figures which cannot be ignored. Facts, after all, are stubborn things.

Facts vs. Headlines

Despite such empirical data, many financial “journalists,” including some at Bloomberg above, are paid to sell a simplistic message rather than clarity. Ignoring the obvious fall in bond prices (above), they somehow have the gal to celebrate “positive nominal yields” in a twist of messaging that almost defies belief.

And few, if any, of these “experts” have the historical and non-linear market knowledge to place singular/linear headlines (fantasies) like positive nominal yields within the more nuanced context of 3-dimensional reality.

History, for example, would remind these misleading headlines that for well over a century, every time sovereign debt in advanced economies reaches unpayable levels (now higher than even EM levels), the net result is unequivocal: It’s either inflation or default.

Always. Every time. Period.

The current disaster in global bond markets, playing out now, will be no different: Inflation, default or “reset.”

Policy Makers Heading in the Wrong Direction

After years of buying time, votes, book deals and even a Nobel Prize, global financial leaders have smiled in public while privately failing with staggering panache among the more informed.

Rather than openly face and solve $300+T debt disasters the hard way, namely via economic growth, fiscal austerity, debt restructuring, inflation recognition (vs. “transitory” denial) and an accountable and transparent need for financial repression (nod to Reinhart and Rogoff), our leaders and central bankers have gone in the complete opposite and wrong direction.

Instead, they have recklessly and addictively relied upon mouse-click fiat money rather than money tied to actual goods, services and production to provisionally support years and years of un-earned reputations and unloved bonds.

As opposed to politically unpopular fiscal austerity, the math-ignorant and job-preserving (i.e., pathologically selfish) US politicos just added another $1.7 trillion spending bill to bribe/pay for their tenure but which they can’t otherwise pay back.

Instead, they just hand the bill to my kids.

You really can’t make this stuff up. It’s embarrassing open madness and blatant self-interest over national interest. But then again, that’s the effective definition of a politician: Self first, nation later. Facts be damned.

Just consider clowns like George Santos…

Nothing Left but Bad Choices

Economic growth, as we see it (and as housing, manufacturing, trade and services data confirm) will not save us or our bonds.

The debt is factually too high and the growth, even if China re-opens its COVID-locked doors, will never catch up.

Further debt and slower growth points to the only options left in the global bond markets:

1) Print more fake and grotesquely inflationary money to buy unloved bonds.

2) Default on those bonds (political suicide), or…

3) Enter into a Western debt restructure—aka the big re-set for which I’ve previously warned will be “greased” via the introduction of a CBDC-driven control state masquerading as an “efficient payment system.”

Wonderful.

Watch the Bond Market: It’s the Thing

As I’ve said for years, and will openly say for years more: The bond market is the thing.

Everything follows the bond market’s lead, because debt rather than growth, manufacturing and sound fiscal leadership has been the singular and toxic wind beneath the broken wings of every national flag since Greenspan killed capitalism years ago.

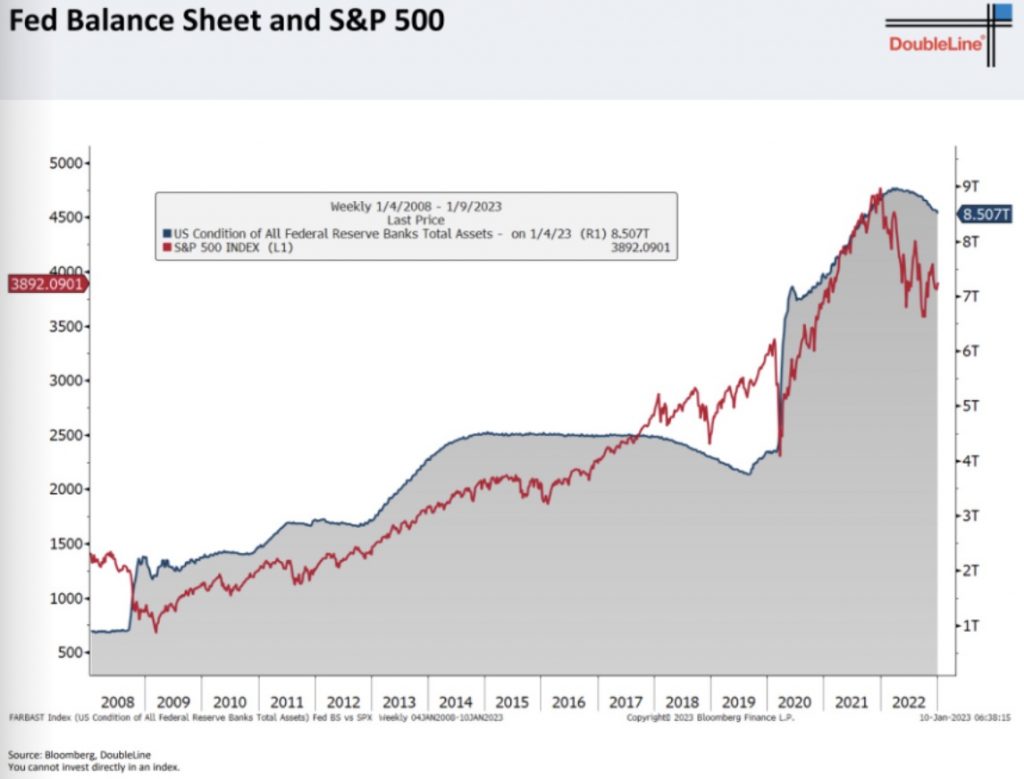

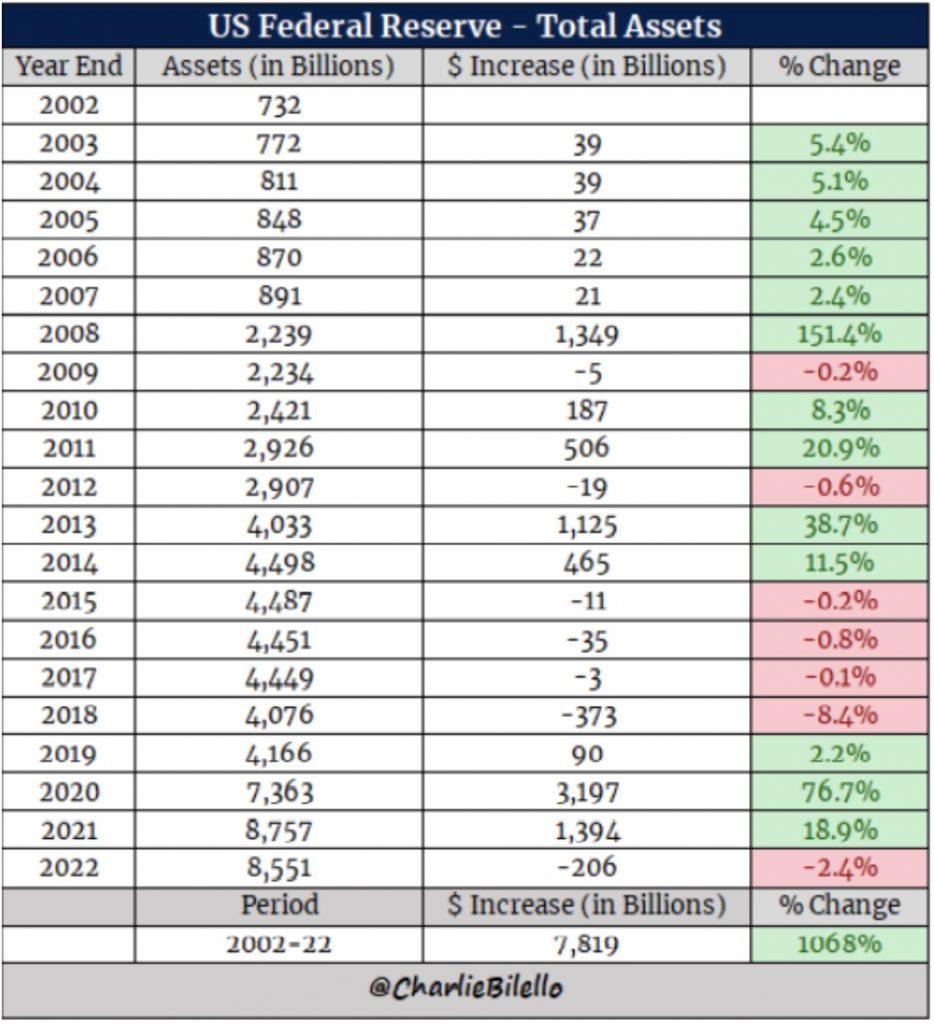

Debt, of course, buys time. And mouse-click money buys the debt. This madness creates false fun, intoxication and drunken euphoria. Our S&P, for example, simply tracks (up or down) Fed QE or QT. In short: A Fed Market.

But there’s a cost for such madness.

As Rates Rise, Markets Fall

Mouse-click money also creates inflation and distorts every other asset class, from housing to stocks.

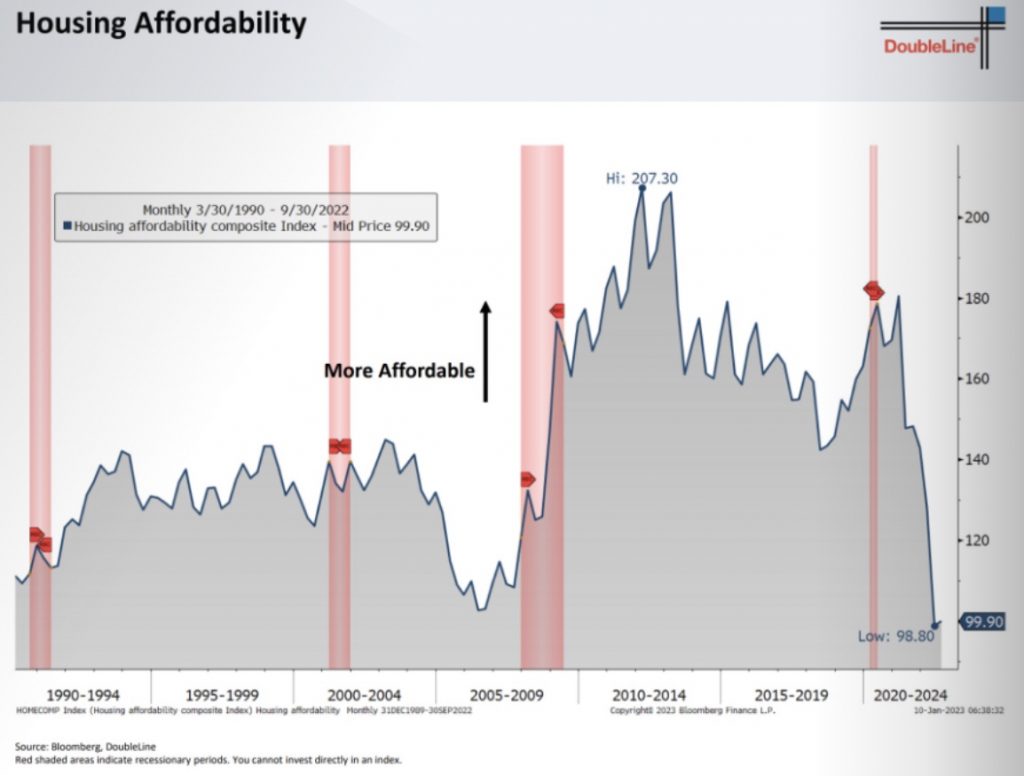

Property markets, for example, love low rates but crater once rates rise and affordability metrics tank, and I do mean TANK:

As we are seeing in real time, eventually the fantasy and artificial tailwind of drunken QE becomes a sickening hangover as central bankers like Powell try to “tighten” what was once “loose.”

Astounding Arrogance

These central bankers share the astounding arrogance of believing (or at least pretending) that markets can be carefully controlled like a home thermostat to usher in “soft QT landings” after years of fatally addictive QE highs.

But as the data now confirms, there’s nothing soft now or ahead.

During the QE intoxication period, when bonds are bought by central banks to keep yields and rates artificially repressed, the cost of debt is nearly free and the stock, bond and property markets balloon on free money, stock buy-backs and seemingly perpetual debt roll-overs.

Tech Stocks & Property Markets

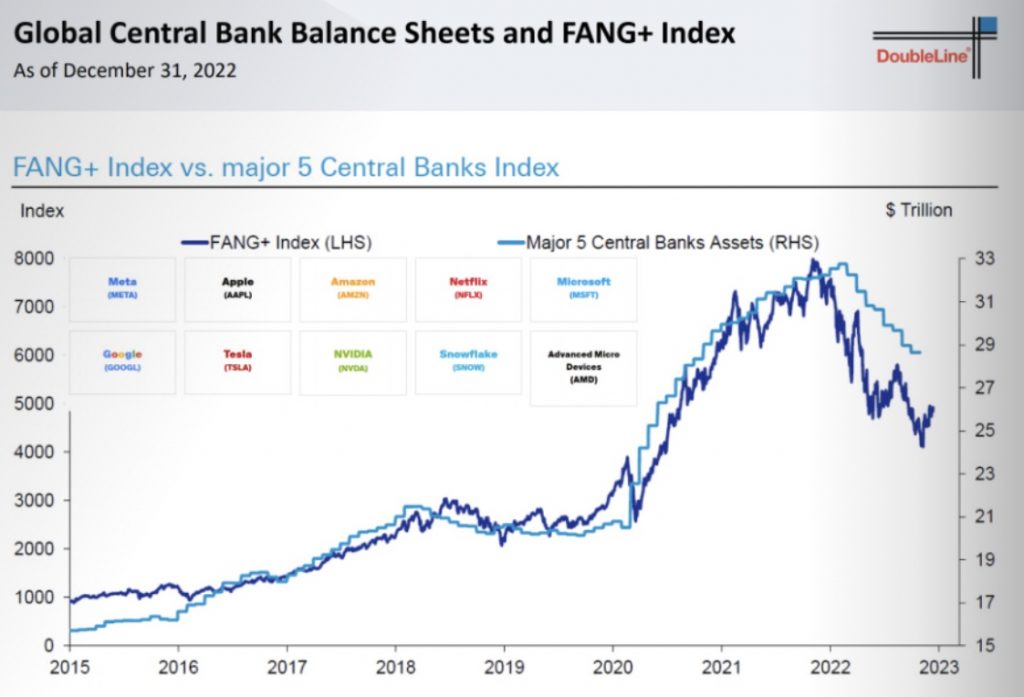

This was especially true of tech stocks like the FANGS—their entire rise and fall was and is clearly correlated to a fake money printer and low rates, as I patiently warned years ago and have recently been shorting to my advantage once the sign was clear.

It was easy to see. The Fed (and rate markets) signaled it.

Too Little, Too Late: The Open Failure of Modern Monetary “Policy”

In 2022, when central bankers privately realized they had made an historical QE mistake and tried (far too late with far too little) to introduce QT, Titanic stock, property and currency bubbles begin their slow then rapid fall toward the ocean’s floor.

This process has already, of course, begun.

In 2022, for example, the tightening Fed reduced its sickening balance sheet by a mere 2.4%. Hardly a dent.

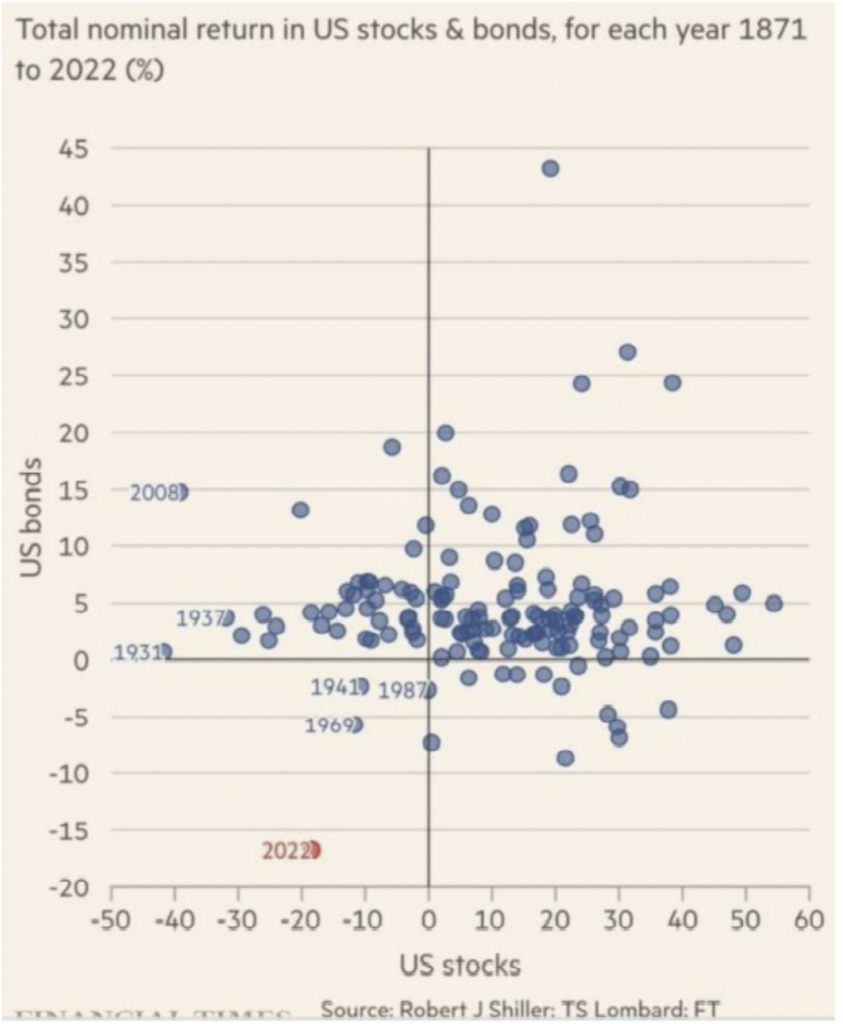

But even that pathetically tiny bit of “tightening” in the US backdrop of a pathetically massive debt-to-GDP ratio of 125% was enough to usher in the worst year for stocks and bonds since 1871.

Please: Re-read those last lines and re-examine those last two graphs. Let it sink in.

By now, it should be bluntly obvious how central banks rather than natural market forces OWN our so-called “free markets”?

Where the money printing goes (up or down), so goes the debt-driven markets and debt-soaked economies they manipulate.

Far, far more alarming, however, is this little added fact: If QT continues at its current pace of -$95 billion per month, just imagine what such a 13% annualized Fed balance sheet reduction (as opposed to 2.4% in 2022) in 2023 will do to these already historically broken markets?

Will a QE Pivot Even Work?

In the past, of course, the Fed’s “easy solution” to tanking markets was just another drunken run (or pivot) toward a QE money printer to finance US debts and hence keep yields and rates “accommodated” and “controlled.”

But in the past, US deficits were below 20% of global GDP growth. That was a ticking time bomb.

But heading into 2023, US deficits are already greater than 30% of global GDP growth, which means that time bomb is already exploding.

Sensational?

Nope.

This is just the simple math and the open failure of years of easy money and easy debt, none of which our central bankers will transparently confess, as Putin and COVID serve as far better scapegoats for the goats at the trigger of our mouse-clicked money.

In short, it took us 150 years to see markets this pathetic, and the worst is still to come.

Thus, as Congress spends like a drunken sailor, who will pay its embarrassing bar tab?

The private sector?

Nope. The balance sheets just aren’t there.

A pivot to more QE?

Well, that’s a potential albeit desperate possibility—and it will send gold soaring, and likely BTC as well, whatever one’s views on the current (and FTX infected) crypto narrative.

The US Dollar’s Slow Fall from Prominence

Of course, more money printing at the Fed will weaken even the relatively strong but unsustainable USD of 2022, as we’ve consistently warned throughout the USD’s 2022 rise.

The temporary, relative and artificially strong USD of 2022 was an absolute kick in the groin to currencies and nations like the EU, UK and Japan whose currency and bond markets didn’t and don’t have the global world reserve status to similarly raise rates hundreds of basis points in a year to “fight inflation” (or Putin’s Ruble…).

Japan & the EU: Fighting Back?

But even these hard realities haven’t prevented a zombie nation like Japan from attempting to now fight the USD, as Tokyo’s recent move to raise 10-year rates on the JGB confirms.

This rate hike provided a little wind behind the yen, as expected, in the now unofficial currency war taking place globally.

More importantly, there is increasing talk out of Tokyo to repatriate capital back to Japan, which would involve dumping more USTs to purchase more Japanese IOUs at a time when the US needs more not less buyers of its unloved and distrusted bonds.

By the way, less demand for USTs just means more rising yields and rates…

In sum, the slow but steady process of de-Dollarization continues its predictable trend as the US runs out of options, trust and friends in a bond and currency market in the middle of a major “Uh-Oh” moment.

The 2023 ECB, moreover, is already signaling similar rate hikes and flows away from USTs in favor of local bonds and currency. This won’t help Uncle Sam’s bar tab…

Again: The bond market is the thing, and these things (most notably US bonds) are objectively rotten to the core.

Shark Fins Approaching

More rising bond yields are the rising shark fins swimming at full speed toward global economies bloodying their waters with unsustainable debts and recessionary chum.

The Planned Recession

The only force to slow down these rising yields/shark fins is the mother of all Fed-induced recessions (deflationary), which means Powell’s promise of a “softish landing” is about as bankable as his promise of “transitory” inflation.

As I’ve said many times, no recession can be cured with rising rates and a strong currency. Never. Not once.

Thus, once the re-defined an unofficial recession we are already in becomes “official”—the US will weaken its Dollar, which gold, of course, will love. If not already in 2023, certainly by 2024.

All we can do for now is track those shark fins and doubt those bankers…This will link you directly to more fantastic articles from Egon von Greyerz and Matthew Piepenburg CLICK HERE.

Gerald Celente shares with King World News listeners around the globe what may send the price of gold soaring to $2,100-$2,300 in a matter of weeks. To listen CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.