On the heels of yesterday’s Fed Meeting, the price of gold soared to a new all-time high. Here is a look at where things stand.

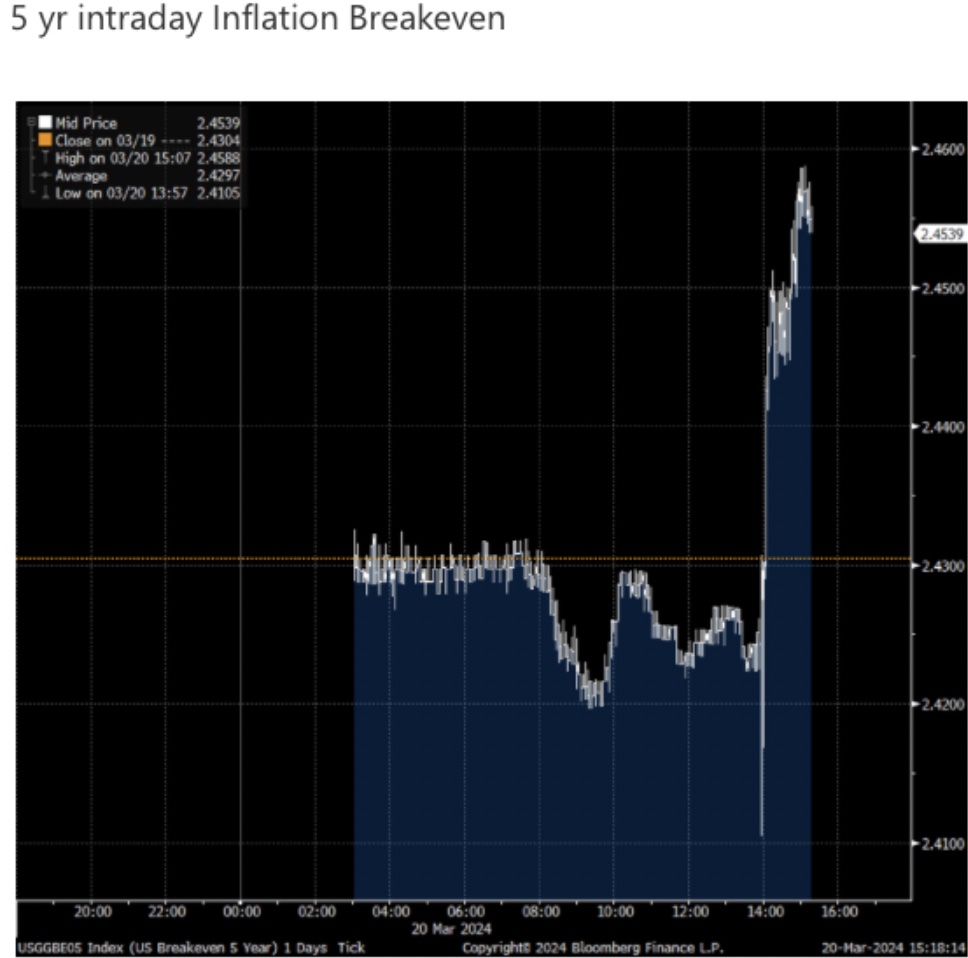

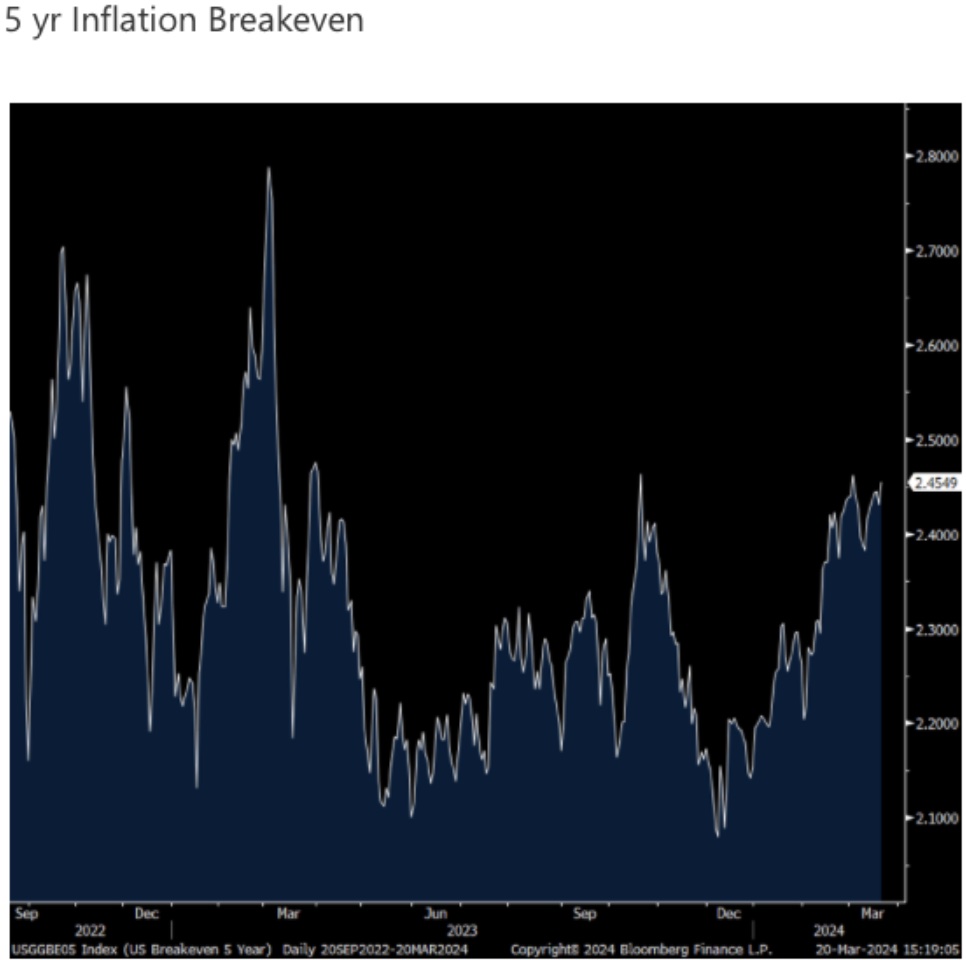

March 21 (King World News) – Peter Boockvar: Jay Powell clearly leaned dovish today as even a strong labor market he said would not stop the beginning of rate cuts. And this is why the short end yield fell as it did. However, the long end is not really budging and is exactly the same 4.28%ish level it stood right before the statement. Also of note, inflation breakevens for 5 yr and 10 yr maturities are rising with the former just a few bps from the highest level since January 2023 as if Powell and Co is going to get soft on inflation, the long end and the TIPS market are not going to like it.

18 Month Look At 5 Year Inflation Breakeven

With regards to the balance sheet, the message is mixed as where he made it clear they will begin QT tapering ‘fairly soon’, he also said in so many words that ‘going slower could mean going further’ in terms of the ultimate destination and size of their balance sheet.

I’ve argued that while the Fed might/will cut short term rates, you could see higher long term rates instead and while one day a trend doesn’t make, this immediate response in the yield curve to Powell’s dovishness gives me more confidence in that view…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

The FOMC statement was just about identical to the one written at the January meeting. They did tweak the labor market comment by taking out the wording “job gains have moderated since early last year” which preceded “but remain strong” and instead just said “Job gains have remained strong.”

They kept in this key line, “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%.” As they should have kept it in so as if they are going to possibly cut on June 12th, they can always tweak this at the May meeting.

While I think it’s worthless to look at their forecasts for 2025, I’ll just point out that the median fed funds rate by yr end next year is 3.9% from 3.6% seen prior.

King World News note: Gold continues to have a solid bid as the available physical gold continues to be swept off the market by BRICS countries and their central banks. There will be continued volatility as the Western central banks play with the price from time-to-time, but London Gold Pool II is clearly running into trouble with their latest gold price suppression scheme.

Alasdair Macleod’s latest audio interview discussing the short squeeze in the silver market has just been released CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.