On the heels of a solid upside advance, today the price of gold has fallen $63, silver has tumbled $1.60, but also look at the S&P and Japan.

Pullback Should Be Short-Lived

April 22 (King World News) – Jesse Colombo: Precious metals are correcting a bit today, which is to be expected after such a sharp rally.

What I find notable is the lack of volume (in both futures & spot trading) behind this sell-off, which is further reason to believe that it is likely to be short-lived.

Healthy Pullback With Low Volume On Gold Selloff

Highest Short Position Since 2007

Peter Boockvar: The weakness in the yen has brought the speculative non-commercial net short position to the highest level since 2007 as of last Tuesday (reported Friday) and from a contrarian standpoint, a rally could come at any time. A few months ago I highlighted the record net short in corn where a 7.5% rally followed.

Soybeans had a record short too and then rallied by a similar amount but then pulled back. We’re still long fertilizer stocks by the way.

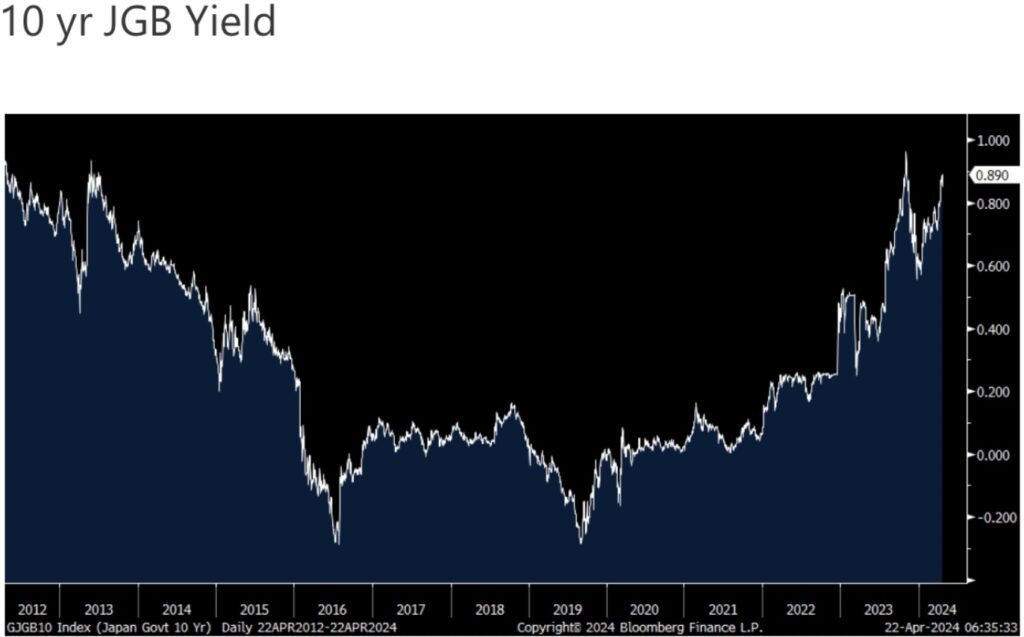

On Friday speaking in DC, BoJ Governor Ueda said “If underlying inflation continues to go up, we will very likely be raising interest rates.” As for QE, “Irrespective of what the data will say in the near future, we will like to find a way and timing to reduce the amount of JGB purchases.”

The JGB response overnight was another 4 bp rise in the 10 yr yield to .89% to the highest since November. Yields were higher too in the rest of Asia and seen in Europe and the US. We are all in the same bond soup together so what happens there matters for what happens here with bond yields. The yen though still can’t get out of its own way and its little changed just under 155.

Citi Warns On Stocks

Naveen Nair at Citi: Last week, we warned that stocks were trading close to major support levels, which we have now closed below on a weekly basis. We turn bearish as a result, with techs formations suggesting another >5% loss in S&P e-minis and Nasdaq 100 futures – though we do flag that upcoming Magnificent 7 earnings pose a key risk to this view.

S&P e-minis

Price has closed weekly below the 55d MA, which has initiated a 55-200d MA setup. On top of that, weekly slow stochastics has crossed lower from overbought territory.

- The 55-200d MA setup suggests we could see another ~6% loss towards the 200d MA (currently at 4702). We remind we saw a seimilar setup in Aug 2023.

- Weekly crossover from overbought territory in slow stochastics suggests momentum has turned around.

- We are on-track to posting a bearish outside month at the top of the trend, which indicates further imminent losses.

S&P Set For Another Big Plunge

S&P Major Support All The Way Dow At 4,190!

Bearish Outside Month = Much More To The Downside For S&P

Celente – $3,000 Gold In 2024

To listen to one of Gerald Celente’s most important interviews ever discussing his predictions for the price of gold and what other surprises to expect in 2024 CLICK HERE OR ON THE IMAGE BELOW.

China Has Stockpiled 30,000+ Tonnes Of Gold

To listen to Alasdair Macleod discuss China’s massive gold hoard as well as what to expect for the rest of 2024 CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.