When it comes to the gold market 2024 has been a wild year. For example, COMEX gold swaps are now all-time record short the gold market. How this will resolve could be one for the history books if the swaps massive bearish bet goes against them and they are squeezed.

May 31 (King World News) – Alasdair Macleod: Gold and silver prices reflect relentless demand from China and Asia, who are simply getting out of dollars.

Normally at contract expiry, gold and silver prices get smashed as call options are driven into worthlessness and stops are triggered by the establishment’s shorts. And given silver’s spectacular performance this month (up 18%), a substantial retracement was to be expected. The outturn was less dramatic. Gold was marginally higher on the week, up $10 at $2344 in European trade this morning from last Friday’s close, and silver was up 75 cents at $31.15.

That physical demand from Asia is overwhelming paper markets is becoming increasingly apparent. We shall note Shanghai’s physical deliveries with interest when they are posted next week. But that doesn’t tell the whole story. Virtually all China’s banks offer gold accounts, and their physical backing remains undelivered within the Shanghai Gold Exchange’s vaulting network.

This demand contrasts with western appetites for gold, which remains subdued. There is little sign of the wider investment public joining in the fun, but as Asian buying continues to drive bull markets, enormous demand is bound to be generated eventually in the wealthy western populations.

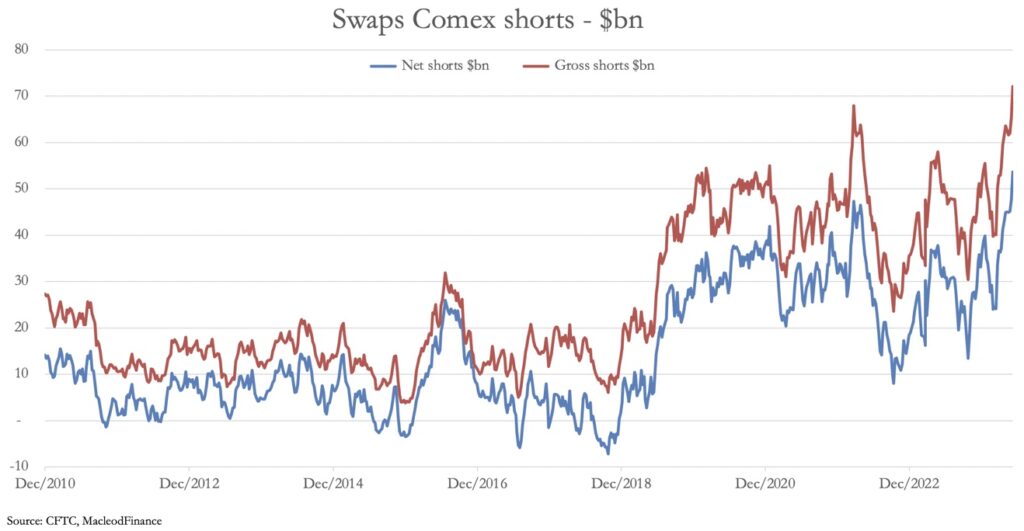

Other than market psychology, I see two factors at play. The first is that the western paper markets are extremely fragile with respect to a situation escaping from their control. The chart below shows the mark-to-market losses of Comex gold Swaps (mostly bullion bank traders) on 21 May, the last CFTC data release:

COMEX Swaps Now All-Time Record Short The Gold Market

Since then, by hook or by crook the establishment has managed to reduce Open Interest by 47,000 contracts, and managed the price down by $75, providing the Swaps with temporary relief. But in the face of surging demand for physical, their priority must be to close down their shorts.

This has the effect of draining liquidity out of paper markets, exposing the laggards in the bullion bank community to serious, possibly existential losses. The chart below puts this in a technical context, which the hedge funds will be watching closely.

The moment gold prices start accelerating away from the 55-day moving average there will likely be a rush of speculative paper demand, both in western markets and in Shanghai against restricted supply, because the paper establishment will also be buying to restrict its losses.

The second factor driving demand is already in play and bound to accelerate. Cognizant of deteriorating prospects for the value of paper currencies, foreigners are dumping them in favour of gold, silver, and other commodities. The surging copper price has been driven not by industrial demand but by Chinese stockpiling, which has led to a vicious short squeeze on Comex. Copper is not alone: Comex silver has been driven by similar conditions.

It is important to understand that the Chinese are not so much buying gold, silver, copper and other commodities, but dumping dollars. Commentators think this is being driven by China’s policy of reducing her dependence on dollars for trade settlements. That has been true, but China is increasingly aware of the US Government’s debt trap, the mispricing of western capital markets, and sees mounting risk in the dollar. Increasingly, this is why China is selling dollars.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.