Gold futures closed the week well above the $3,000 level and the mining stocks had an important upside breakout.

KWN just released Alasdair Macleod’s audio interview (LINK BELOW) and another audio interview will be released with an hour. Until then…

March 22 (King World News) – Alasdair Macleod: There is a Comex options contract expiry next week and 240,000 April contracts are yet to be sold, rolled, or stood for delivery. But after this disruption powerful bullish factors will return.

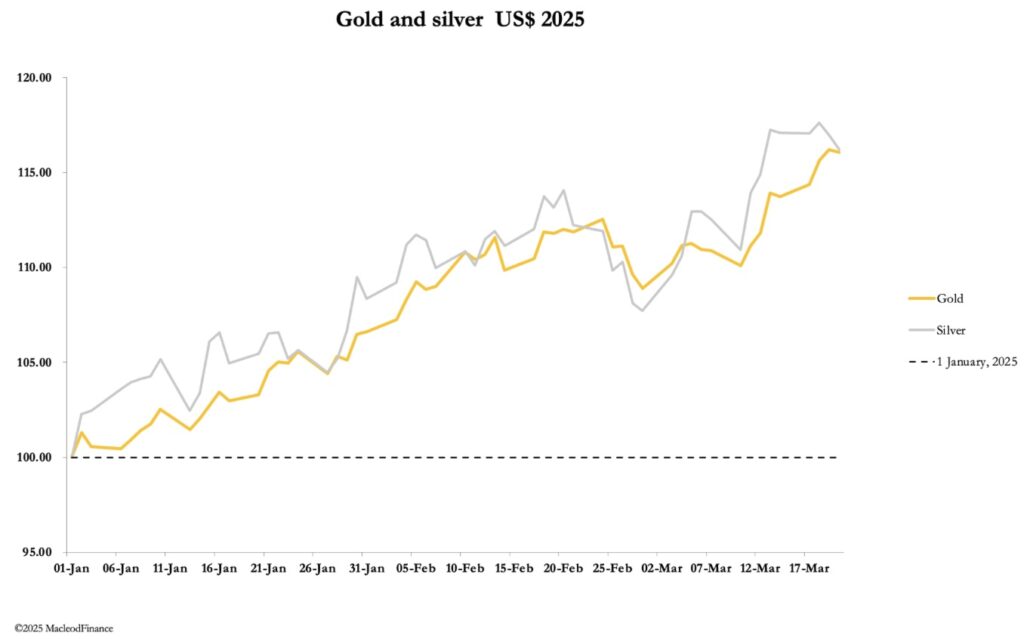

Gold rose this week, but silver declined. No doubt, the difference is that gold is being hoarded by central banks while silver is not. In this market report, we look at how this is affecting the two metals.

Gold rose this week, while silver declined moderately. In European trade this morning, gold was $3030, up $45 while silver was down 83 cents at $33. Comex trading in both were moderate, despite gold hitting new highs at $3057 yesterday morning (Thursday).

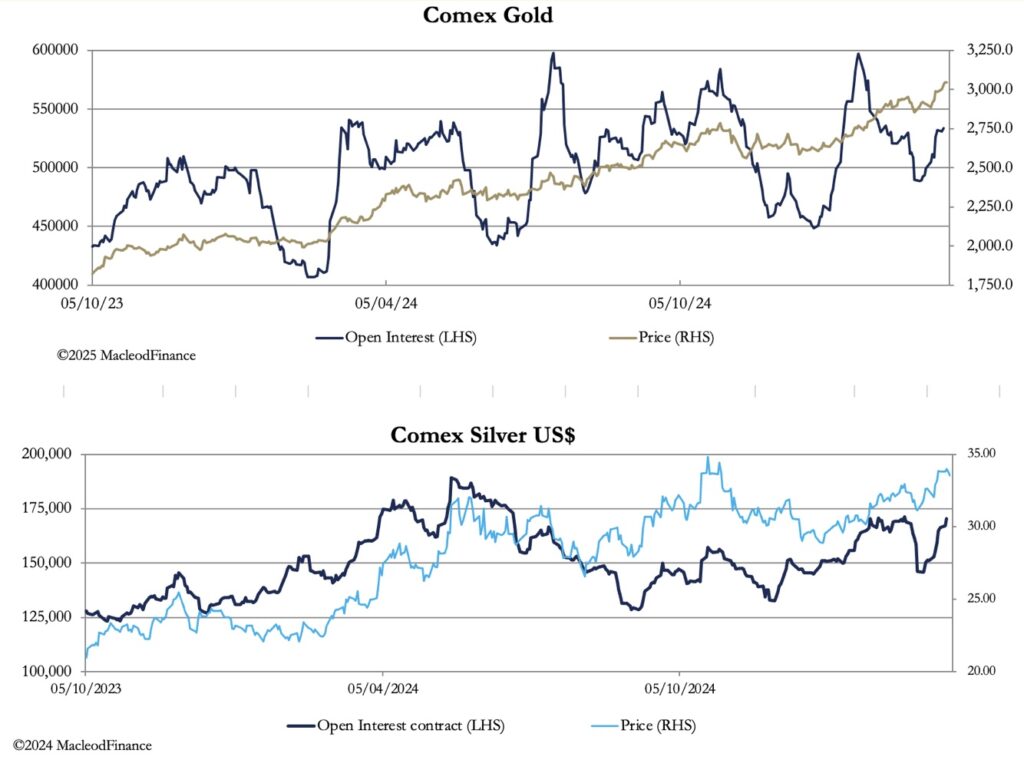

The charts of price and open interest put current market action in context.

Gold has seen some recovery in Open Interest which is beginning to drive current price performance. But silver, which has a relatively higher open interest position has yet to challenge the highs of last October. Normally, we would see silver moving up nearly twice as fast as gold, but as the headline chart illustrates, while silver has been more volatile than gold, it is only level-pegging this year so far, leaving the gold silver ratio at a high 91.5 times.

Silver requires long-suffering patience. But if gold continues its bull trend, we can expect silver to do better with some rapid catching up to do. It appears to depend on what is happening in gold.

There are a number of factors specific to gold, which we will consider in turn:

- The massive transfer of physical gold into Comex warehouses is to cover stand-for delivery commitments which have accumulated since the Covid crisis and accelerated in recent months to an annualised pace of about 1,700 tonnes. The threat of US tariffs making the importation of gold to cover these commitments more expensive was enough to trigger panic buying of Comex futures by bullion banks yet to honour deliveries.

- With gold hitting new highs and being the best performing asset class in the first quarter of 2025, investment managers and others are just beginning to realise they should readjust their portfolios by selling current poor performers such as techs and financials and reinvest in gold and related mines. This is a trend likely to build over the remainder of this year.

- While there is no verifiable evidence, it is logical to assume that central banks are withdrawing from leasing activities. It makes no sense for this community to be accumulating massive quantities of bullion and then to lose control of it by leasing. The current withdrawal of leased bullion from the Bank of England’s vault to disappear into the markets never to return underlines this point.

Withdrawing bullion supplies by refusing to roll over existing leases is sure to lead to significant market difficulties. The bullion bank establishment has relied on gold leasing to oil the wheels of the market and its ringmasters, the BIS, NY Fed, and Bank of England are running out of ways to persuade central banks to continue leasing their gold reserves.

In short, it looks like a perfect storm is brewing for gold, threatening to devastate long-standing paper market assumptions. But in the very short term, we have an option expiry next week, and the shorts will probably try hard to get the price below $3000 to make 6,700 Comex calls expire worthless.

JUST RELEASED! Gold Closes The Week Above $3,000

To listen to Alasdair Macleod discuss the gold and silver markets and more CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.