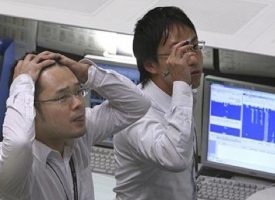

With continued volatility in global markets, the top trends forecaster in the world noted that even in today’s crazy world this seems unimaginable.

Is This Really Happening?

January 30 (King World News) – Gerald Celente: The Federal Reserve Bank of New York has pumped $6.6 trillion into major financial trading houses in the last five months through the repo market (repurchase agreement) market, according to data posted on the bank’s website.

The first week of the current repo rescue was last 17 through 24 September, when the repo interest rate unexpectedly jumped to 10 percent. During those seven days, the New York Fed put $373.9 billion into Wall Street trading firms, lending the money at between 1 and 2 percent to keep the markets oiled and working.

During the first week of 2008’s Great Recession – a week during which Lehman Brothers filed bankruptcy and the Bank of America swallowed Merrill Lynch – the New York Fed put $285 billion into the repo market to keep institutions afloat. That’s about $339.2 billion in today’s dollars.

In other words, the New York Fed has had to put about $34.7 billion more into the repo market now than it did at the crash that set off the Great Recession…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

Wall Street’s bulls dismiss concerns that the Fed’s cheap money is fueling risky speculation, calling the worriers “quantitative easing conspiracists.”

Repo Money Madness

The Fed pumped in $90.8 billion in short-term loans to trading houses through the repurchase agreement or “repo” market on 21 January. Overnight loans available to banks and trading houses totaled $58.6 billion; $32.2 billion was opened for 14-day loans.

On 15 January, the Fed reported that $229.5 billion in these short-term loans were outstanding compared to $210.6 billion on 9 January.

This market prop came after a 15 January injection of $52.6 billion to tide the markets over through the mid-month weekend.

TRENDPOST:

As we have long noted, the Fed’s cheap money is fueling a speculation bubble that will lead to another market plunge. Indeed, following last August’s market slump, the subsequent Dow’s 3,000-point rise since last September had nothing to do with inherent market value but by the flood of cheap money the Fed has made available for the trading houses to gamble.

Mirroring our equity market trend forecast, on 20 January, Scott Minerd, chairman of Guggenheim Investments and an advisor to the New York Fed, published a statement in which he likened central banks’ market manipulation to a Ponzi scheme and stated, “Ultimately, investors will awaken to the rising tide of defaults and downgrades.”

KWN has now released a great interview where Bill Fleckenstein discusses what to expect in the gold market, the stock market, bond market, commodities and much more and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

Two Of The Greats…

ALSO RELEASED: Two Of The Greats On Coronavirus Panic Plus Some Surprises CLICK HERE TO READ.

© 2020 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.