The global Ponzi scheme is quickly approaching a day of reckoning.

March 14 (King World News) – Gerald Celente: As we note just about every week, the “Bigs” keep getting bigger and the rich keep getting richer, while the average person—the plantation workers of Slavelandia—keeps getting poorer.

Once upon a time, not too long ago, America’s and much of the world’s streets were filled with small businesses. There were grocery stores, hardware stores, stationary stores, drug stores, local banks, etc.

Now they are all grocery chains, hardware chains, stationary chains, drug chains, bank chains owned by the big corporations, private equity groups, hedge funds and venture capitalists… in a country near you.

Thanks to the sellout by low-life politicians—who get paid by the “Bigs” to do what they are told with bribes and payoffs that imbeciles call “campaign contributions”—they did away with the list of antitrust laws that once prohibited this.

Feeling the Pain

According to a report published by the National Federation of Independent Business (NFIB) today, because of their concern about persistent inflation, small business sentiment fell to 89.4 in February from 89.9 in January, marking the 26th-straight-month where the index remained below its 50-year average of 98.

Bill Dunkelberg, NFIB’s chief economist, said that “While inflation pressures have eased since peaking in 2021, small business owners are still managing the elevated costs of higher prices and interest rates.”

The report showed small businesses expect business conditions on a six-month basis to decline 1 point to a net-negative 39 percent and real sales in the next three months will be to a net-negative 10 percent.

It’s in the Numbers

Last August, IBM said AI would replace some 8,000 employees. Then in January, the company said it would cut nearly 4,000 jobs.

CNBC reported that IBM told employees in its marketing and communications division today “that it’s slashing the size of its staff.”

This is the 75th-consecutive week we have been reporting on job cuts from major corporations. We’ve noted that these companies are cutting jobs so they can boost their bottom line to keep their artificially inflated stocks high…

In Times Of Increased Uncertainty

First, The Problem: An Undeniable Currency/Wealth Crisis & Transformation.

Fiat currencies are openly entering the last chapters of their once illusory but now steadily declining purchasing power and global credibility. La plus ça change…

This slow and steady spiral of fiat currency strength and the consequent risk of wealth destruction is nothing new. In fact, all debt-soaked systems throughout history have ended with a debased and then broken fiat currency. This is true without exception—from Ancient Rome to the Modern West.

Today’s global currencies are empirically following the same familiar pattern. In a global setting of unprecedented (and rising) debt levels which have risen from $258 trillion in 2020 to well over $330 trillion by 2022, etc. 2023, etc. 2024…

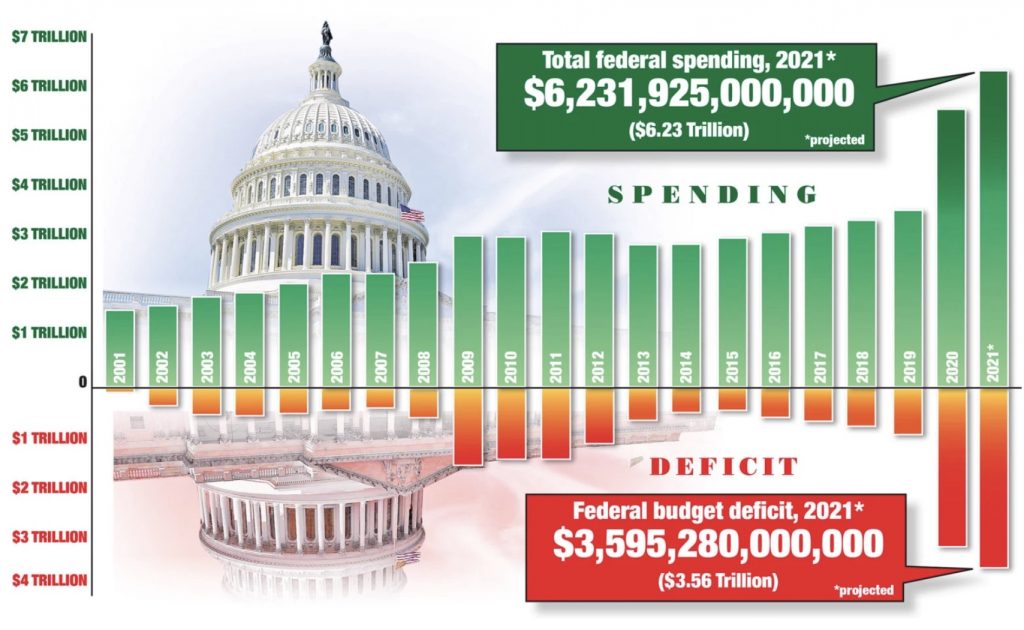

Out Of Control Spending:

The US Portion Alone Is Trillions

In early 2002, this legend made major investments for himself, his family a his group of investors into physical gold when the price was $300 per ounce.

His company is now the world leader for direct investor ownership of physical gold and silver outside of the banking system. It is also the industry leader in wealth preservation through precious metals for HNW clients in over 90 countries seeking private and unencumbered ownership of their assets outside of a fractured commercial banking system.

To listen to this amazing interview about the surge in the price of gold over $2,200 this week as well as the coming mania in the gold market, silver, inflation, and what to expect next CLICK HERE OR ON THE IMAGE ABOVE.

Sponsored

No need to look any further than the hi-tech industry who, along with their “Magnificent Seven,” have pumped up the Nasdaq to new highs.

According to the website Layoffs.fyi, some 50,000 employees have been fired by 204 tech firms since the start of the year. Indeed, the greater the layoffs the higher stocks rise.

Today, chipmaker Nvidia soared more than 5 percent, Meta was up 3 percent, Microsoft 2.6 percent, and Oracle jumped 11 percent.

Really?

Day after day, the stocks keep rising as more and more people get fired, personal debt keeps rising, and some 63 percent of Americans are living paycheck-to-paycheck.

Making a very bad situation worse, the Organization for Economic Cooperation and Development (OECD) reports that the “rich” countries’ government debt will hit nearly $16 trillion this year. And, of course, the bottom line is that the longer interest rates stay high, the more it will cost to service the debt… which of course at some point the debt bomb will explode.

Indeed, OECD said the 2024 debt among member countries will hit $54 trillion.

TREND FORECAST:

What individual, what business, and yes, what city, state, or nation can submerge deep in debt and keep doing business and not go bankrupt?

In front of everyone’s eyes for all to see, it is a government Ponzi scheme that, as with all schemes, will meet its day of reckoning. And when the day arrives gold prices and bitcoin prices will skyrocket.

However, there is a deadly downside. As we have greatly detailed over the decades and continually note with hard facts and indisputable data, as Gerald Celente says, “When all else fails, they take you to war.”

And as we have greatly detailed in this and previous Trends Journals, if We the People do not unite for peace, World War III has begun and the worst is yet to come.

On the economic front, many major nations are in, or on the brink, of recession. Across the globe emerging markets are submerging, thus the refugee crisis that has people escaping countries where they suffer from poverty, government corruption, crime and violence … will continue to escalate and become a major socioeconomic and political issue.

Also, from top to bottom, nations and their people will be suffering from Dragflation: Declining economic growth and rising inflation. In the U.S., today’s Consumer Price Index shows that inflation has not declined as much as expected with the CPI up 0.4 percent in February and up 3.2 percent year over year. Core inflation, which strikes out food and energy from the headline reading, went up 0.4 percent in February.

Therefore, with our forecast for an increase in job layoffs—which also keeps wages from significantly rising—Dragflation will be the way of much of the world as it costs more for the plantation workers of Slavelandia to buy less.

Making a rising inflation problem even worse is the Israel and Ukraine War wild cards. We forecast both wars will escalate and should Iran become militarily involved and/or oil rich Arab nations impose an oil embargo, Brent crude will spike to above $130 a barrel which, in turn, will crash economies and equity markets.

To listen to one of Egon von Greyerz’s best interviews ever CLICK HERE OR ON THE IMAGE BELOW.

To listen to Alasdair Macleod discuss the price of gold breaking above $2,200 CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.