Friday’s historic takedown in the gold and silver markets caused some dealers to close the door on precious metals purchases.

Some Dealers Shut Down New Orders

February 3 (King World News) – Email from King World News reader Paul B out of Australia: Hi, I’m a long time listener from Australia. Australia has had a massive run on gold and silver and unlike some countries, the public has not been selling much back to the dealers. Now many bullion sealers have suspended trading. Just thought you would like the update.

Regards Paul.

KING WORLD NEWS NOTE: Friday’s Historic Takedown In The Gold & Silver Markets Caused Some Dealers To Close The Door (Short-Term) On Precious Metals Purchases

Bullion Banks And The January 29 Takedown

The Final Hand: Some of the Bullion Banks Just Folded Their Cards

Email from retired pawnbroker, Gurjit L: I spent thirty years behind a plexiglass counter, watching desperation and greed weighed out in grams and karats. Gold chains during wedding season. Silver bars when times got hard. I’ve lived through every so-called “once-in-a-generation” rally since the 1990s.

But what happened on January 29, 2026, wasn’t just another rally. When silver crossed $120 and gold touched $5,600, I didn’t see excitement. I saw exhaustion. I saw the “Big Four” bullion banks finally run out of other people’s metal. This wasn’t speculation; it was a structural failure—the moment when decades of paper promises collided with empty vaults.

From here on out, expect violence in price. Halts. Rule changes. “Liquidity events.” The kind of chaos that makes even veteran traders step away from the screen and rub their eyes.

The Flash Crash: When the Algorithms Took Over

What we saw today, Friday, January 30, was the “violence” I warned about. It wasn’t a slow slide; it was a decapitation.

In a matter of hours, silver didn’t just drop—it entered a “capitulation event.” It peaked at $121/oz on Thursday, and by midday Friday, it was screaming through “air pockets” all the way down to $75. That is a 38% wipeout in a single sleep cycle. Gold followed suit, getting dragged from its $5,600 throne down to the $4,750 level.

To the guy watching the nightly news, it looks like “the bubble burst.” To those of us who know how the plumbing works, it was a coordinated liquidity drain. When the nomination of Kevin Warsh for the Fed hit the wires, the algorithms didn’t just sell—they stepped aside and let the floor fall out.

Forced Liquidations & The Price Disconnect

This wasn’t just “selling.” This was forced liquidation.

When the price moves that fast, the “margin man” comes calling. Funds that were “long” metals to hedge against the falling dollar suddenly found themselves in a vice. As AI tech stocks like Microsoft simultaneously cratered, these funds were forced to sell their “winners” (gold and silver) just to stay solvent.

Here is the kicker: while the “ticker” on your screen showed silver at $75, try actually finding a physical 1,000oz bar for that price. You can’t.

- The Shanghai Disconnect: While London and New York were “crashing,” the Shanghai Gold Exchange (SGE) maintained a massive premium of nearly $16/oz.

- The Reality: The “paper price” has become a fictional number used by banks to settle debts. The “real price” is what you have to pay to put metal in your hand—and that hasn’t budged nearly as much as the screen suggests.

The Narrative vs. The “Oh Hell” Moment

Turn on the news and you’ll hear the same tired script: gold fell because Warsh is a “hawk.” That story is designed for people who have never traded size.

What actually happened was simpler and uglier: a major short position broke. Somewhere inside a bullion bank, a desk crossed the invisible line between a bad loss and a fatal one. Every trader knows that feeling—the “oh hell” moment, when survival matters more than pride. That’s what January 29th was: forced buying in a market where physical metal is no longer available in size. Friday was the “payback”—the banks using every trick to smash the price back down so they could cover those shorts without going bankrupt.

The Part No One Can Say Out Loud

The problem isn’t price—the problem is solvency. Admitting that bullion banks are structurally short metal they cannot source would undermine confidence in collateral itself. That’s why the media ignores the plumbing:

- The BRICS Unit: Now 40% gold-backed and gaining steam.

- mBridge Volumes: Now exceeding $55B in cross-border settlements outside the dollar.

- The Physical Drain: The sustained movement of metal from Western vaults into sovereign Eastern hands.

The Trump Strategy: Ego, Power, and the “War Machine”

We are seeing an ingenious scramble for liquidity. President Trump knows the “X-Date”—where interest payments on the $38.5 trillion debt make the country mathematically unrecoverable—is looming. Quarterly interest payments ($270B) now exceed the entire U.S. Defense Budget.

Trump’s vision is singular: No War Machine, No America. * The Saudi Deal: Finalized $1 trillion in investment commitments for U.S. AI, energy, and defense.

- The Venezuela Operation: Following the January 3rd military raid and abduction of Maduro, Trump has moved to seize control of Venezuelan oil exports to fuel the U.S. machine directly.

- Resource Reclamations: Pressuring BlackRock to secure Panama Canal ports via a $23B forced buyback.

- Domestic Muscle: He is strong-arming big firms to shift hundreds of billions back into U.S. infrastructure.

- DOGE (Department of Government Efficiency): Musk and Ramaswamy are hacking away at the federal bloat, cutting spending and offloading thousands of jobs that have been draining the U.S. treasury for decades.

He knows: do it now, or it’s “bye-bye USA.”

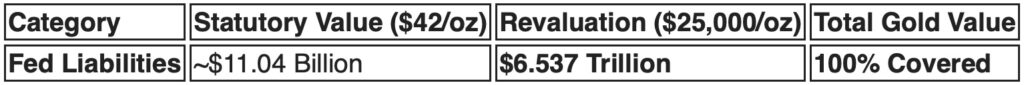

The Rumors: The $25,000 Accounting Reset

Whispers are growing that the ultimate move is a total accounting reset. By revaluing U.S. gold reserves to a market-realistic price, the Treasury could “zero out” the Fed’s balance-sheet hole.

To be clear: this will not “clear” the debt; it simply reduces the burden and pushes the problem down the road for a few years. Maybe they think that’s all the time they need. Remember, the play is never to get rid of the debt—the aim is simply to manage it and the interest repayments. The whole system is built on debt; it has to stay that way, or the machine stops working.

Conclusion: From the Pawn Bench to History

What we thought would take months is unfolding in days. The “crash” of Jan 30 wasn’t the end; it was a desperate “flush” by banks screaming for oxygen.

Silver is the real bottleneck. Gold resets balance sheets; Silver runs the war machine. Missiles, drones, and satellites require silver. A gold failure embarrasses bankers; a silver failure halts the military. That is why silver moves second—and then moves violently.

As always, take a pause, breathe, and watch your stacks. The currencies—especially Trump and the banks—will fight tooth and nail, biting like a rabid dog on steroids to keep their power.

Enjoy the show.

Disclaimer: I am not a financial advisor. I’m just a retired pawnbroker who’s watched metal cross the counter for a lifetime. The rest is up to your own logic.

Billionaire Pierre Lassonde Predicts Gold Price Will Hit $25,000

This is one of Pierre Lassonde’s greatest interviews ever where he predicts jaw-dropping prices for gold, silver and mining stocks and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

Friday’s Brutal Gold & Silver Takedown

To listen to Alasdair Macleod discuss Friday’s gold and silver takedown CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED!

This Is The Biggest Breakout In History! CLICK HERE.

Major Gold & Silver Update After Friday’s Crash In The Silver Market CLICK HERE.

Making Sense Of Friday’s Utterly Rigged Nonsense In The Silver Market CLICK HERE.

What To Do After Friday’s Brutal $37 Plunge In Silver CLICK HERE.

Historic Gold & Silver Plunge As Banks Cover Short Positions CLICK HERE.

Graddhy – We Just Saw A Short-Term Top In Gold, But There Is Good News CLICK HERE.

Billionaire Pierre Lassonde Just Predicted Gold Price Will Hit $25,000 CLICK HERE.

WILD METALS TRADING: Here Is What Is Happening CLICK HERE.

US Collapse Will Now Accelerate As Dollar Begins Historic Plunge CLICK HERE.

What A Difference The Metals Make, Plus US Dollar Woes CLICK HERE.

The World Is Changing As Gold Becomes Most Important Global Reserve Currency CLICK HERE.

The Amount Of Gold Needed To Buy A BMW Has Collapsed! CLICK HERE.

Buckle Up Because This Is About To Massively Rock Global Markets! CLICK HERE.

Michael Oliver – Historic Breakouts Will Now Send Gold & Silver Prices To Levels That Will Shock The World! CLICK HERE.

© 2026 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.