Everything is deteriorating rapidly and interest rates are rising again.

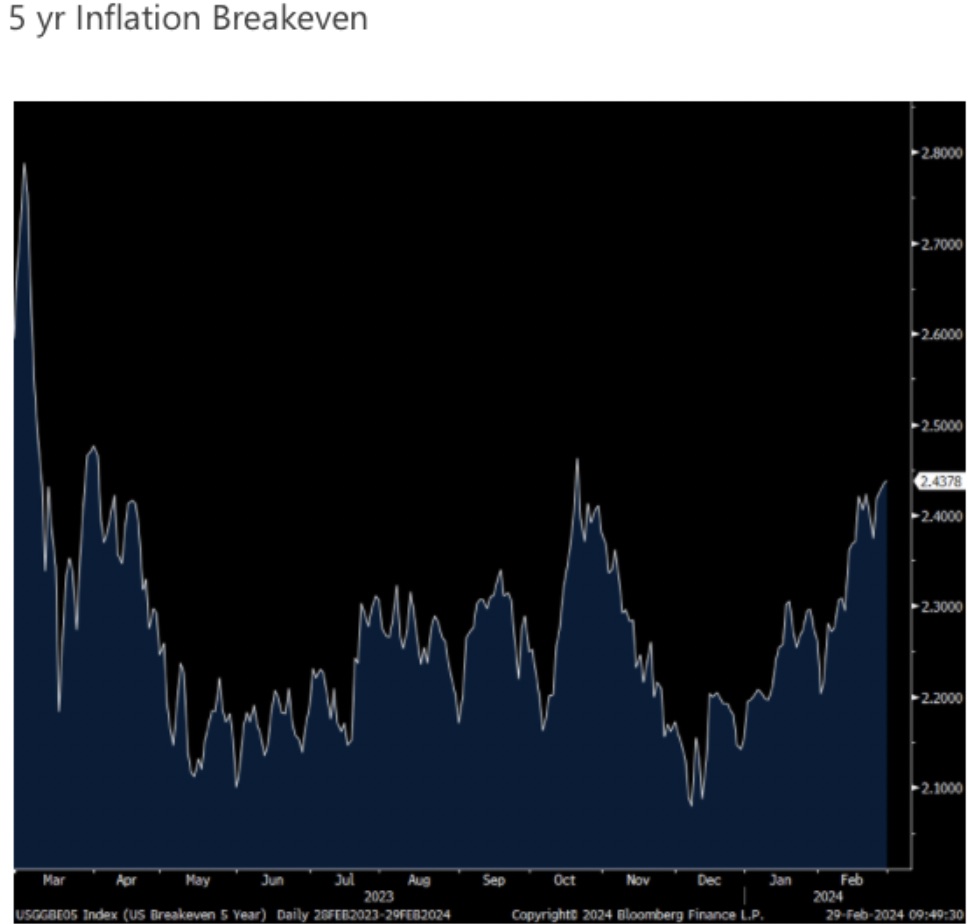

February 29 (King World News) – Peter Boockvar: Let me start by saying that while regular Treasuries are rallying on the in line inflation print, the inflation breakevens are actually rising a touch with 2 yr and 5 yr levels up about 1 bp. The 10 yr inflation breakeven is unchanged.

By the way, the 2 yr inflation breakeven at 2.78% is at the highest since March 2023.

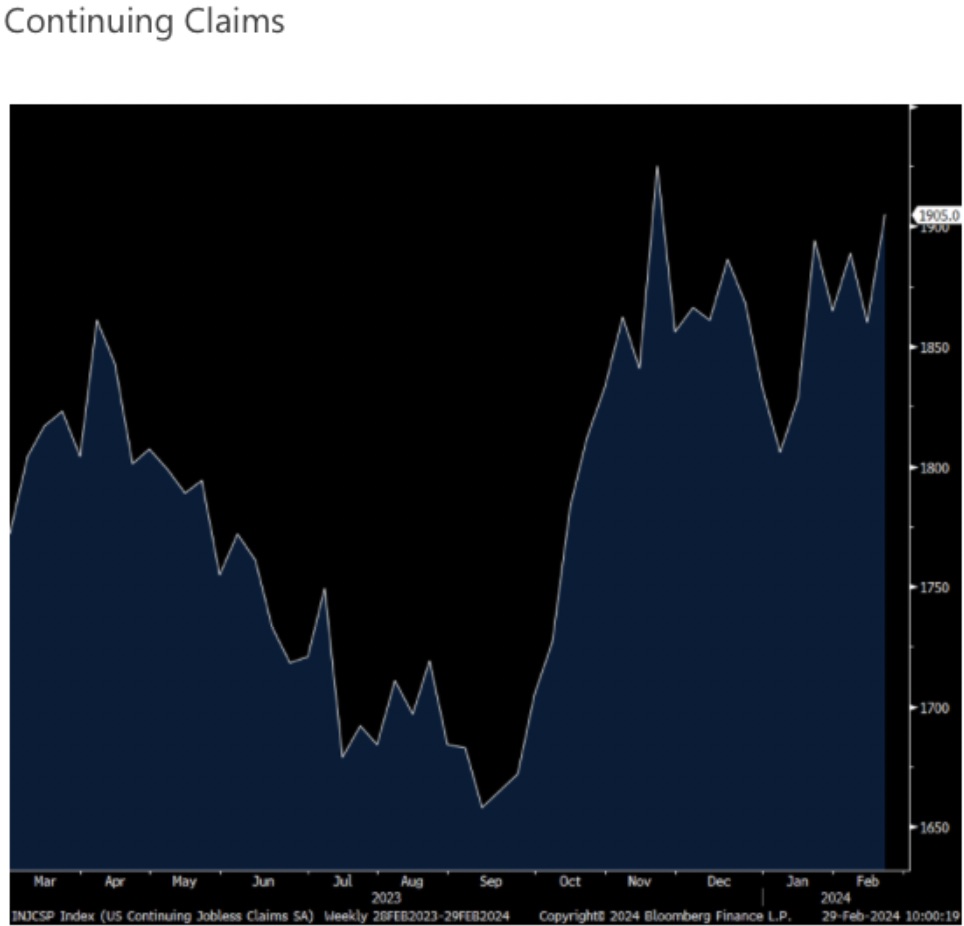

The 5 yr is less than 3 bps from the highest since last April. So this is more seemingly a relief, short covering driven rally more than anything else in conventional Treasuries but could also be helped by the highest continuing claims print since mid November.

Initial jobless claims totaled 215k, 5k more than expected and up from 202k last week.

Also of note, continuing claims got back above 1.905mm again, higher by 45k w/o/w. That’s the most since mid November, further evidencing a slowdown in hiring.

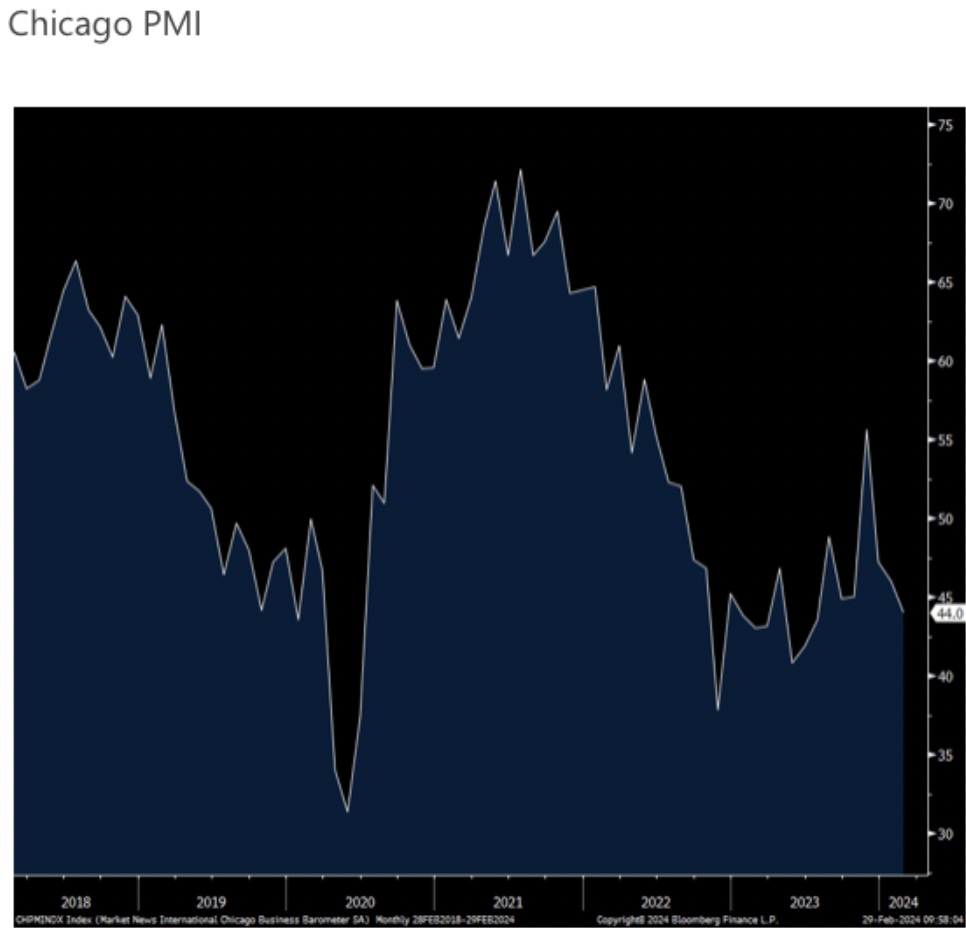

Following all regional manufacturing surveys that remain in contraction in February, except Philly, the Chicago PMI remains well below 50 at 44 vs 46 in January and 4 pts below expectations.

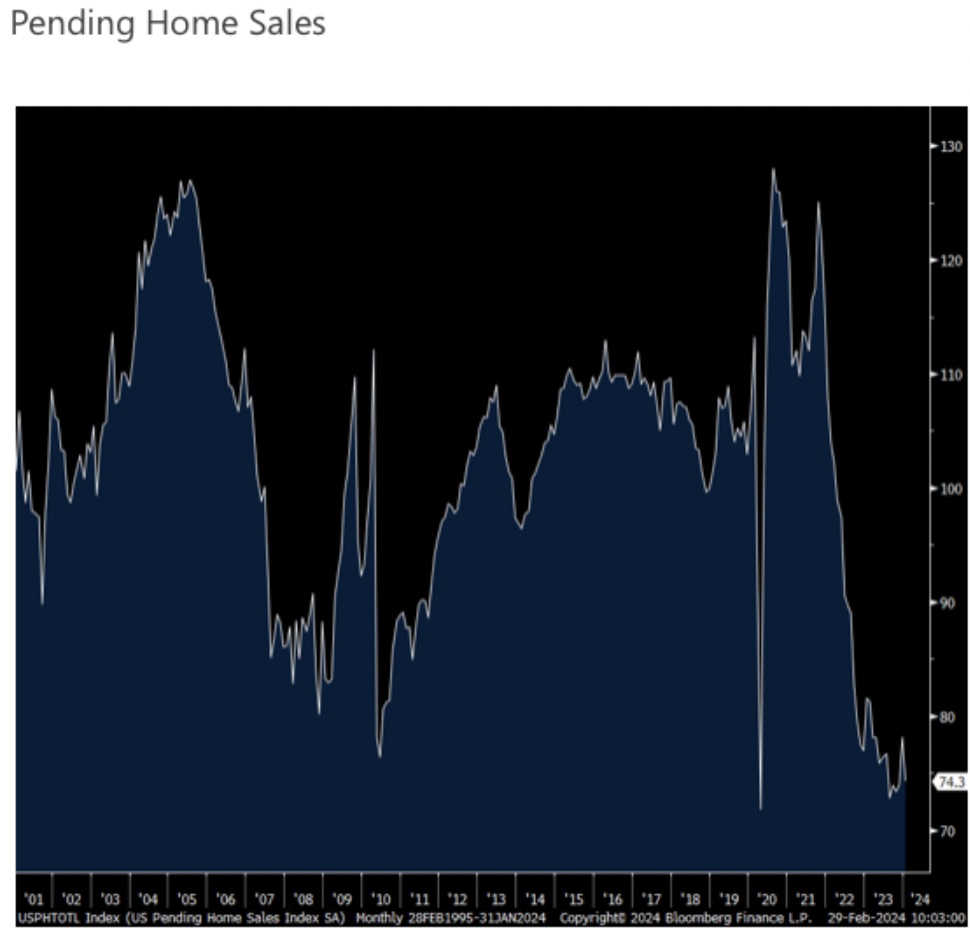

Pending home sales in January fell 4.9% m/o/m, well worse than the estimate of up 1.5% and December was revised lower to a gain of 5.7% vs the original print of up 8.3%. The index itself is near the lowest since this tally began in 2001.

No mystery here, “consumers are showing extra sensitivity to changes in mortgage rates in the current cycle, and that’s impacting home sales” said the NAR. Add in record high home prices. Again, the first time home buyer is very challenged on pricing/monthly costs.

To listen to Alasdair Macleod discuss what is happening behind the scenes in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.