The economic collapse is accelerating. Take a look…

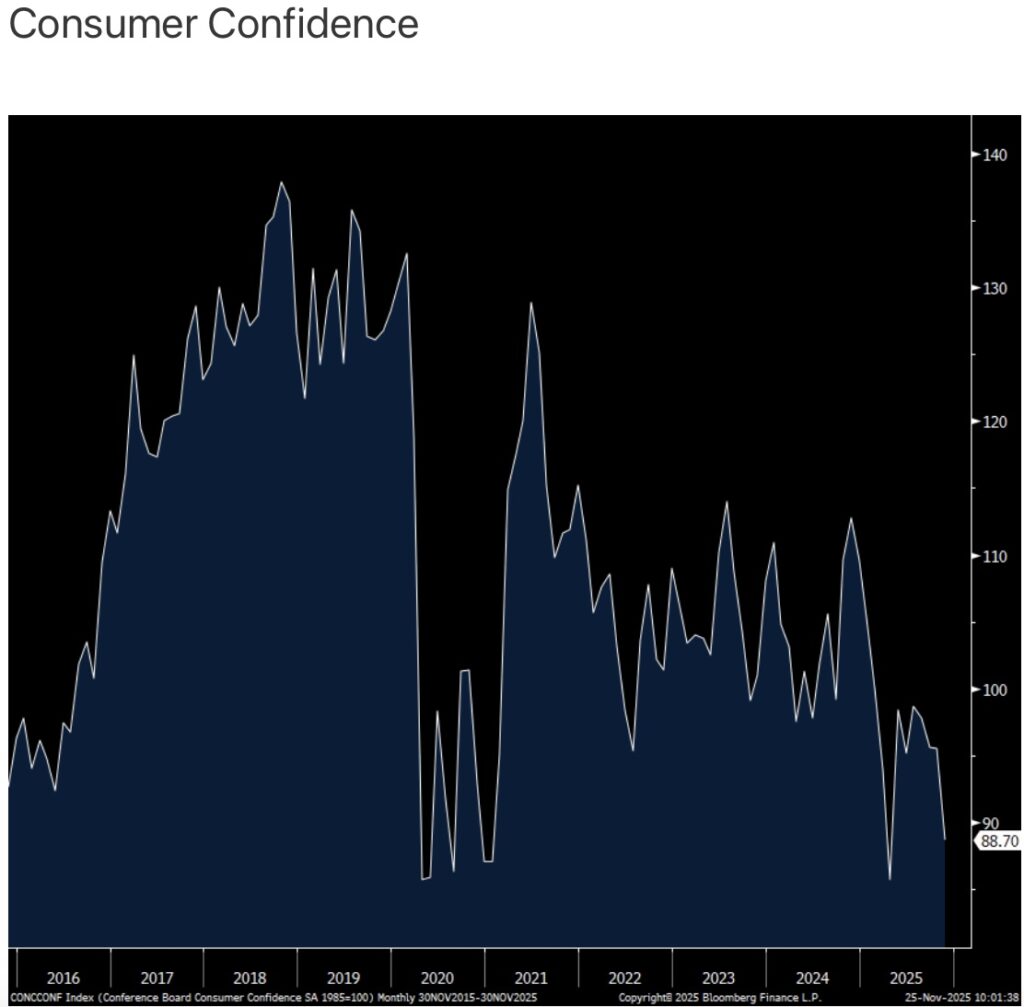

Consumer Confidence Collapse

November 25 (King World News) – Peter Boockvar: The November consumer confidence index from the Conference Board fell to 88.7 from 95.5, below the estimate of 93.3 and the 2nd weakest print since January 2021.

Both main components were down m/o/m. One yr inflation expectations held at 5.7% on average with a median read of 4.8% vs 4.6% in October.

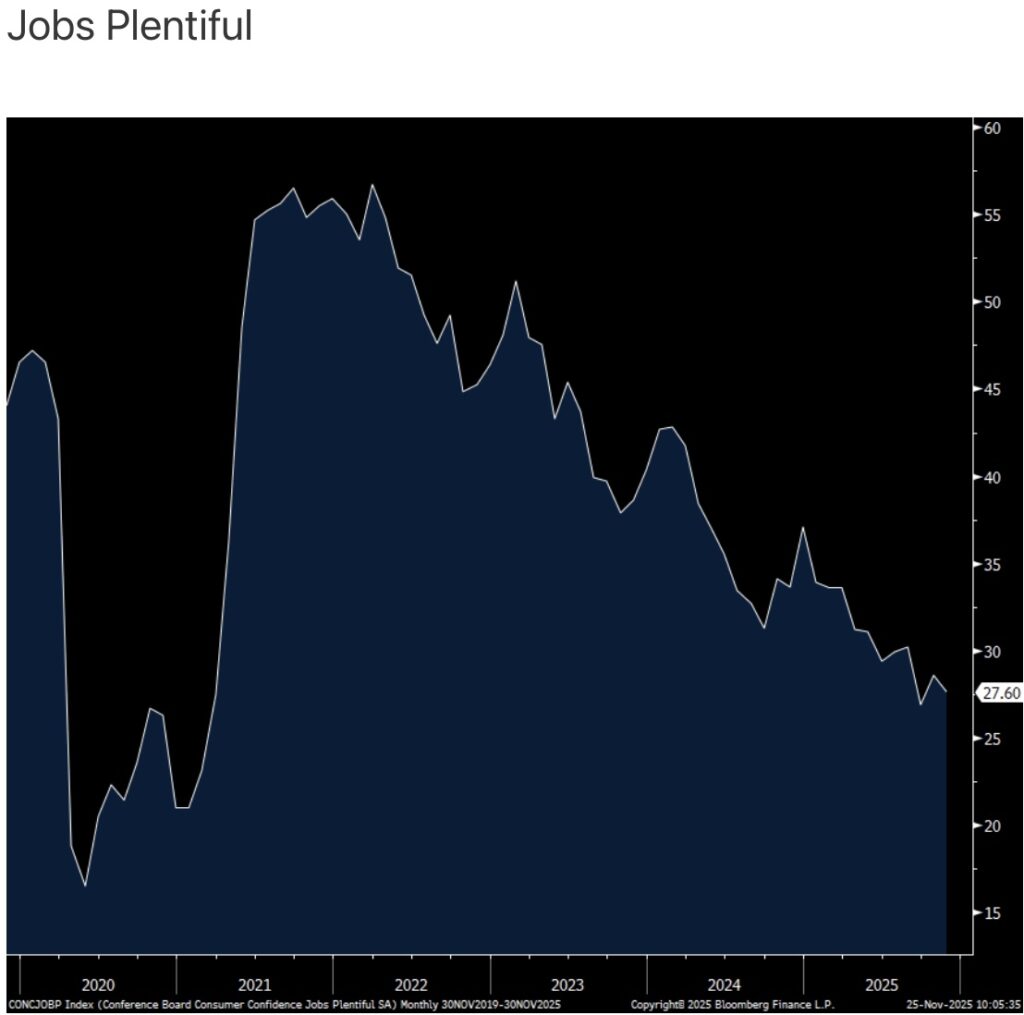

The answers to the labor market questions were mixed. Jobs Plentiful fell 1 pt to 27.6 and that is the 2nd lowest since March 2021.

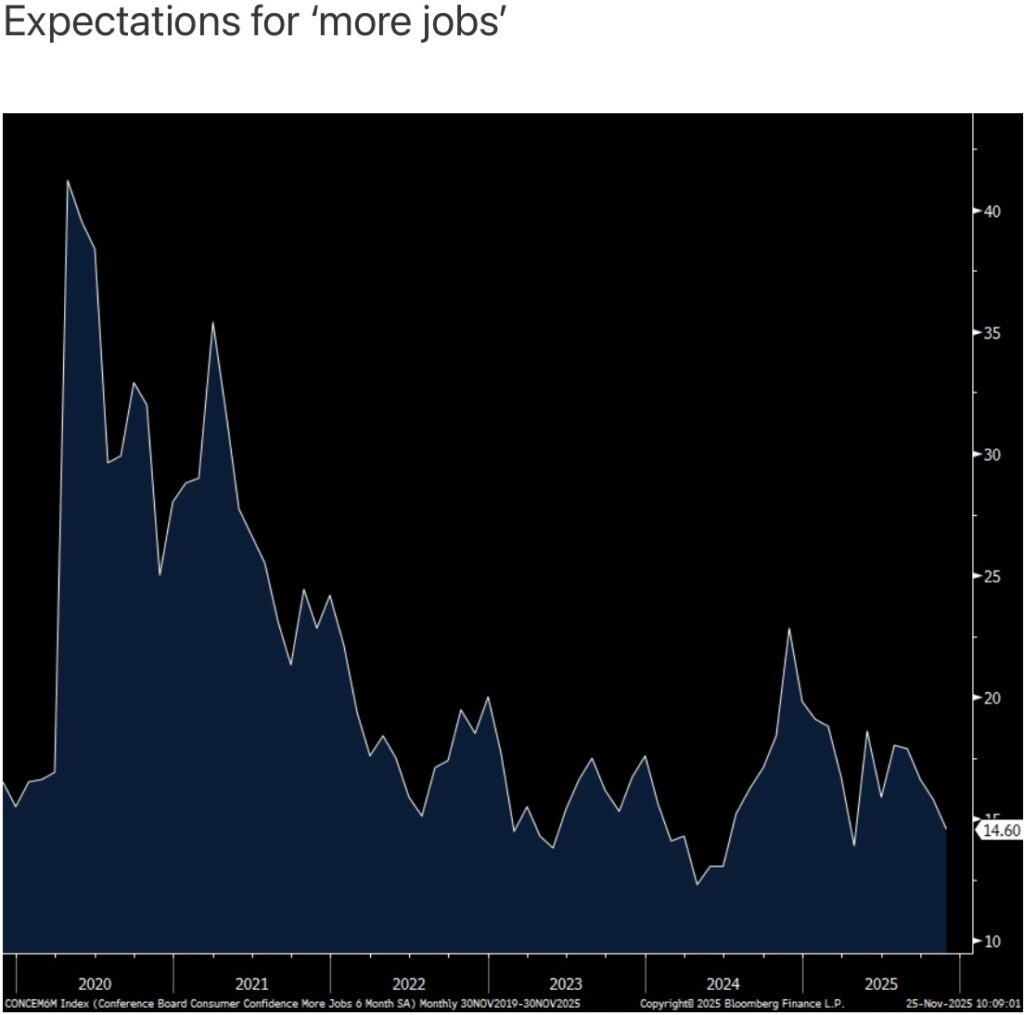

Hard To Get though fell .4 pts. Expectations for the labor market looking out 6 months deteriorated as those that see ‘more jobs’ fell 1.2 pts to the lowest since April. Income expectations weakened as well.

Spending intentions fell for autos, homes and major appliances. The ‘home’ category was particularly noteworthy because it fell to the lowest since April notwithstanding the drop in mortgage rates.

Politically, the Conference Board said “Confidence fell among consumers of all political stripes, with the sharpest retreat among independent voters.”

Not surprisingly, this is what continues to be the wet blanket on consumer confidence, “Consumers’ write in responses pertaining to factors affecting the economy continued to be led by references to prices and inflation, tariffs and trade, and politics, with increased mentions of the federal government shutdown. Mentions of the labor market eased somewhat but still stood out among all other frequent themes not already cited.”

Finally of note, “Assessments of current financial situations collapsed to the lowest level since August 2024, when a confluence of negative events stoked a brief financial market selloff and US recession concerns.”

Bottom Line

My bottom line, inflation and the ever rising cost of living continues to be the main consumer pain point. This VERY MUCH complicates the job of the Federal Reserve. I know it’s easy to think that the Fed should cut rates in response to an economy that seems more fragile and with a softening labor market but if that is the case because many consumers are stressed with inflation, shouldn’t inflation then be the main focus of the Fed? In other words, don’t we need low and stable prices first before we can be confident of a stronger economy and labor market? No easy answers here for them.

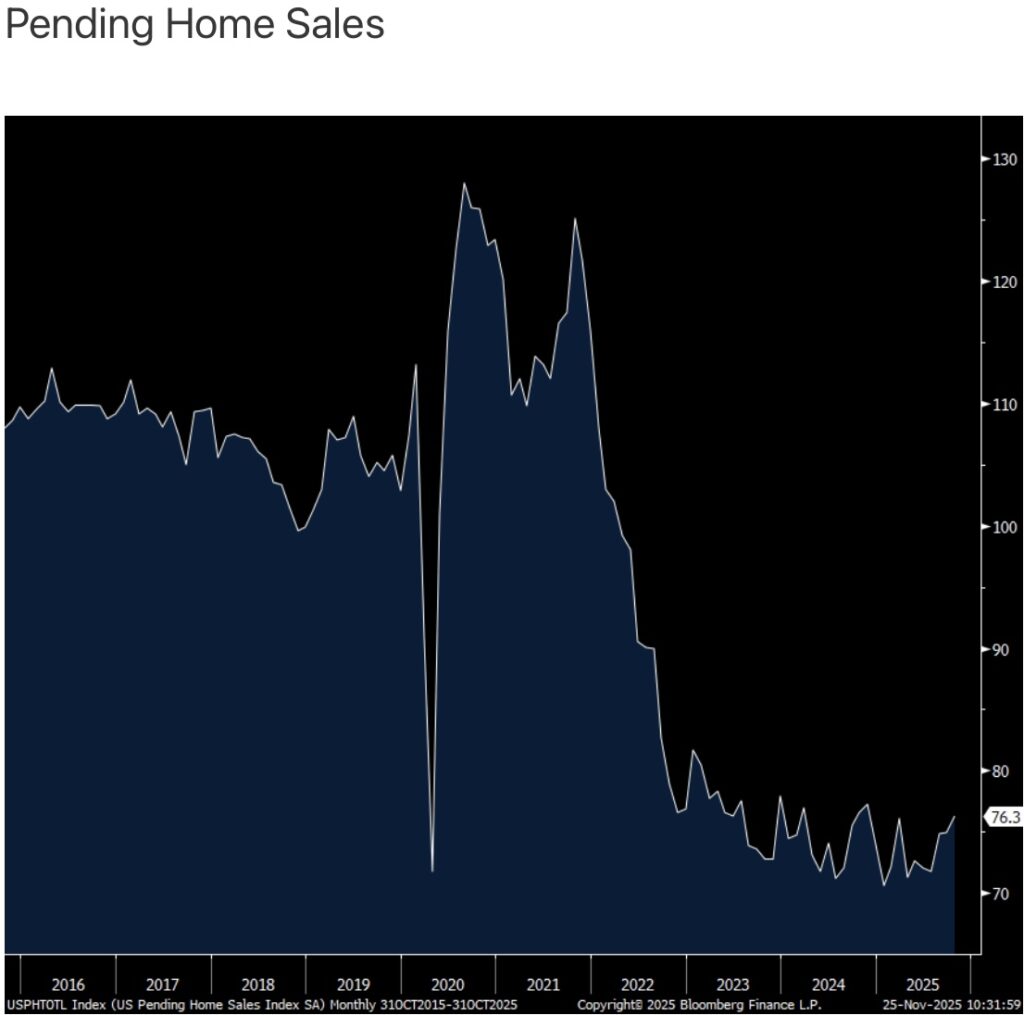

High Home Prices Keep Sales Collapsed

Pending home sales in October rose 1.9% m/o/m after a flat read in September and that was above the forecast of a slight .2% rise.

The NAR said “The Midwest shined above other regions due to better affordability, while contract signings retreated in the more expensive West region.” Sales in the Northeast were up by 2.3% m/o/m and by 1.4% in the South vs a 5.3% increase in the Midwest and a 1.5% decline in the West.

Bottom line, we know the housing market is trying to unfreeze here with the drop in mortgage rates and more supply seemingly coming to market but pricing still remains particularly tough for the first time buyer because of the cumulative 50% rise in prices over the past 5 years.

Manufacturing Continues To Collapse

Following negative prints seen in the Philly and Dallas manufacturing indices and the positive one for NY, the Richmond survey fell to -15 from -4.

Bottom line, the manufacturing recession unfortunately continues on in November.

ALSO JUST RELEASED: What Is Happening In The Gold Market Is Stunning CLICK HERE.

ALSO JUST RELEASED: Just What We Need: More Inflation & Cheap Money, Plus A Look At Oil And Gold Miners CLICK HERE.

ALSO JUST RELEASED: Another Bull Market Is About to Kickoff As Everybody Is Worried About The US Dollar CLICK HERE.

ALSO JUST RELEASED: Celente – Surprises To Expect For The Rest Of 2025 & 2026 CLICK HERE.

ALSO JUST RELEASED: Macleod – There Is Something Very Odd Going On In The Gold Market CLICK HERE.

ALSO JUST RELEASED: There Is Something Highly Unusual Occurring In The Gold Market CLICK HERE.

ALSO JUST RELEASED: Harvey Organ Explains The Massive Fraud In The Gold Market CLICK HERE.

ALSO JUST RELEASED: John Ing – Gold’s New Trading Range Ahead of The Move To $5,000 CLICK HERE.

ALSO JUST RELEASED: Silver Just Saw Another Historic Upside Breakout, Plus A Stunning Gold Chart! CLICK HERE.

Expect Major Surprises For The Rest Of 2025 & 2026

***To listen to Gerald Celente discuss what surprises to expect for 2025 & 2026 CLICK HERE OR ON THE IMAGE BELOW.

Something Very Strange Is Going On In The Gold Market

***To listen to Alasdair Macleod discuss the highly unusual events occurring in the gold market CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.

![GOLD & SILVER BULL TO REASSERT ITSELF: “People Should Expect [High Inflation And] Negative Real Rates For Years To Come” GOLD & SILVER BULL TO REASSERT ITSELF: “People Should Expect [High Inflation And] Negative Real Rates For Years To Come”](https://s43022.pcdn.co/wp-content/uploads/2019/07/King-World-News-Gold-Silver-Update-Plus-A-Bad-Situation-Getting-Worse-And-Dont-Worry...Everything-Is-Okay-275x200_c.jpg)