There was a delay in publishing due to a technical issue that has now been resolved. Serious inflation is on the way as gold soars to $2,300 and silver hits $26.20.

Serious Inflation Is On The Way

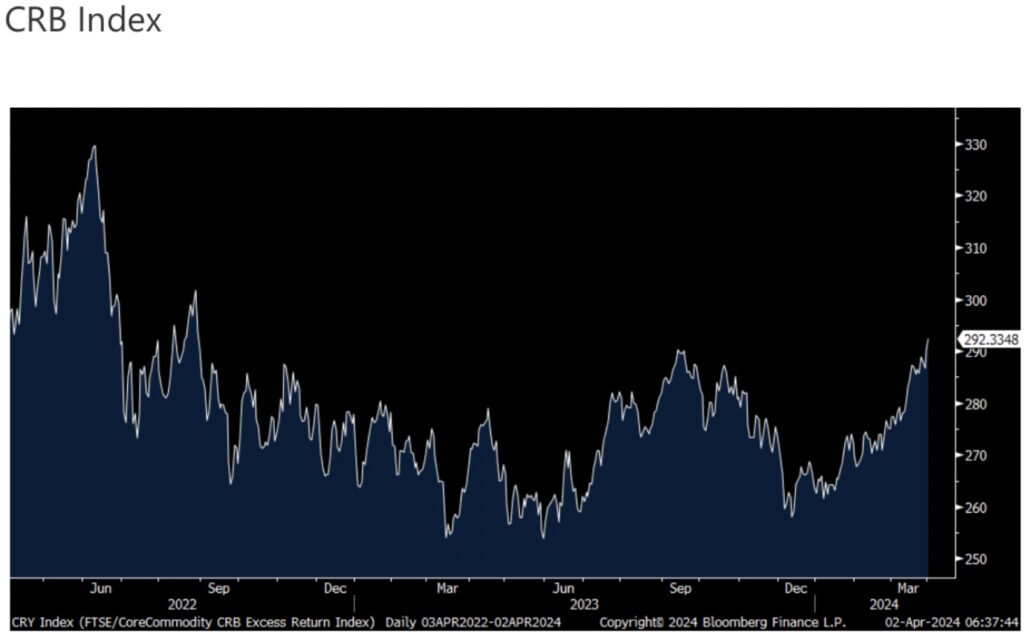

April 2 (King World News) – Peter Boockvar: With WTI now above $85, higher by almost $2 today, I do want to point out that the CRB index closed yesterday at the highest level since August 2022.

A Little More “Transitory Inflation” Right As The Fed Wants To Cut Interest Rates

We Remain Bullish Gold, Silver Uranium, Copper & Oil

We’ll have to see how this flows thru inflation if sustained in coming months/quarters but it certainly won’t help, particularly on the energy side and will further complicate the job of the Fed. We remain bullish and long on energy, precious metals, fertilizer, uranium and copper stocks…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Cut Rates Into Another Inflation Wave?

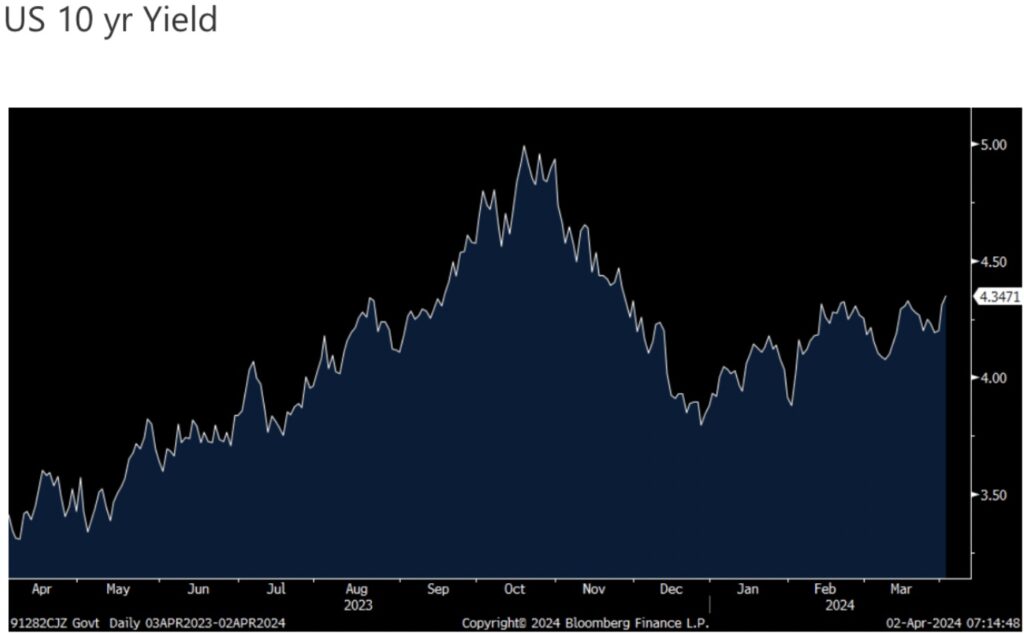

Rate cut odds by the way for the June meeting are now under 50%, as of 40% right now. Odds for one by July though are at 96%. The US 10 yr yield is quietly rising to the highest level since late November. I remain bearish on duration and expect the 10 yr yield to retest the 5% at some point this year.

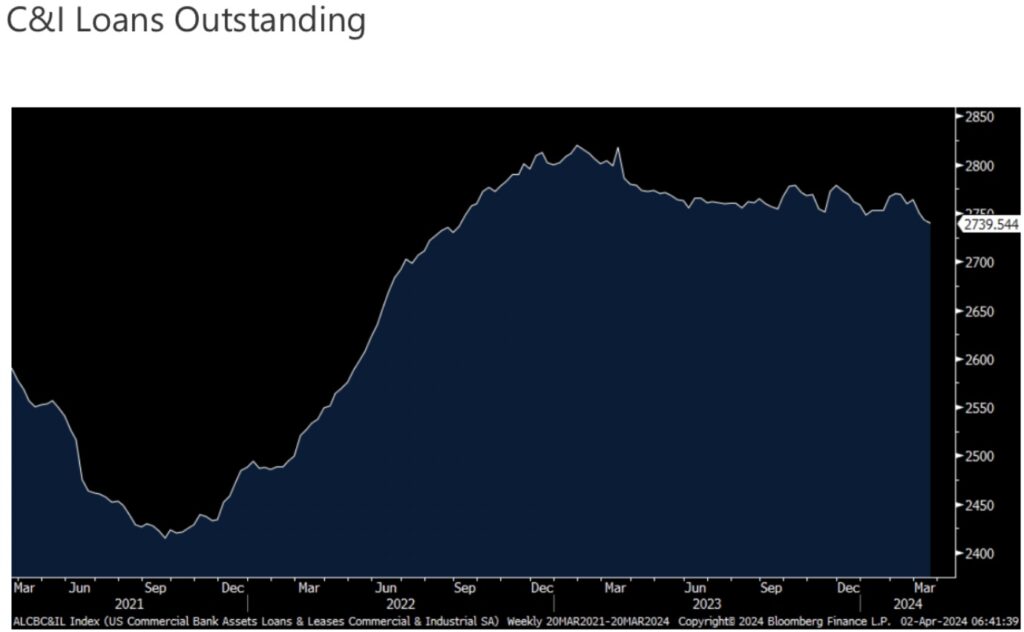

“Brother, can you spare a loan?”

I forgot to mention yesterday that for the week ended 3/20, C&I loans outstanding fell for the 5th week in the past 6 and at $2.739 Trillion, is at the smallest level since September 2022. How strong is the US economy when banks that are in the business of lending aren’t lending and businesses don’t feel like borrowing?

Thanks to my friend Michael Green for pointing this out as we went through the S&P Global PMI’s yesterday. This was from the one on Mexico whose manufacturing PMI at 52.2 was little changed with the 52.3 seen in February. The press release said, “Although firms remained confident that positive trends in output and new orders will be sustained in the year ahead, optimism faded in March. There were heightened concerns surrounding insecurity, competitive conditions and faltering demand from the US.” I bolded for emphasis.

Europe

With Europe back open after the holiday, the Eurozone March manufacturing PMI was revised slightly higher to 46.1 from its initial print of 45.7. Germany’s manufacturing sector remains deeply in a recession at 41.9 while Italy’s is back above 50 at 50.4 and France sits at 46.2. S&P Global said this, “In the first quarter, the pace of the decline in incoming orders slowed considerably. However, there are still significantly fewer orders coming in than in the previous month. It is therefore to be expected that the industry is on the verge of surpassing the longest contraction spell for incoming new orders in the survey history, which was 25 months during the euro crisis in 2011 to 2013. This does not speak for a quick turnaround in activity.” Prices paid remained below 50 but less so while those received fell to the lowest since last November. Bottom line, expect no to little growth from the Euro region this year.

Meanwhile In The UK

The March UK manufacturing PMI is doing better than its bigger European peers Germany and France. It’s index was revised to 50.3 from 49.9 initially and up from 47.5 in February. S&P Global cited stronger domestic demand for the uplift and the outlook rose to an 11 month high. The caveat, “Potential blockers remain such as continued weak export performance and supply chain stresses, with the neighboring EU market the main drag on overseas demand and the Red Sea crisis still impacting supply chains. Signs from the survey that the impact of both of these factors is easing is therefore welcome news.”

As the FTSE 100 tends to be more commodity heavy, its higher by .25% today while the DAX and CAC are little changed. UK stocks are some of the cheapest in the world and we’re long big oil there. Playing catch up to the US Treasury selloff yesterday, European yields are jumping by 8-10 bps.

King World News note: All of the inflation that is now in the pipeline is beginning to drive the prices of gold and silver higher. For those of you wanting to accumulate physical silver, time may be running out to purchase silver on the cheap. Meaning you may have to be aggressive at this point in time on the buy side.

JUST RELEASED!

Michael Oliver on gold hitting all-time highs and why silver is set to explode higher along with the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

To listen to Alasdair Macleod discuss gold hitting new highs and what surprises are in store for next week CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.