The bullion banks are becoming increasingly concerned about their short positions as the price of gold closed very close to a major upside breakout above $2,000 and the price of silver continues to surge toward the $25 level.

War In the Gold & Silver Markets Heating Up

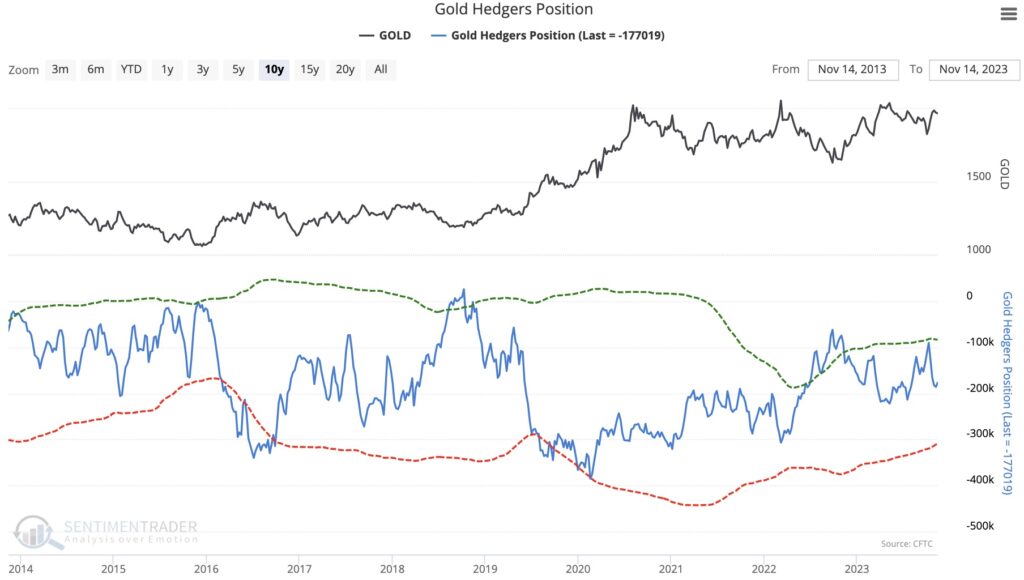

November 26 (King World News) – King World News note: With the price of December gold futures closing the week above $2,000, it appears the bullion banks are not in any hurry to get in the way of the rally in gold and may be beginning to worry about their short positions (see chart below).

10 Year Chart Showing Bullion Banks & Hedgers Gold Short Positions Are In Neutral Territory vs The Past Few Years

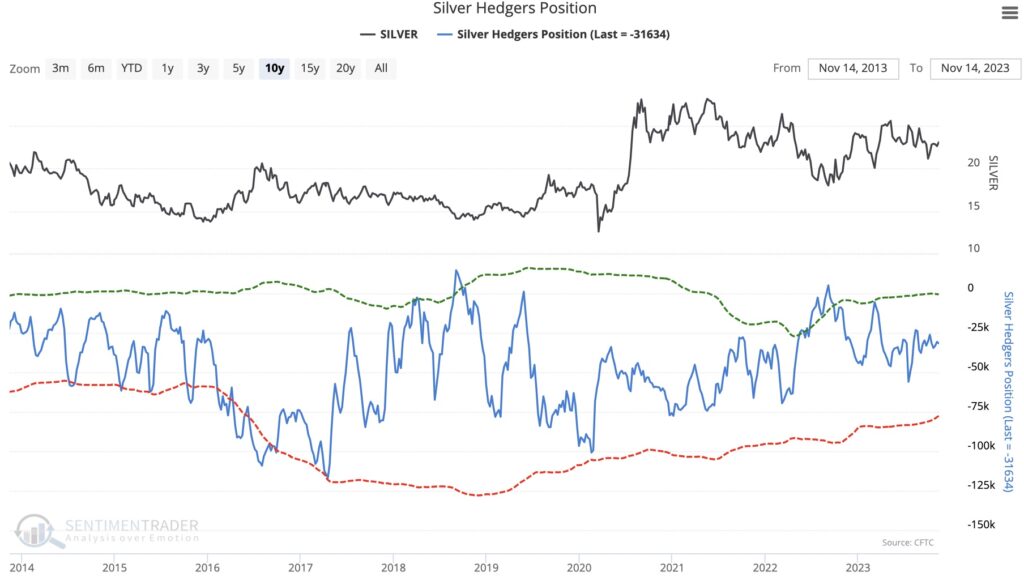

King World News note: With the price of December silver futures closing last week at $24.38, it appears the bullion banks are also not in any hurry to get in the way of the rally in the silver market (see chart below).

10 Year Chart Showing Bullion Banks & Hedgers Silver Short Positions Are In Bullish Territory vs The Past Few Years

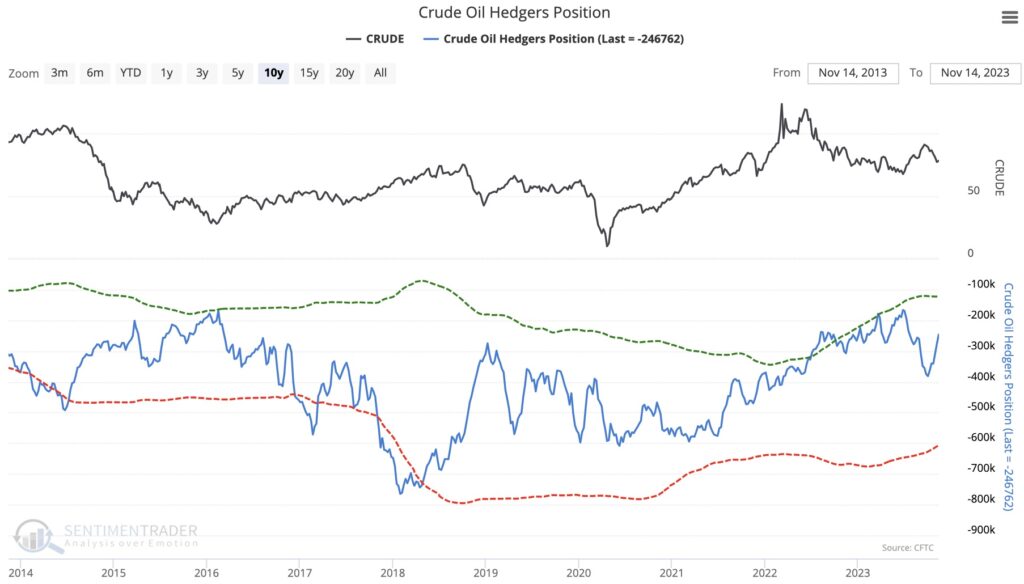

King World News note: With the price of December crude oil futures closing last week in the $75-$80 key support level, the bullion banks and hedgers are positioned for a rally in the crude oil market (see chart below).

10 Year Chart Showing Bullion Banks & Hedgers Crude Oil Short Positions Are In Bullish Territory vs The Past Few Years

Extremely Important Levels To Watch

King World News note: As Naveen Nair from Citi noted, if the price of gold hurdles the last line of resistance at $2,009 it will surge to test the all-time high at $2,075. When it comes to silver, Michael Oliver at MSA Research says the silver market has already decisively broken out in terms of a positive momentum shift. For those keeping a close eye on the crude oil market, there has been a great deal of short covering on the recent price dip. This leaves the crude oil market in a much healthier position with a possible opportunity for the bulls to regain control and try to push the market back above $80.

Regardless, while it is possible that the crude oil market may continue to struggle if the global economy remains weak, a weaker global economy has historically ignited the price of both gold and silver. For example, and this is very concerning for the bullion bank shorts, when the Dow was chopped in half during the 1973-1974 bear market, the price of gold tripled in price, and the price of silver more than tripled! If you are accumulating physical silver, just be aware that it is possible the price may begin to runaway on the upside as it is approaching the final breakout Michael Oliver noted would launch the price of silver back to the all-time high of $50.

Just Released: Gold & Silver Breakout!

To listen to Alasdair Macleod discuss why next week may be a huge surprise gold and silver investors around the world CLICK HERE OR ON THE. IMAGE BELOW

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.