As we kickoff trading in the back half of June, Peter Schiff discusses gold, plus we are seeing wild prices for baseball memorabilia.

But first, a note from Peter Schiff on the war in the gold market…

Peter Schiff: “While the price of gold hit a 52-week high today (Friday), we have been above $1,350 twice in the past 6 years, yet failed to hold. So to really break out gold needs to close about $1,375. Today’s rally is particularly impressive given the stronger dollar. Resistance is futile!”

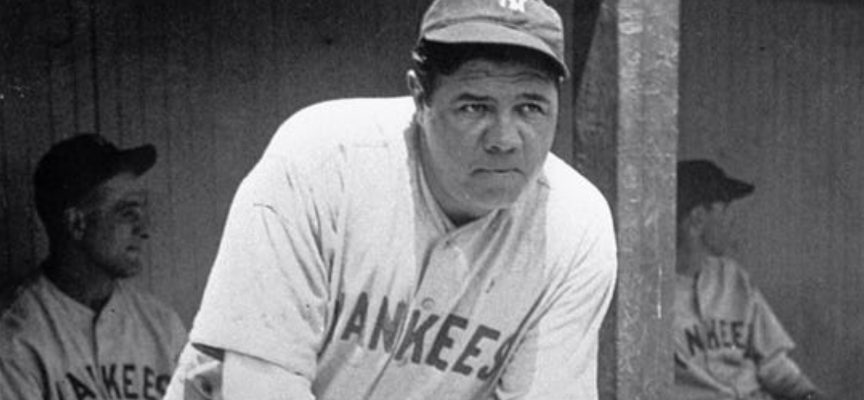

Wild Prices For Baseball Memorabilia

June 17 (King World News) – Here is a small portion of what Peter Boockvar wrote today as the world awaits the next round of monetary madness: As the Fed gets together for the upcoming pow wow where a few people sit around a desk and trying to figure out what the right interest rate should be, the inflation they all hoped to create continues to show up in asset prices rather than consumer prices.

At the weekend baseball memorabilia auction at Yankee Stadium, a 1928-1930 Babe Ruth game used jersey was sold for $4.7mm, https://huntauctions.com/live/imageviewer.cfm?auction_num=65&lot_num=47&lot_qual=&closed. A note from Lou Gehrig to Babe Ruth went for $400,000, double the pre auction estimate, https://huntauctions.com/live/imageviewer.cfm?auction_num=65&lot_num=10&lot_qual=&closed. These prices follow the Jeff Koons rabbit sale of about $90mm. I’d rather own the baseball pieces for those prices but you get the point…

BONUS INTERVIEW:

To listen to Doug Casey’s just-released KWN interview discussing his prediction of financial and economic chaos and a panic into gold CLICK HERE OR BELOW:

I’ll say again, in a world of massive monetary inflation in terms of the cheapness of capital and quantity of money that has been created globally, inflation is in the eye of the beholder and to narrowly look at one gauge, core PCE, in measuring it is just not credible.

With respect to market asset price inflation as the Fed discusses what to do next, the US high yield index is yielding just 6.07% vs 8.12% in late December and over 10% when energy credit collapsed in late 2015 (see chart below).

Plunge In US High Yield Index

This is just a few bps from the lowest level since April 2018. The spread to Treasuries is 395 bps vs 537 bps in early January. Along with a near record high in stocks, if the Fed is consistent and symmetric with its analysis of financial conditions, will they take this into account when discussing policy?

Are stock prices and credit spreads discounting mechanisms saying everything will be ok and any slowdown in growth will be temporary or are stocks and credit only discounting what they think the Fed will do and thus have their historic messaging signals on the economy been completely neutered? You know what I think.

I’ll talk all about this tomorrow but I do believe markets are ahead of themselves with the extent they think the Fed will cut rates and also in terms of the start date. Keep in mind though that Jay Powell can cut rates at ANY TIME via his words so we don’t need an actual meeting to get a change in policy.

***KWN has now released the timely and informative audio interview with James Turk and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

***Also just released: Egon von Greyerz – My $1 Million Wager And The Gold Maginot Line CLICK HERE TO READ.

© 2019 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.