Dr. Stephen Leeb: Chairman & Chief Investment Officer of Leeb Capital Management – Dr. Leeb is a registered investment adviser and has been managing big cap growth portfolios since 1999. Over the last decade, his independently-verified performance record has been ranked in the top 5 percent among peers according to Informa’s PSN manager database. Dr. Leeb is a New York Time’s Best Selling author, eight books total on investments and financial trends.

Peter Boockvar: Managing Director, Chief Market Analyst of The Lindsey Group & Co-Chief Investment Officer of Bookmark Advisors – Prior to joining The Lindsey Group, Peter was with Omega Advisors, a partner at Miller Tabak + Co for 18 years and at Donaldson, Lufkin and Jenrette. He is a CNBC contributor and appears on other major networks such as Bloomberg and King World News.

Gerald Celente: Founder & Director of the Trends Research Institute – Gerald has had a long track record of making some of the most controversial, yet correct calls in terms of global trends and events. In fact, many consider Mr. Celente to be the top trends forecaster in the world. Gerald has been quoted and interviewed in media throughout the world such as KWN, CNBC, Fox, CBS, ABC, NBC, BBC,…

Lawrence B. Lindsey: President and Chief Executive Officer of The Lindsey Group and author of Conspiracies of the Ruling Class: How to Break Their Grip Forever – His career has spanned government, business, and academia. He served three presidents: Ronald Reagan, as senior staff economist for tax policy at the Council of Economic Advisors; George H.W. Bush, as Special Assistant for Domestic Economic Policy; and George W. Bush, as Director of the National Economic Council…

Rick Rule: Chairman / Founder of Sprott US Holdings & President of Sprott Asset Management USA; Portfolio Manager – Rick is known as one of the most “street-smart” people in the natural resource sector and gold world with nearly 40 years of experience. Sprott Asset Management USA Inc. manages over a billion and through acquisition is now part of the $7 billion Sprott Asset Management LP…

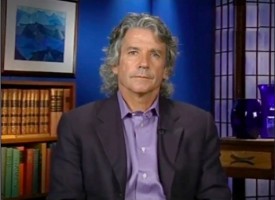

Bill Fleckenstein: President of Fleckenstein Capital – Bill is a professional money manager with over 30 years of experience, he also writes a daily Market Rap column for his web site at Fleckenstein Capital. Bill has appeared at one time or another in virtually all financial media including King World News, Bloomberg, CNBC, The New York Times, MSN, Marketwatch, Barron’s and more….

Dr. Stephen Leeb: Chairman & Chief Investment Officer of Leeb Capital Management – Dr. Leeb is a registered investment adviser and has been managing big cap growth portfolios since 1999. Over the last decade, his independently-verified performance record has been ranked in the top 5 percent among peers according to Informa’s PSN manager database. Dr. Leeb is a New York Time’s Best Selling author, eight books total on investments and financial trends.

Dr. Paul Craig Roberts – Former US Treasury Official, Co-Founder of Reaganomics, Economist & Acclaimed Author – Dr. Paul Craig Roberts is an American economist, a columnist and recent author of “The Neoconservative Threat to World Order: Washington’s Perilous War for Hegemony”. He served as an Assistant Secretary of the Treasury in the Reagan Administration earning fame as a co-founder of Reaganomics…

Dr. Marc Faber: Editor & Publisher of the Gloom Boom & Doom Report – Dr. Faber Famous for his contrarian approach to investing, Marc Faber does not run with the bulls or bait the bears but steers his own course through the maelstrom of international finance markets….

Andrew Maguire: Whistleblower, Independent London Metals Trader & Analyst – Andrew has 35 years trading experience, both as an institutional and independent trader. He is an accomplished veteran of the markets. In 2010 Andrew went public in an exclusive King World News interview and disclosed his notification to the US regulators at the Commodity Futures Trading Commission (CFTC) of fraud being committed and price manipulation in the int’l gold and silver markets.

Get ready for US capital controls because it’s coming. Take a look…

Today Nomi Prins, who has given keynote speeches to the IMF, Federal Reserve and World Bank, told King World News that gold has been the light in this volatility storm.

What a wild week of trading. Look at the aftermath of the chaos.

This week had it all, and the “Golden Age” for these stocks is about to be unleashed!

The biggest financial bubble in the history of financial bubbles continues to unwind.

A staggering 40% of Americans say living in U.S. not worth it.

This market just flashed a major danger signal!

King World News had been warning in many audio interviews for the past couple of months that the world would see a Trump Plaza Accord II. Just as KWN predicted, it is now here and it is being marketed as the “Mar-a-Lago Accord.” Take a look…

Here is a look at tariff wars, stagflation and fiat money.

Big moves in global markets as volatility increases and gold price continues to surge.