Today Art Cashin discussed the state of the stock market plus there is also a look at inflation volatility in the years to come.

Bulls Need To Get Their Act Together

August 8 (King World News) – Art Cashin, Head of Floor Operations at UBS: The bulls remain on the defensive after the shaky opening is followed by some renewed selling despite bond yields moving back down below 4% on the ten-year.

Right now, it looks pretty much like internal dynamics as they try to feel their way around. They will look to see if they can find support in the S&P first around the 4450/4460 area and then back up as we told you yesterday down around the 4420/4430 area.

It is not truly news related and it is the market taking its own pulse and temperature.

The bulls need to get their act together by noon. Since it is a purely technical reaction, it is tough to look for anything on the headlines to change.

Stay safe.

Arthur

Moody’s Downgrade Of Banks

Peter Boockvar: With regards to the Moody’s credit downgrade on a bunch of banks, here is what was said in what we can call their bottom line,

“Moody’s said the rating action reflects several sources of strain on the US banking sector: funding pressures, regulatory capital weaknesses and rising risks associated with commercial real estate exposures.”

In terms of specifics,

“US banks Q2 earnings showed material increases in funding costs as well as profitability pressures related to the significant and rapid tightening in monetary policy and inverted Treasury curve, which will continue to lower profitability and implies a weaker ability to generate capital internally. Some banks have reduced loan growth, which preserves capital but also slows the shift in their loan mix toward higher yielding assets, even as their funding costs rise, which weighs on profitability.”

Also,

“Higher interest rates continue to reduce the value of US banks’ fixed rate securities and loans and interest rate risk is not captured well in US bank regulation and thus can create liquidity risks.”

This is what was said on CRE,

“Moody’s believes small and mid-size banks that have greater exposures to CRE lending, especially construction and office lending, face higher risks because of high interest rates, a significant slowdown in US economy growth and reduced demand for office space driven by work from home trends. These forces are likely to result in deteriorating loan asset quality in certain CRE sectors, further pressuring the credit profiles of banks with more significant exposures to those sectors.”

Bottom Line

My bottom line, there is nothing really new here that we don’t already know about the risks that banks face in this current environment. I believe there are not viability risks for most of these banks but instead face more of a profit challenge and in turn a credit scarcity for those that need to borrow from them…

ALERT:

Powerhouse merger caught Rio Tinto’s attention and created a huge opportunity in the junior gold & silver space CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Ahead of CPI Thursday I wanted to provide some more anecdotal information on the rental situation, especially on the heels of the SF Fed’s paper out yesterday on what they expect for rents next year in CPI. We know the anecdotes talk about what’s going on right now while the SF Fed is talking about how right now eventually flows thru CPI late this year into next year because of the extreme lag.

Camden Property Trust is a major owner of high quality multi family apartment buildings in mostly sunbelt states so they sit where the greatest demand is but also where a lot of supply is coming. In their earnings call Friday they said “Second quarter signed leases grew by a blended rate of 4.1%, with new leases up 2.2% and renewals up 5.9%. Our preliminary July results show moderating rates of growth with blended rates in the mid 3% range. Renewal offers for August and September were sent out in the high 5% range.” They have occupancy rates in the mid 95%.

“Where is Shelter Inflation Headed?”

The SF Fed’s paper titled “Where is Shelter Inflation Headed?” is not telling us anything we don’t know as long as one listens to other rent surveys and listens to what companies like Camden are saying themselves. Also, with CPI still printing 8% rental inflation and reality more like 3-4%, of course shelter inflation in CPI is going to slow from here. Though even as the SF paper said with respect to their own modeled forecasts, “substantial uncertainty surrounds these forecasts.” https://www.frbsf.org/economic-research/publications/economic-letter/2023/august/where-is-shelter-inflation-headed/

Now after the large amount of supply is absorbed by the rental markets over the coming 18 months, the supply will then dry up again. Camden said “the tight financial markets and the difficulty of getting bank financing and equity financing, along with increased costs of capital, is having the Fed’s desired result, which is it’s slowing everything down…So, we think it’s going to be 12 months, 18 months kind of timeframe to observe all this new supply. And then when you think about what the market might look like sort of towards the end of 2024 and end of 2025, it’s pretty constructive for the supply side of the equation.”

Lots Of Inflation Volatility In The Years To Come

I’ll argue again that we should expect a lot of inflation volatility in the years to come, bouts of high inflation like we saw, followed by pullbacks which we’re seeing now, followed by re-acceleration to come thereafter. The 1970’s all over again in terms of the inflation waves…

This Is Now The Premier Gold Exploration Company In Quebec With Massive Upside Potential For Shareholders click here or on the image below.

With regards to used cars, which we know is an important inflation component, Manheim yesterday said its wholesale July index fell 1.6% m/o/m and by 11.6% y/o/y. Manheim is saying they see a slowdown in the rate of decline as while “Used retail inventory continues to rebuild” they also see “used retail sales also showing some summer strength” and as a result “we do not foresee wholesale price declines of serious import through December.” To highlight my inflation volatility argument, we still will have used car inventory challenges in the coming few years because of the well below trend of new car sales over the past 3 years.

China

China’s July trade data is another important story today as it both reflects it’s own internal economic weakness but also that of the rest of the world that buys stuff from them. Exports fell 14.5% y/o/y, a bit weaker than the 13.2% drop expected. Exports to the US fell 23% y/o/y, to Japan by 18.4%, to Taiwan by 23.3%, and to the EU by 20.6%. Imports, both which are internally consumer but also of parts that eventually make it into exports, were down by 12.4% y/o/y which was much more than the estimated fall of 5.6%. The Shanghai comp was down just .3% in response but the H share index was much weaker, lower by 2.2%.

Taiwan’s exports in July were actually not as bad as feared, falling 10.4% y/o/y, about half the forecast of a 20.7% drop. Helping was less of a drop in the shipments of their key export, semi’s which dropped 6.2% y/o/y. The TAIEX was down by .7% overnight.

Meanwhile In Europe

So after suffering almost 10 yrs of ECB negative rate policy which taxed bank capital and pressured profits, the Italian government has decided to suffocate its banks via a windfall profits tax just as they were beginning to benefit from positive nominal rates. Of course the government won’t reimburse all the lost profits during NIRP but now they want a 40% take of the profit gravy. And some wonder why the Italian economy doesn’t grow anymore? Intesa Sanpaolo stock is down 8.5%, BPER weaker by 10%, and Unicredit is lower by 7%.

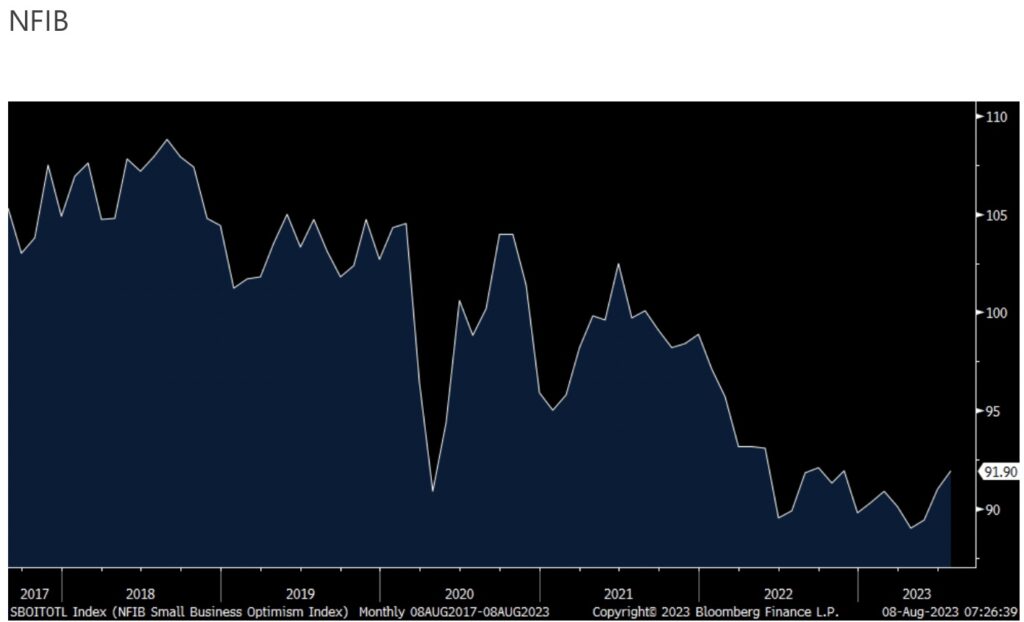

Small Business Optimism

Finally, the NFIB small business optimism index for July rose to 91.9 from 91 and that matches the best level since last September though the index has been in a pretty tight range of 89-92 over the past year and compares with 104.5 in February 2020.

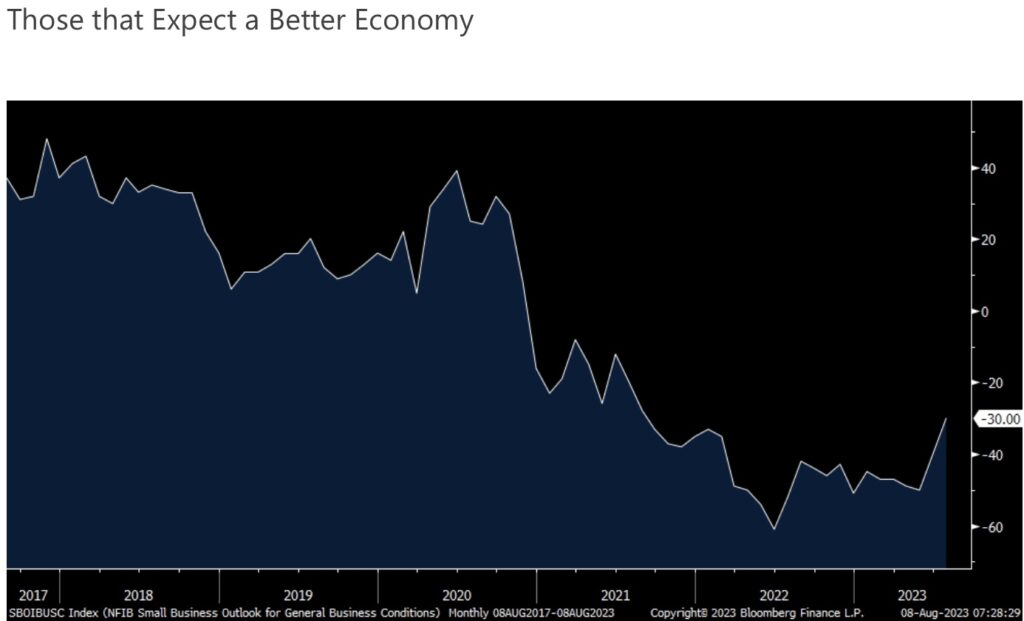

After falling by 4 pts in June, Plans to Hire rose 2 pts while the number of job openings was unchanged. The compensation components were mixed. There was a 10 pt improvement in those that Expect a Better Economy to the least negative since August 2021 at -30 so let’s hope they are right.

Those that Expect Higher sales improved by 2 pts to -12, 3 pts above the 6 month average.

There was no change in the Good Time to Expand category at 6. Plans to increase capital spending rose 2 pts to 27 and that matches the best level since early 2022 and likely coincides with hopes of a better economy. But there was little change in plans to boost inventory. The earnings story though is challenged as this component dropped by 6 pts to match the most negative since September 2022. There was no change in Easing of Credit Conditions and a 4 pt drop in Higher Selling Prices which the Fed will like to see.

Bottom Line

Bottom line, while we saw the improvement in optimism from small business, the NFIB still used the word ‘dismal’ and said “With small business owners’ views about future sales growth and business conditions dismal, owners want to hire and make money now from solid consumer spending. Inflation has eased slightly on Main Street, but difficulty in hiring remains a top business concern.” Specifically on credit, 4% “reported that financing was their top business problem, up 2 pts” and “The average rate paid on short maturity loans was 8.5%, .7 of a percentage point below June’s highest reading since June 2007.”

ALSO JUST RELEASED: What Is Happening With Wells Fargo Customer Bank Deposits Disappearing CLICK HERE.

ALSO JUST RELEASED: The Fed Is Going To Pivot From Dis-Infllationary QT To Mega-Inflationary QE CLICK HERE.

To listen to James Turk discuss the short term and long term predictions for the US dollar, gold, silver and the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

To listening to Alasdair Macleod discuss what to expect from gold, silver and bonds CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.