Today King World News is pleased to share a fantastic piece which addresses the all-important question: Are global stock markets about to crash or is this just another false alarm? This piece also includes three key illustrations that all KWN readers around the world must see.

By Jason Goepfert Founder & CEO Of SentimenTrader

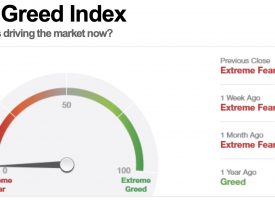

May 12 (King World News) – "Talk of a stock market bubble has started to pick up, but it's nowhere near previous extremes, and that's probably a good thing (see charts below).

According to Bloomberg, a monstrous trade occurred Monday in VIX futures. It's always impossible to know the exact underlying strategy, but consensus is that it was a bet on higher volatility into June/July. Looking at other large (seemingly) directional trades in the VIX, the track record is mixed, but generally we find that when there is a large trade betting on a rise in volatility, it happens more often than not.

There have been a number of articles lately – again – about seemingly endless talk of stocks being in a bubble. And if everyone is talking about it, then we can't be in one. That's wrong on several fronts.

Trying to lay a finger on what "everyone" is talking about is more difficult than ever, because there are so many avenues to hear voices we never could hear before (Twitter).

The other misleading part is simply that not everyone is talking about a stock market bubble. In fact, few are, relative to the past.

Let's take a look at mentions of "stock market bubble" in the media over the past 20 years, which closely follows what the public is talking about. Publications want their articles read, and to reach that end they write about what interests people. If that's stock market bubbles, then that's what they're going to write about, and justifiably so.

We can see from the chart that bubble talk had percolated in mid-1999, as stocks were in their final leg of the bull market. It settled down as stocks actually peaked, but that was one incident of the public identifying a bubble in real-time.

The next surge of interest came in early 2003, but that was due to more references to a bubble that had burst, and not one that was building.

Interest bubbled up again in late 2005 (that was wrong), then again in late 2007. That was a picture-perfect example of the public zeitgeist precisely nailing the peak of the another bubble.

Interest ebbed as the market crashed, picked up a bit in late 2009 (like 2003, this was due to the bubble being burst). The last big spike in bubble talk was in late 2013 and early 2014. While not on a par with previous extremes, it was still clear that investors were getting nervous about a bubble, which still hasn't popped.

That leaves us with where we are now, which is not much bubble talk at all. In fact, last August the pace of bubble stores sunk to its lowest level since 2001. We would mostly ignore this kind of discussion, but perhaps take note if we see a big increase in bubble news in the coming months." The fantastic charts and commentary are just a portion of the latest remarkable report. To try a free 14-day trial of the internationally acclaimed work that Jason Goepfert produces at SentimenTrader simply CLICK HERE.

***ALSO JUST RELEASED: This Incredibly Chaotic Period Helps To Understand Where We Are Headed From Here CLICK HERE.

© 2015 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the blog page is permitted and encouraged.

The audio interviews with Chris Powell, Andrew Maguire, Rick Rule, Bill Fleckenstein, John Mauldin, Michael Pento, Gerald Celente, Egon von Greyerz, Dr. Paul Craig Roberts, James Turk, Dr. Philippa Malmgren, Eric Sprott, Robert Arnott, David Stockman, Marc Faber, Felix Zulauf, John Embry and Rick Santelli are available now and you can listen to them by CLICKING HERE.