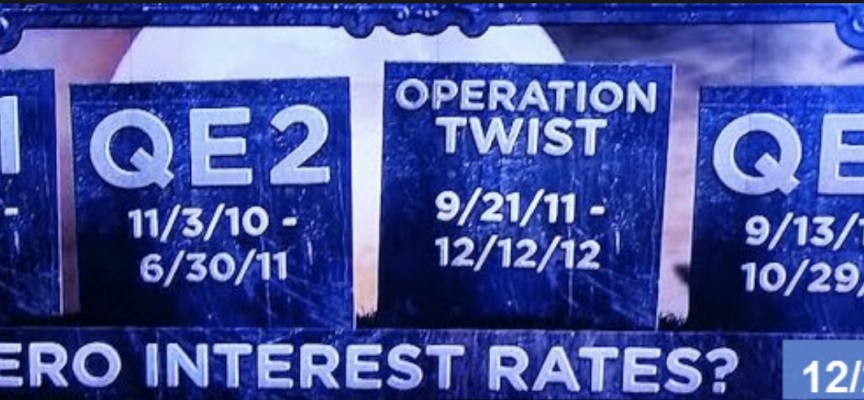

With everyone wondering what the next move will be by global central banks, “QT” is what is going to move world markets in the future and you heard it here first.

Peter Boockvar: First, After hearing Fed President Eric Rosengren yesterday afternoon again giving his support for allowing the balance sheet to “start the roll off now” as “we’re basically at our employment mandate and we’re basically at our inflation mandate. So ideally we don’t have to manipulate the yield curve” as he joins a growing line of Fed members that are supportive of reducing the size of their balance sheet, I realized one word has been missing from all of their comments on this important issue.

You Heard It Here First: “QT”

We’ve heard ‘shrinking/trimming the balance sheet’, allowing it to ‘roll off’, and ‘gradually removing accommodation’. We haven’t heard that this is another form of ‘tightening.’ I’m thus going to call it what it is, Quantitative Tightening, QT. No more shrinkage comments from me which I know you thought of that Seinfeld episode when you did.

While the fed funds futures market has reduced the odds of a June hike to about 50%, nothing tells me that the Fed wants to back off from moving again in June. I mean if they’re talking persistently about QT and that won’t start after more rate hikes, then we’ll get more rate hikes. Voting member Robert Kaplan today says because he expects a GDP pickup in Q2, he still sees two more hikes. But data dependency hasn’t gone away as he also said they can slow that down if the economy softens, and vice versa. Thus, 2 more hikes this year is his “baseline” scenario. By the way, Kaplan referred to QT as ‘balance sheet unwind.’

King World News note: “QT” is sure to become the new buzzphrase to describe what the Fed is really doing with monetary policy. Just remember that Peter Boockvar coined it.

And Now A Note From Art Cashin…

From legend Art Cashin: On this day (+1) in 753 B.C., the Ancient and Eternal City of Rome was founded. For the first quarter millennium of its existence it was ruled by kings – starting with Romulus (part of a notable brother act with a doggy home life) and ending with Tarquinius Superbus. (If your king sounded like an oversize van, wouldn’t you give up the monarchy?)

Next came the Republic: lots of success, gladiators, scholars, arch-ways, public baths, Spartacus and Caesar (but no salads). During this period, Rome dominated, educated and even enumerated virtually all of the known world. (Doubters may look up “Census – Tiberius et. al.)

So – okay – you’re sitting there saying “I learned all that in sixth grade.” And you’re also saying “does that dope expect me to believe he knows the ancient date when Ancient Rome was founded.” Well…the answer is – Yes! You see it’s the “A.U.C.” thing.

If you were living in Ancient Rome and wanted to count time, it was tough. You couldn’t do “B.C.” since you couldn’t anticipate the date of the birth you were counting before. (Huh?) So, without the birth of Christ as a date of demarcation, the Romans had a problem. If you were opening a toga shop would you put on the letterhead….er….parchment head….e.g. “Founded – ???”

At first they tried the obvious: “In the third year of Romulus…” But that got to be a problem as new kings were envious of the names of old kings still having their names around on walls, letterhead, etc. Even worse, it could get confusing, “Was he born in the 2nd year of Pliny the 3rd or the 3rd year of Pliny the 2nd?”

So the Romans opted for something a bit more permanent like the city itself. Thus, they began dating everything from the time the city was founded which you will recall from Latin class would be Ab (from) Urbe (the city) Condite (founding). Thus, they made cornerstones and time clocks possible. “Annus MMDCCLXIX A.U.C.”

It was not the founding of the city of Rome that traders were thinking about Wednesday. If they were thinking of any city, it was most probably Golconda – an ancient city in India, where myth said great fortune came to all who passed through it. (See John Brooks fabulous account of Wall Street in the roaring twenties, “Once in Golconda”. A must read for your library. In fact, anything by John Brooks is a must read for your library.)

Uneven Earnings Season And Oil Surprise, Buckle Dow And Dent Others – Most U.S. indices managed to open higher on Wednesday morning. The clear exception was the Dow Jones, which was left sputtering under the weight of selling in IBM on post-earnings disappointment.

That dichotomy lasted most of the morning but the game clearly changed shortly before noon. One of the catalysts for change was the price of oil.

Oil inventories hit the tape around 10:30. On the raw data, they looked somewhat neutral and by seasonal comparison they looked slightly bullish to some.

Somebody else had a different interpretation, however, and crude began to get crushed. Soon it was down a dollar and then quickly down two. (There was also a shift in contract that may have confused trading.)

The deterioration in oil spooked the stock market and bids quickly canceled, leaving a bit of a vacuum that allowed the selling in equities to appear to accelerate.

Once again, the indices were distorted by a small handful of components. For example, IBM alone allowed for 56 points of the Dow Jones selloff. (Maybe we’ll write about distortion by the minority next week.)

When the closing bell rang, the unevenness of the playing field was highly evident.

The Dow lost the most (IBM influence). The S&P showed a marginal loss, while the Nasdaq and Russell showed moderate gains.

The indecisiveness was also apparent in the entrails of the action. Declines edged advances by 15 to 13 with declining volume beating advancing by 5 to 3. Volume was light again.

The Maven Opines – Yesterday, I noted my friend, Barry Habib’s rather uncanny projection late last year that the yield on the ten year might see 2.18% in the first quarter of 2017. While time-wise he was off by a couple of days, his yield projection was stunningly spot on and without many, if any other correct calls.

I asked Barry what he thought now and here’s what he replied:

Some good points here.

It was a big deal for the 10-year to break under 2.31%, which was a very solid floor. The past 4 attempts to dip under that level resulted in a quick rise to 2.55% – 2.6%. The break under this tough floor shows underlying strength in bonds and may be the first signs of hesitancy by equity bulls.

The current floor of 2.18% is also a very tough customer. It represents a 50% fibonacci retracement from levels that are quite extended. This suggests that yields will be vulnerable to any news that is not friendly to bonds or a stock rally. And the move would likely be exacerbated to the upside. I think that there is a very high probability that yields rise a bit from here…probably back towards 2.30% in the near term.

As you can see Barry’s a touch less laser-focused but that’s due to some real crosscurrents with uncertainties on taxes, regulation and a shifting economy.

We will stay in touch.

Overnight And Overseas – In Asia, markets were mixed. Hong Kong saw a nice pop, while Shanghai was barely changed. Japan saw a tiny loss and India had a modest gain.

In Europe, markets on the continent are seeing gains, while London is down a shade.

Among other assets crude is back above $51, partly on rumors that the OPEC slow down would continue. Gold is flat to a shade lower. The euro firms against the dollar, while yields are a touch higher.

Consensus – Crude bulls need to regroup and stay above $50. Focus will begin to shift to French election. Geo- politics remains a wild card.

Stick with the drill – stay wary, alert and very, very nimble.

***For those who missed it, KWN recently released the remarkable audio interview with Michael Belkin, the man who counsels the biggest money on the planet, and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

***ALSO JUST RELEASED: What Just Took Place In Stocks Has Rarely Happened In The Past 117 Years CLICK HERE.

© 2017 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.