Below is a stunning look at the US dollar and gold. This is an extremely important update, and will help investors around the world understand what to expect as we head into 2025.

December 27 (King World News) – King World News note: The US Dollar Index has broken out on the upside after a 27-month consolidation (see monthly chart below).

US Dollar Index Breaks Out (Currently 108) After 27-Month Consolidation. Next Resistance Level Is 111-114

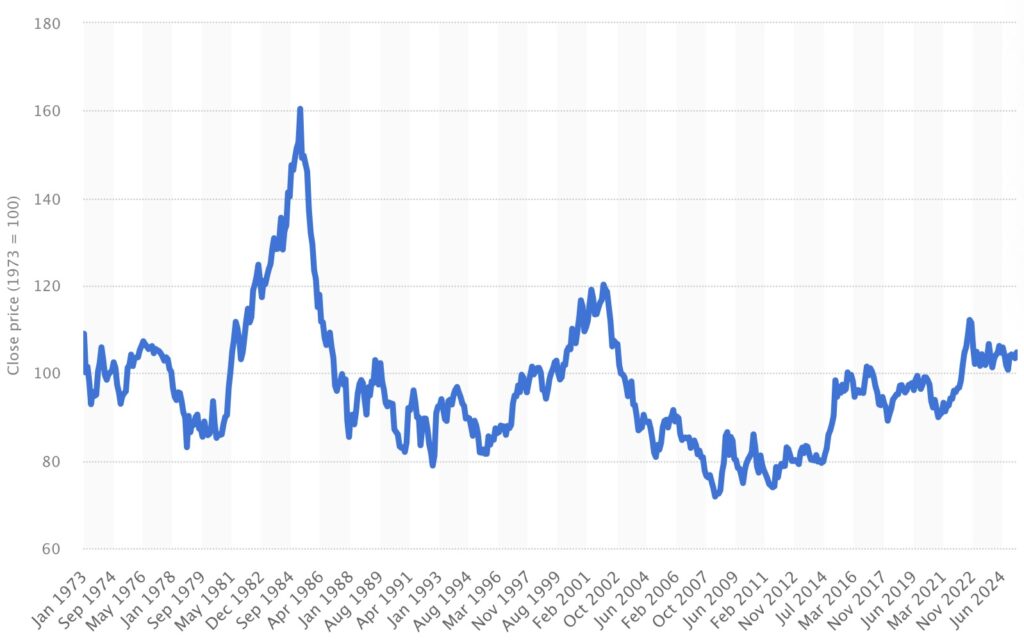

Below we see a longer-term chart of the US Dollar Index. You can see the USDX hit 160+ in 1985. You can also see the 120+ peak in the middle of the chart set in 2002. That is followed by the 114+ peak set in 2022.

Below Is A 52-Year Chart Of The US Dollar Index.

Note The 1985 Peak Of 160+ In 1985. A Second Peak Of 120+ Was Hit In 2002. That Was Followed By 114+ Peak Set In 2022.

Interesting Times For The Dollar

It will be very interesting to see if the USDX tests the 114+ high set in 2022, or if we are nearing the end of the rally. Regardless, the US Dollar Index remains on a long-term buy until key levels are taken out on the downside. If the USDX continues its upward trajectory and takes out the 114+ high that would be a game-changer. King World News will continue to monitor the US Dollar Index and update readers around the world.

What Does This Mean For Gold & Silver?

Regardless of where the dollar trades, all of these global fiat currencies are garbage backed by nothing. Gold, on the other hand, remains a pillar of strength in a world where central bankers across the globe seem to have gone mad. 2025 is shaping up to be a very interesting year for the monetary metals.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.