After gold ended at the highest monthly closing price in history in November, the price of gold is now only $7 from making a new all-time high.

Within hours Alasdair Macleod’s Audio interview will be released! Until then…

Gold Continues To Surge Toward All-Time High

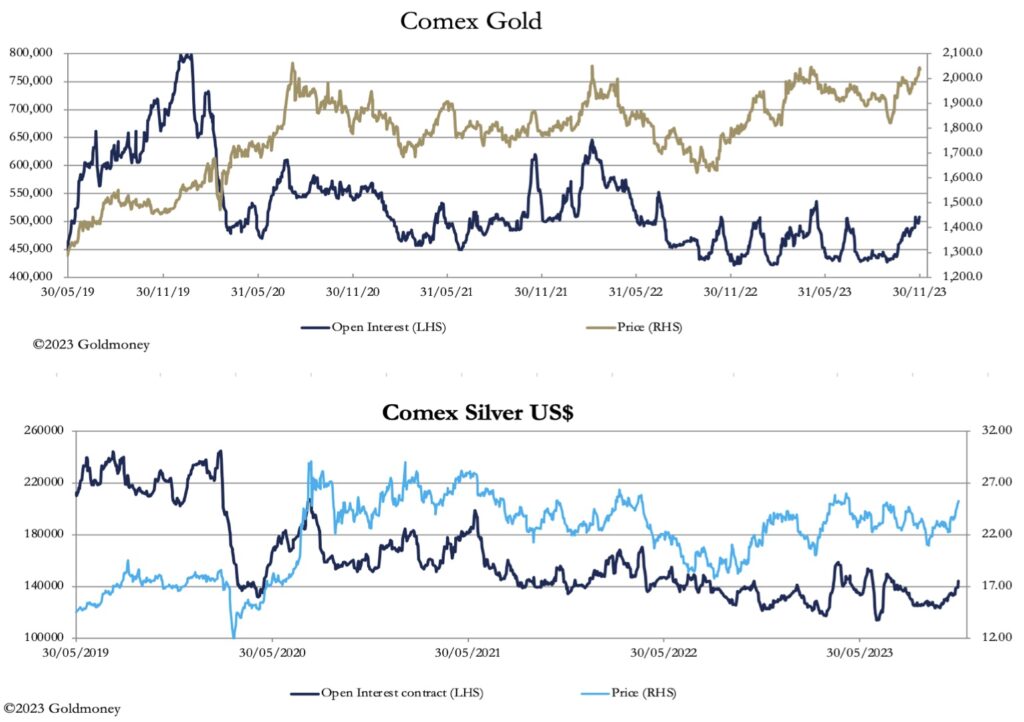

December 1 (King World News) – Alasdair Macleod: Gold and silver continued to rise this week, with gold bursting through the $2000 level, and silver $25. In European trade this morning, gold was $2042, up $42 from last Friday’s close, and silver was $25.20, up 93 cents. After a busy Monday, Comex volumes in both contracts declined over the week.

Being the month end, usually the bullion establishment likes to shake out weak holders, so that call op.ons are abandoned, and their mark-to-market values are window-dressed favourably. There has been liOle sign of it. If anything, standing for delivery has been the feature, with 28,184 gold contracts (87.7 tonnes) and 1,554 silver contracts (241.7 tonnes) in the last five trading sessions.

In both contracts, Open Interest on Comex has been rising, but are not yet in overbought territory, as the next two charts show.

The bullish gold chart has worked like a charm, up next.

Having broken convincingly above $2000, on technical grounds some consolidation is likely before the old highs at $2070 can be challenged successfully. And aHer the last few weeks of rising prices, it is quite likely that prices for both metals will succumb to some profit-taking later today, ahead of the weekend.

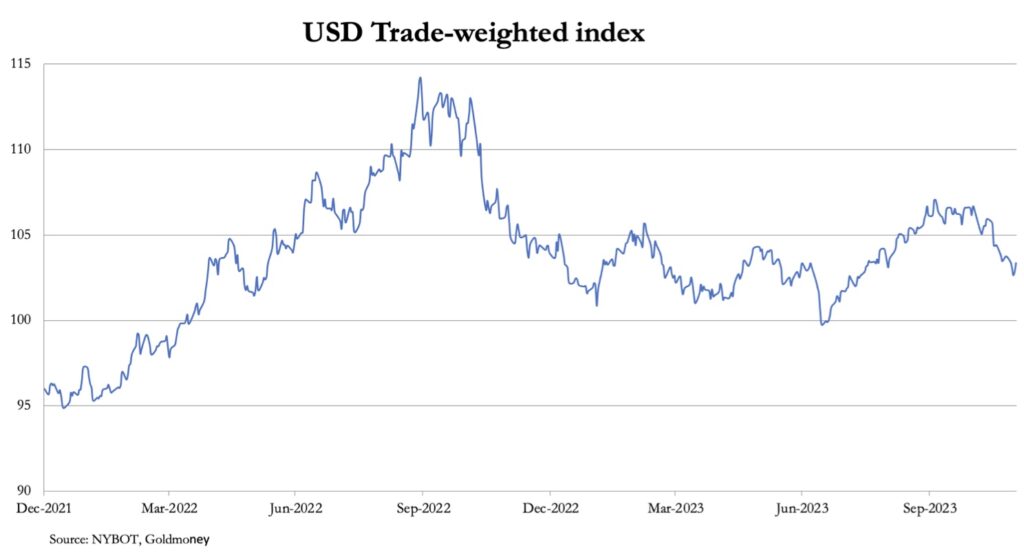

There is no doubt that gold and silver are being driven higher by a weakening dollar. The next chart is of the dollar’s trade weighted index, which will be worrying foreign holders of dollars.

And in US Treasuries, a substantial bear squeeze is driving yields lower. The next chart is of the 10-year US Treasury Note.

Foreign holders will be assessing the outlook for the dollar and Treasuries. They will note that with the US entering recession and a profligate administration in charge, plus $7.6 trillion of maturing debt to be rolled over next year that there are enormous funding hurdles for the US Government ahead. Furthermore, the recession is global, which is not only driving government deficits higher in the US but in the whole G7 as well. International trade will contract, meaning that fewer dollars need to be held in reserve. Inevitably, this will result in selling pressure as the dollar debt trap unfolds. The question to be answered is that aHer this technical bear squeeze in bonds is over, how high will yields then rise (and prices fall)?

Increasingly, foreigners holding dollars are looking at an opportunity to sell, and they are likely to conclude that the dollar and US Treasuries no longer represent safety. It’s not for nothing that the rating agencies are cutting US Treasury ratings.

This is why far from gold and silver rising, which is the conventional market view, it is the dollar declining, noticeably against other currencies ini.ally. A large part of the dollar’s bull position has been because the Fed took the lead in driving interest rates and bond yields higher, leading to selling of low-yielding yen and euros. That is now reversing, driving the dollar’s TWI lower, a process which has not ended and should see gold go higher.

ALSO JUST RELEASED: GLOBAL GAME-CHANGER: Russia To Lead BRICS And Push For Gold-Backed Currency CLICK HERE

ALSO JUST RELEASED: Two Collapses Are Taking Place As Silver Surges And Gold Threatens All-Time High CLICK HERE

ALSO JUST RELEASED: Get In Before The Public Starts Buying Silver – Headed Hundreds Of Dollars Higher CLICK HERE

ALSO JUST RELEASED: Celente – As Investors Dump dollars, Gold Prices Will Soar CLICK HERE

ALSO RELEASED: Turk Says These Are The Key Levels To Watch As Gold & Silver Blastoff CLICK HERE

ALSO RELEASED: BUCKLE UP: Silver & Gold Are Now In Blastoff Mode Along With The Mining Stocks! CLICK HERE

ALSO RELEASED: KEY CHARTS: Turk Says Gold, Silver And Mining Stocks Ready To Launch! CLICK HERE

ALSO RELEASED: Greyerz Just Warned The Death Of The Global Financial System Is At Hand CLICK HERE

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.