King World News readers around the world need to purchase physical silver before the public starts stampeding into the market to buy sending the price hundreds of dollars higher.

Get In Before The Public Starts Buying Silver

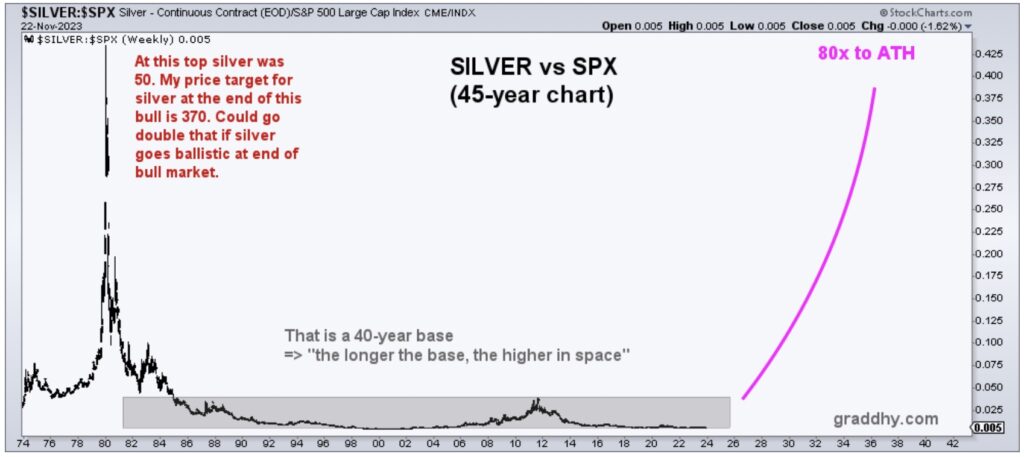

November 29 (King World News) – Graddhy out of Sweden: When I hear classic contrarian investing sayings like:

”buy low, sell high”

”be a contrarian”

”buy when there is blood in the streets”

”be greedy when others are fearful”

I think about this silver chart. The setup of dreams.

Silver Is Going To Skyrocket To $370-$740! (Red Notes In Chart)

Getting in before the general public is always key.

Central Banks Pretending To Be Tough On Inflation

Peter Boockvar: In the discussion and debate about the now expected and hoped for Federal Reserve rate cuts that are now priced for next year, it’s important to do a perspective on what the historical REAL rate has been so we can see what used to be ‘normal.’ Before the Fed via Alan Greenspan started to experiment with near zero interest rates (he cut to 1.00% in 2003 before Bernanke and Yellen said that wasn’t enough and liked zero instead for 7 years), the average REAL rate (difference between core CPI and the fed funds rate) in the 20 years leading into 2000 was 283 basis points.

So even if the Fed decided on 250 bps for a period of time because Powell won’t be fully satisfied with inflation unless it STAYS down, a core inflation rate of 2% would see a fed funds rate of maybe 4.5% which is basically what the fed funds futures are pricing in one yr from now. Still ignored though in the rate cut excitement is the continued shrinkage in the Fed’s balance sheet, notwithstanding the excitement that QE has brought us.

With regards to the ECB balance sheet, Christine Lagarde spoke at a hearing in the European parliament over the weekend and said the ECB will soon be discussing accelerating the reduction in the size of their balance sheet. After all, they are still reinvesting the proceeds of maturing bonds from their Pandemic Purchase Program. I believe the pandemic is over. European bonds though didn’t respond much as they are rallying on the hopes for rate cuts there too next year.

The euro did touch $1.10 yesterday for the first time since August, along with the broad dollar weakness but is down a touch this morning. For perspective, over the past 10 years, the euro has averaged $1.15 vs the US dollar…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Copper Hits Highest Level Since 2022

Copper is at the highest level since early September, iron ore is just off the highest level since April 2022 and the Baltic Dry Index, which tends to follow iron ore prices, closed yesterday at the highest level since June 2022. I’m just guessing that a theme here is the growing urgency being seen with Chinese authorities to more forcefully clean up the residential developer housing mess by encouraging banks, via cheap loans from the government, to lend to a select group of builders so they can finish up the unfinished apartment buildings.

To this, I read a story in the Global Times yesterday that said “Inspired by recent government policies to bolster financing needs of real estate enterprises, major banks in China have proactively initiated roundtable discussions with the cash-strapped developers, weighing more financing support to help them navigate through a property market slump.”

With respect to the plan for the Chinese economy in the coming years, the new head of the PBOC laid it out yesterday, “The traditional model of relying on infrastructure and real estate might generate higher growth, but it would also delay structural adjustment and undermine growth sustainability. The ongoing economic transformation will be a long and difficult journey. But it’s a journey we must take.” A greater reliance on the consumer is the big picture plan and with a savings rate north of 30%, the pool of money is there to make this transition.

First Quantum Shuts Down Major Copper Mine

By the way on copper, which we’re long and bullish on, it could also be getting a lift on the Panama government news of them shutting down a major copper mine owned by First Quantum Minerals. Supplies of copper are going to be tight in the coming decade just as the world is going to need a lot more of it to satisfy all the renewable hopes and dreams.

ALSO JUST RELEASED: Celente – As Investors Dump dollars, Gold Prices Will Soar CLICK HERE

ALSO JUST RELEASED: Turk Says These Are The Key Levels To Watch As Gold & Silver Blastoff CLICK HERE

ALSO JUST RELEASED: BUCKLE UP: Silver & Gold Are Now In Blastoff Mode Along With The Mining Stocks! CLICK HERE

ALSO JUST RELEASED: KEY CHARTS: Turk Says Gold, Silver And Mining Stocks Ready To Launch! CLICK HERE

ALSO RELEASED: Greyerz Just Warned The Death Of The Global Financial System Is At Hand CLICK HERE

Just Released: Gold & Silver Breakout!

To listen to Alasdair Macleod discuss why next week may be a huge surprise gold and silver investors around the world CLICK HERE OR ON THE. IMAGE BELOW

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.