Look at who just became one of the largest holders of gold in the world.

James Turk’s audio interview was just released (LINK AT END OF ARTICLE). For now…

One Of The Largest Holders Of Gold In The World

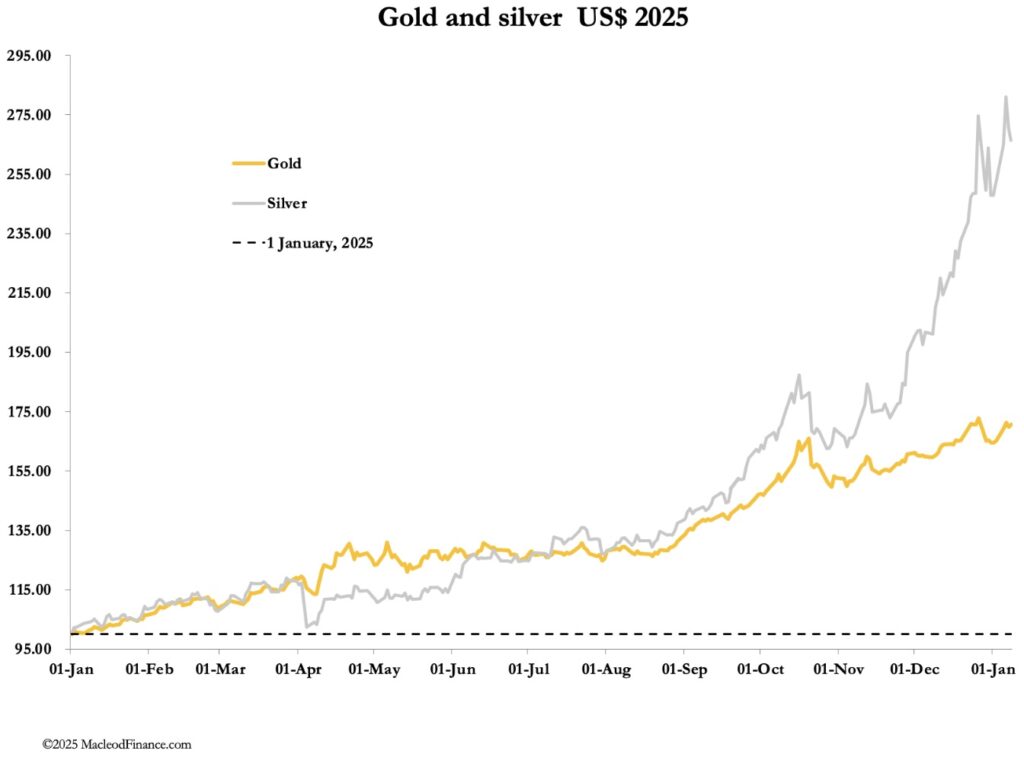

January 9 (King World News) – Alasdair Macleod: Chinese silver demand is on pause allowing prices to drift from all-time highs. Meanwhile, gold marches on towards a test of its post-Christmas highs.

However, the physical silver shortage is what matters and will continue to drive prices. In gold, there is a dawning realisation that there must be something solid behind its bull market, with speculators returning to Comex. And those clever people behind Tether’s gold stablecoin have been ramping up their reserves buying a further 26 tonnes in 2025 Q4, making them larger holders than most central banks.

Silver’s frenetic rush paused this week with dealers assessing its next move. In European trade this morning it was $77.95, up $4.05 from last Friday’s close, but below Wednesday’s high point of $82.60. At $4471, gold is up $40 on the week, closing in on all-time highs.

Silver prices in Shanghai have held significant premiums over London spot, peaking at almost $90 at one point. This led to strong opening prices in London until Thursday, exacerbating the shortage of physical, until things seem to calm down in Chinese markets overnight. It is worth bearing in mind the Chinese propensity for gambling, which is bound to lead to some wild trading conditions.

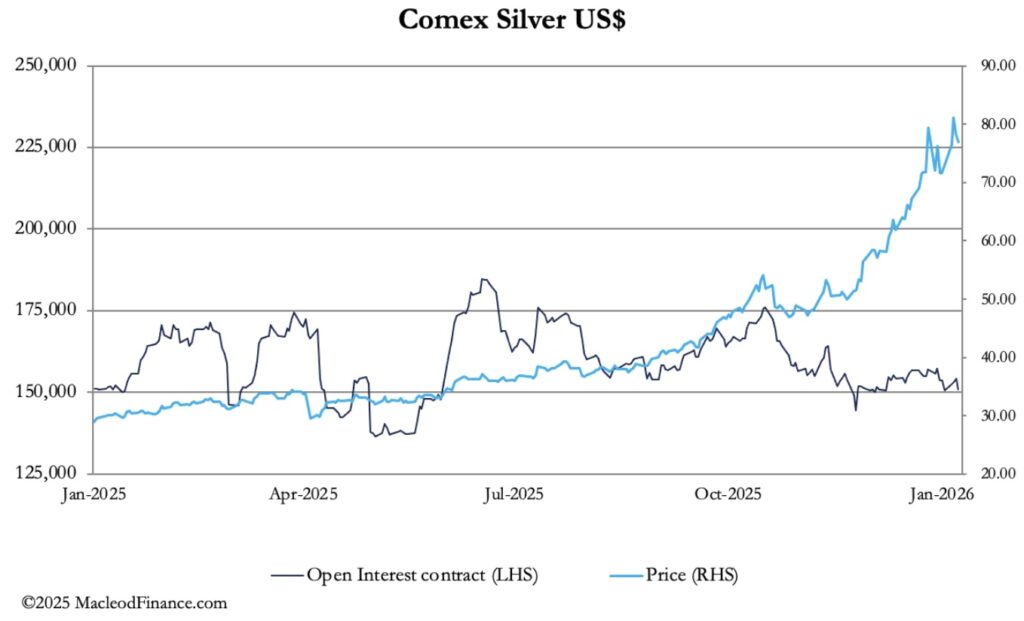

Meanwhile, on Comex speculators both in the US and using the Globex facility have stayed out of it. The next chart confirms that the low level of speculator interest remains, despite silver’s dramatically bullish run:

A reweighting of Bloomberg’s Commodity Index and the S&P GSCI which are adjusted once a year to ensure that no commodity dominates their compositions is now taking place, leading to funds tracking them selling gold and silver futures. Presumably, the pause in prices for gold and silver are to a degree at least attributable to this event. However, as an event taking place over the coming week it is a temporary factor which must be to some extent already discounted.

Importantly, as the chart above shows silver has not been driven by speculator interest, so the vulnerability to this position-unwinding should be limited. Instead, it is certainly possible that the physical liquidity crisis in London could quickly resume as the price driver, while Comex open interest declines even further as a result of tracker fund liquidation.

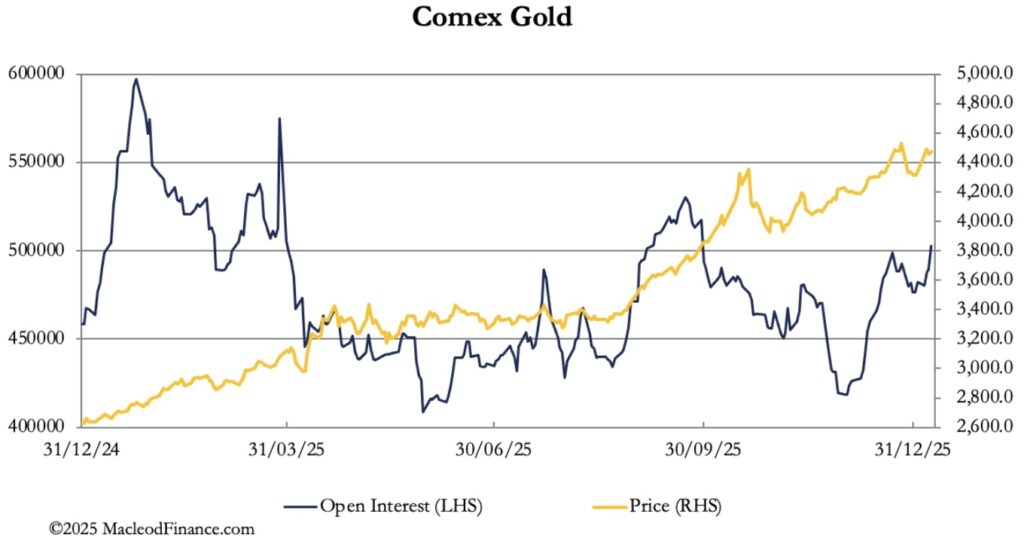

Circumstances in the gold contract are markedly different. Yesterday’s preliminary open interest on Comex rose by over 13,000 contracts, confirming that a developing speculator interest is beginning to drive prices:

This interest is despite the unwinding of commodity fund rebalancing, suggesting that there is decent momentum behind it.

Presumably, it reflects growing uncertainty over the dollar’s future at a time when the US is pursuing a more aggressive foreign policy with respect to the western hemisphere. Some of the speculator interest is likely to reflect trend chasing rather than reasoned analysis, but if this buying gains further momentum, there’s room for an additional 100,000 contracts, allowing for a rebalancing liquidation of perhaps 25,000—30,000 tracker contracts.

Stand for deliveries on Comex continue apace, with 1,013 tonnes of silver in the last five trading sessions, and 25.65 tonnes of gold. Since 1 January 2025, totals are 16,550 and 1,257 tonnes respectively.

A notable development is stablecoin Tether’s acquisition of gold. In the last quarter of 2025, it bought 26 tonnes. This is in addition to 116 tonnes held at end-September. Some of this gold is backing its smaller Tether Gold stablecoin, which now has 16.24 tonnes valued at $2.335 billion. Interestingly, Tether retains 126 tonnes in its main stablecoin pot.

Clearly, Tether anticipates growing demand for its stablecoin and has a reserve of gold to draw upon as demand increases. The attractions of a blockchain backed coin compared with ETFs and their high expense ratios are obvious. Its development should be closely watched…

JUST RELEASED!

To listen to James Turk discuss the wild trading in the gold, silver and mining share markets and much more CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED!

NEXT BIG BULL MARKET: Look At Who Just Predicted $369 Oil CLICK HERE.

Is It Possible Silver Will Hit This Jaw-Dropping Price? CLICK HERE.

This Shows Silver Would Have To Skyrocket To $917 To = 1980 Peak CLICK HERE.

Is This About To Send Silver Above $100? Plus China Continues To Increase Its Gold Holdings CLICK HERE.

China’s “Silver Gate,” Gold & War As We Continue Kicking Off 2026 CLICK HERE.

$80 SILVER & $4,500 GOLD: Here’s The Shocker In The Silver Market Today CLICK HERE.

Silver Futures Surge Above $80, Plus This Major Bull Market Is About To Kickoff CLICK HERE.

This Man Predicted Silver Will Soar Above $100 In A Matter Of Months CLICK HERE.

It’s Not Just Gold & Silver Skyrocketing, The Stock Market Is Going To Crash CLICK HERE.

Silver Sparkles & Gold Shined In 2025 But Look At What’s Ahead In 2026 CLICK HERE.

Silver, And What Stood Out To Me The Past Two Weeks CLICK HERE.

Here Is The Remarkable Big Picture Setup For Gold As We Head Into 2026 CLICK HERE.

An Astonishing Christmas Prediction From Legend Richard Russell CLICK HERE.

Michael Oliver – Historic Breakouts Will Now Send Gold & Silver Prices To Levels That Will Shock The World! CLICK HERE.

© 2026 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.