Peter Schiff just warned people to expect panic buying in the gold and silver markets, plus the big move in silver is coming.

Michael Oliver’s audio interview has now been released! (Link below) discussing gold futures breaking above $3,700 this week and silver surging above $42 along with strong advances in the mining stocks! For now…

Silver

September 12 (King World News) – Peter Schiff: Silver just traded above $42. Gold is poised to break to a new record high. I think the precious metals are getting ready to melt up. This is an unmistakable market signal that the Fed’s upcoming rate cut is a huge mistake.

Expect Panic Buying

Peter Schiff: Silver is trading above $42.20. Gold is back above $3,650. While these prices may seem high, by next year they will look ridiculously low. The reason prices are not already much higher is that most people don’t see what’s coming. When they finally notice, panic buying will ensue.

Gold Stocks Crushing It

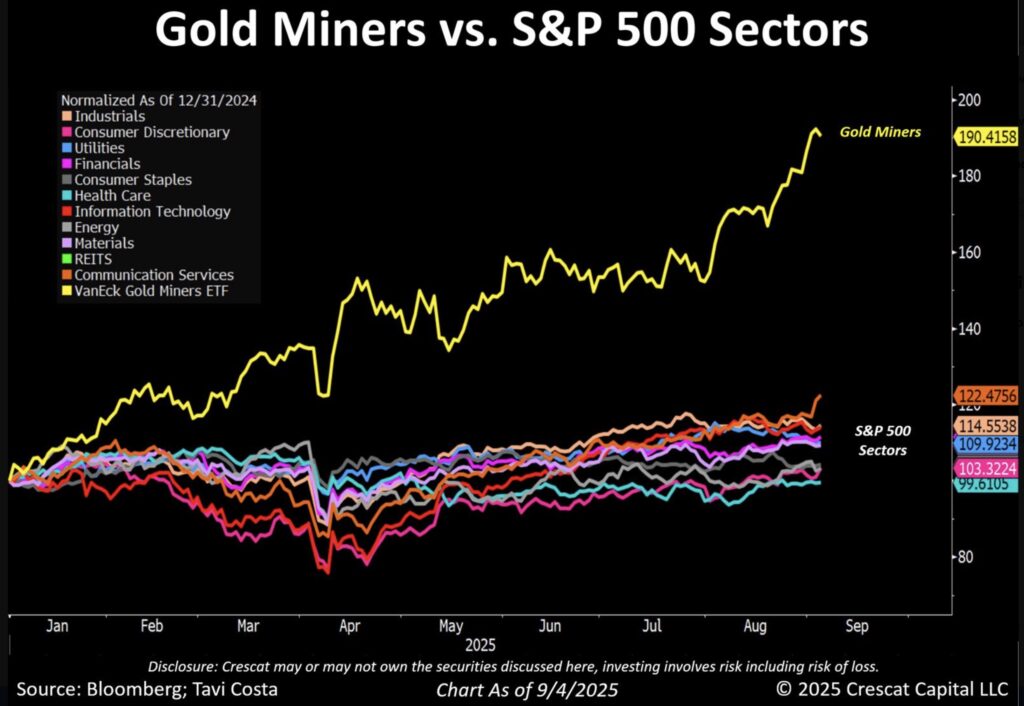

Otavio Costa: Classic stagflationary behavior:

Gold stocks have crushed every sector of the S&P 500 this year.

KING WORLD NEWS NOTE: Gold Stocks Have Crushed Every Sector In The S&P 500

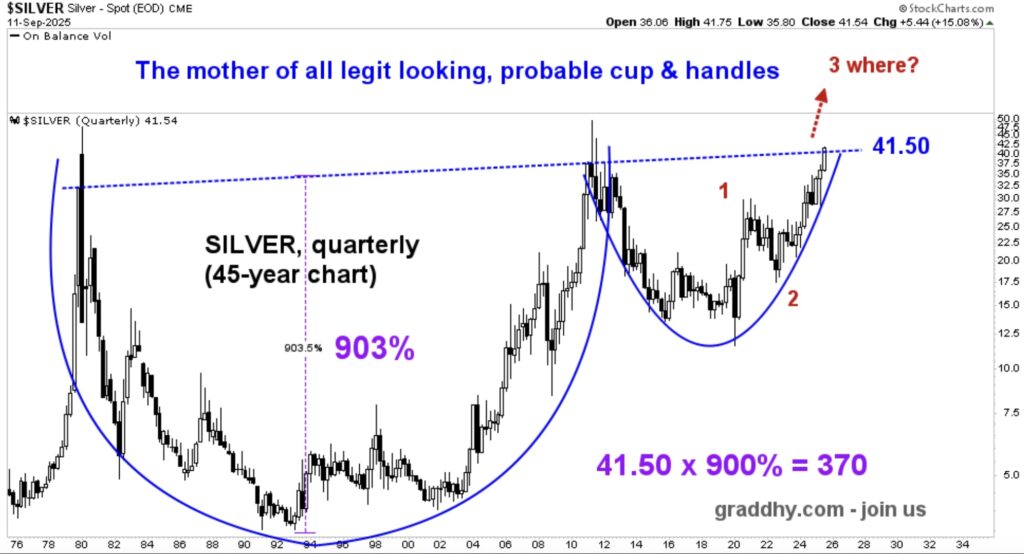

The Big Move In Silver Is Coming

Graddhy out of Sweden: Big patterns lead to big moves.

Getting in before the general public is always key.

Now trying to break above blue line.

Could see $60-$70 on the breakout.

KING WORLD NEWS NOTE: Silver Is Coiled To Blastoff To $60-$70

The Biggest Mistake The Fed Will Ever Make

Peter Schiff: The Fed has made a lot of mistakes, but history will likely record this next rate cut as the biggest. It’ll set into motion a series of rate cuts and a return to quantitative easing, this time with definitive yield curve control. The dollar’s reserve currency status will be lost.

Michael Oliver Says Wise Investors Are Going To Make A Fortune

To listen to Michael Oliver discuss gold futures surging above $3,700 this week, silver futures hitting $42.98 and mining stocks surging CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.