Are we heading toward yet another crisis as long term interest rates around the world continue to rise?

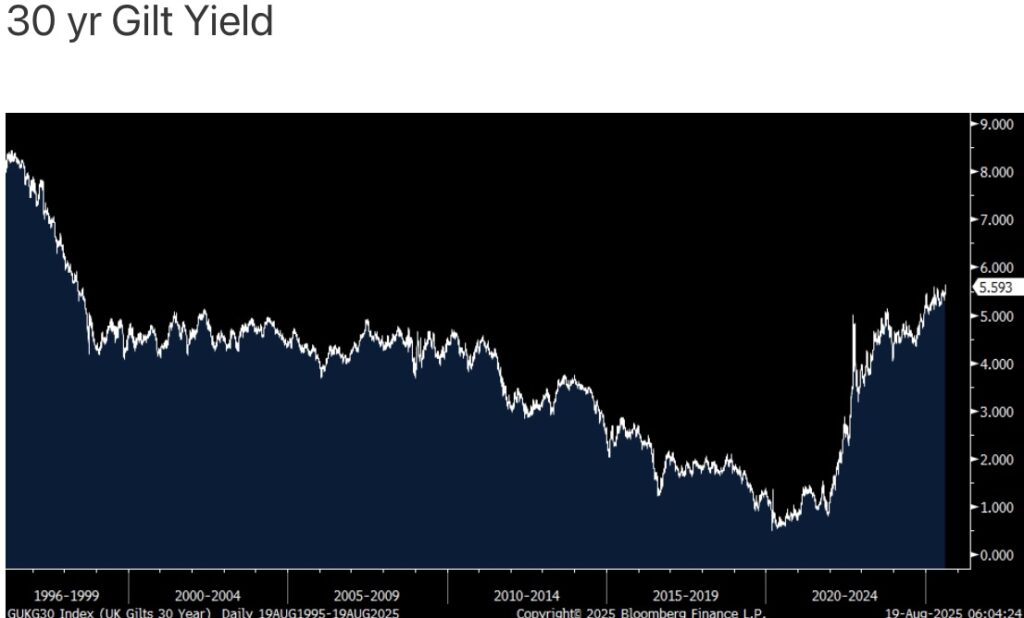

August 19 (King World News) – Peter Boockvar: Just two weeks after the Bank of England cut its bank rate to 4%, the 30 yr gilt yield yesterday closed at its highest level since 1998, rising by almost 20 bps in three days before backing off a touch today by 2 bps.

Even though the ECB has cut its deposit rate by 200 bps over the past year, German and French 30 yr yields today are at 14 yr highs.

I raise this for two reasons, the global bear market in bond duration continues and central bank attempts at lowering interest rates have only had an impact on short term rates. The Fed knows how this feels after they’ve cut 100 bps and we of course all watch to see how the long end trades from here as we are about to get some more cuts.

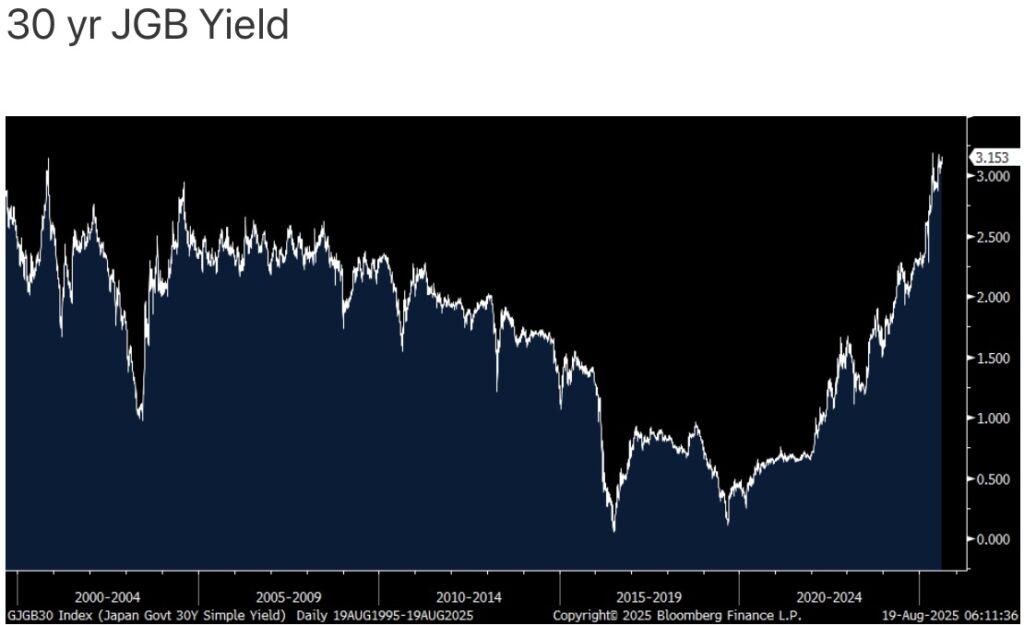

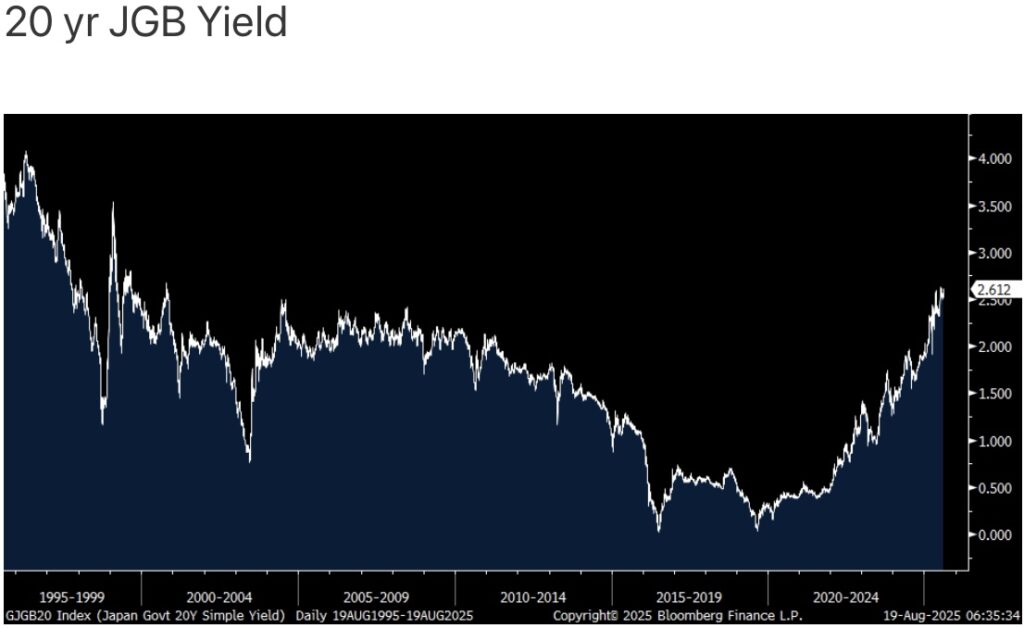

JGB yields, something I continue to encourage people to watch each day, rose too overnight after a mediocre 20 yr bond auction. The 40 yr yield closed up by 5 bps to near a one month high. The 30 yr yield closed within 3 bps of matching a record high since this was first issued in 1999.

The 20 yr yield is less than 1 bps from a level last seen in 2000.

Sensitive to the value of one’s homes, mortgage rates and consumer confidence, Home Depot’s Q2 top and bottom line both slightly missed expectations and comps were a touch light, up 1% vs the estimate of 1.4%.

They cite the reason for the comp miss to FX rates that “negatively impacted total company comparable sales by approximately 40 bps.” I’m guessing it’s their FX exposure to CAD and MXN and maybe had to do with hedges. We’ll listen about this on their call at 9am.

They continue to see green shoots though with their base business. “The momentum that began in the back half of last year continued throughout the first half as customers engaged more broadly in smaller home improvement projects.”

Nomi Prins Just Predicted $9,000-$12,000 Gold

To listen to Nomi Prins discuss her latest predictions for where the prices of gold and silver are headed along with the mining stocks and the uranium sector CLICK HERE OR ON THE IMAGE BELOW.

To listen to Alasdair Macleod discuss the calm before the storm and what to expect from gold, silver and the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.