Rockefeller International Chair, Ruchir Sharma, warned the US stock market will see a catastrophic crash. He also warned “America is over-owned, overvalued, and overhyped to a degree never seen before,” and compared today’s jubilation to the Roaring 1920s, which was followed by the Great Depression. King World News agrees with his assessment and cautions investors to get prepared.

Prepare For Collapse

December 11 (King World News) – Gerald Celente: The Happy Days in America keep getting happier since Donald Trump won the race to the White House.

The University of Michigan’s monthly survey of consumer confidence registered 74.0 at the beginning of December, jumping from 71.4 in November to reach its highest level since May and beating economists’ estimates of 73.0.

Confidence rose among Republican voters and declined among Democrats. Independents split between the two.

We note this survey because it is more than another nod to the partisan divide.

The survey director Joanne Hsu said the numbers reflect the collective economic experiences and observations of respondents, and that “Democrats voiced concerns that anticipated policy changes, particularly tariff hikes, would lead to a resurgence of inflation,” while “Republicans expect the next president to usher in an immense slowdown in inflation.”

Putting their money where their minds are, U.S. consumers’ surging confidence was accompanied by a rise in sales of durable goods—items expected to last at least three years.

Yet, Hsu said the higher sales were not a vote of confidence in the economy, but, instead, consumers are buying more products now because they expect inflation to continue and are buying now to avoid paying higher prices later.

We disagree.

Trump’s election victory has brought more of an upbeat economic vibe to the general public rather than a more-of-the-same if Kamala Harris was elected.

Yet, in reality, more people have less money to spend.

The U.S. Commerce department reported that in October, the U.S. trade deficit narrowed to $73.84 billion, compared to $83.3 billion in September.

The average U.S. monthly trade deficit this year through October is $80.7 billion, 12.3 percent above that during the same stretch in 2023…

ALERT:

Look at which company has positioned itself to become the next K92 high-grade gold powerhouse! CLICK HERE OR ON THE IMAGE BELOW.

Further illustrating the global economic contractions, October’s exports fell 16 percent compared to September’s to $265.72 billion. Imports dropped 4 percent to $339.56 billion.

A slight gain in exported services, including travel and intellectual property, was negated by a drop in shipment of goods. Exports of computer accessories shrank by $1.2 billion and passenger cars by $1.3 billion.

Computer imports were off by $3.7 billion and cars, engines, and parts by $1.6 billion.

Downbeat or Upbeat?

Yet, as evidenced by the U.S. equity markets and its economy, as the old saying goes: “We’re #1.”

Rockefeller Chair Warns US Stock Market Will Crash

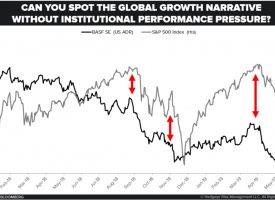

Indeed, in last week’s Financial Times the Chairman of Rockefeller International Ruchir Sharma said investors around the world were pumping more money into U.S. equities at the highest levels ever recorded. He said that back in the 1980s, U.S. companies accounted for just 30 percent of the global stock index, but now it’s up to 70 percent… even though the U.S. Gross Domestic Product accounts for only 27 percent of the world’s GDP.

Warning that the “Awe of ‘American exceptionalism’ in markets has now gone too far,” he also noted that so far this year, foreign capital has poured in over $1 trillion into the U.S. debt markets, while less than half of that has gone into the Eurozone sector.

He wrote that “In the past, including the roaring 1920s and the dotcom era, a rising U.S. market would lift other markets,” but “Today, a booming U.S. market is sucking money out of the others.”

Warning of another dot.com bust and market panic he noted that “Talk of bubbles in tech or AI, or in investment strategies focused on growth and momentum, obscures the mother of all bubbles in U.S. markets,” and that “Thoroughly dominating the mind space of global investors, America is over-owned, overvalued, and overhyped to a degree never seen before.”

The Other Side

Seeing no “bubble” danger ahead, on the upside, Deutsche Bank projects that next year the S&P 500 will hit 7,000, Bank of America predicts 6,666, Barclay says 6,600 while JPMorgan Chase, Morgan Stanley and Goldman Sachs forecast it will close the year at 6,500. Today the S&P closed up at 6,034.

And again, on “The Other Side” is the other economic downside of the world which we have greatly detailed in this and previous Trends Journals.

And just yesterday, China reported that imports fell nearly 4 percent… which equals more Chinese people buying less products because they are making less money. On the export side, the projections were that outbound shipments would rise by 12.7 percent, but they rose just 6.7 percent.

In hopes of trying to prop up the economy which the government destroyed as a result of its three years of zero COVID policy, which destroyed the lives and livelihoods of hundreds of millions, China’s Politburo loosened monetary policy on Monday for the first time in 14 years.

While the announcement pushed Hong Kong’s Hang Seng China Enterprises stock index up 3.14 percent yesterday, today, the Hang Seng was flat. We forecast the Politburo money scheme will help juice the overall economy, but not enough to salvage the damage caused by their COVID war policies that destroyed the real estate market which accounts for some 30 percent of China’s Gross Domestic Product.

TREND FORECAST:

And as we have detailed in this and previous Trends Journals, there is a global economic slowdown and we forecast a bad situation will become much worse.

In trying to reverse this downtrend, central banks will lower interest rates which will in turn juice inflation. And, the higher inflation rises, the higher gold prices will rise as investors seek safe-haven assets.

On the “upside,” the U.S. economy, which is outperforming the rest of the world, will stay strong in at least the first year of Donald Trump’s administration. As we have forecast in the past and continue to forecast, President Trump’s primary interest is “The economy, stupid.” Therefore, he will do all he can to keep propping it up.

Billionaire Pierre Lassonde – Gold & Silver Will Soar In 2025!

To listen to legend Pierre Lassonde discuss how you can become rich investing in 2025, what he is buying right now with his own money, what people should be buying with their money, what to expect from gold, silver, miners and crypto in 2025 and beyond CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.