Here is a look at the greatest disconnect, plus expect even more physical gold demand.

More “Transitory” Inflation

September 1 (King World News) – Charlie Bilello: Eurozone inflation has moved up to 9.1%, its highest level ever. Meanwhile, the ECB only recently abandoned their negative rate policy by moving back to 0%. This is the greatest disconnect between easy monetary policy and unabating rising prices that the world has ever seen.

THE GREATEST DISCONNECT:

Interest Rates Are Far Below Inflation In Europe

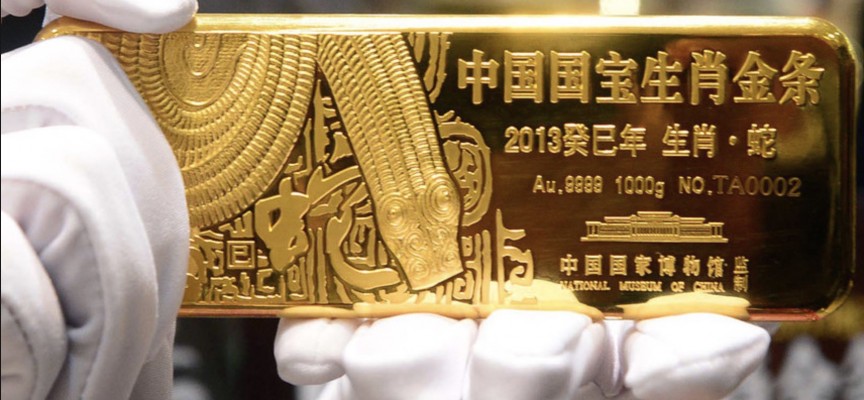

Expect Even More Physical Gold Demand

Garic Moran: Gold tested $1700 support in July, Swiss exports exploded. Opec was openly on the buy side of Gold in years. This test of $1700 will create more central bank demand for Gold than July…

Look At Who Is A Big Investor In This Soon-To-Be Self Funding Gold Exploration Company! To learn more click here or on the image below.

US Dollar May Weaken Before Strengthening…Again

From top Citi analyst Tom Fitzpatrick: Both the DXY and USDJPY failed to complete bullish outside months on Wednesday with closes above 109.29 and 139.39 respectively. Today, however, price action continued higher and closed above both levels, setting new 2022 highs in process. This continues to support our strong USD view; however, given payroll numbers on Friday and, the extended US holiday weekend, we’re a bit cautious in the short-term.

In the medium-term, we bias USD strength, targeting 117.50 on the DXY (double bottom neckline at 102.99) with resistance at 115.47 (long-term ascending resistance) and 121.02 (2001 high). This bias is especially true with USDJPY. We’re watching for a move to the 1998 high at 147.66 given the bullish outside months completed on US5YR, 10YR and 30YR charts with closes above 3.21%, 3.10%, and 3.28%, that suggest an acceleration back to the 2022 highs at 3.62%, 3.50%, and 3.49% respectively.

US Dollar Index Target 117, Then 120

US Dollar Target 148 vs Yen

US Dollar And Gold

King World News note: There is significant physical gold demand across the globe. We will keep a close eye on how the currency markets will impact the gold market. Remember, there are times where the US dollar and gold rise together because gold is in a bull market vs all fiat currencies. Remain patient.

ALSO JUST RELEASED: GLOBAL CRASH ALERT: Art Cashin Just Warned US And China May Go To War CLICK HERE.

ALSO JUST RELEASED: SHOCKING: This Is What Real Financial Pain Is CLICK HERE.

ALSO JUST RELEASED: Richard Russell’s Most Shocking Prediction Came True But He Also Issued This Ominous Warning CLICK HERE.

ALSO JUST RELEASED: Look At What Is Skyrocketing Now, Plus Mining Stocks, Massive Year-Over-Year Price Changes And A Calamitous Situation CLICK HERE.

ALSO JUST RELEASED: Time For Gold’s Daily Cycle Low, So Much Negative Sentiment, Apartment Rents And Cooling Off CLICK HERE.

ALSO JUST RELEASED: MUST SEE: Stunning Look At Today’s Housing Bubble vs Previous Bubble CLICK HERE.

ALSO JUST RELEASED: Demand For Hard Assets Remains Strong, Plus Central Banks Hawkish With Alarming Energy Price Spikes CLICK HERE.

ALSO JUST RELEASED: Greyerz – The US Economy Is Crashing But The Global Collapse Will Be Even More Terrifying CLICK HERE.

UPDATE: Gold, Silver, Energy Crisis And Much More

Michael Oliver discusses the accelerating global crisis as well as what to expect in the gold and silver markets and other major markets and you can listen to his powerful audio interview by CLICKING HERE OR ON THE IMAGE BELOW.

© 2022 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.