Take a look at some of the wild trading taking place in global markets.

December 2 (King World News) – Peter Boockvar: As one end is squeezed, it bulges somewhere else. I’m talking again about the impact of tariffs, or the possibility of more of them, as the US dollar continues to remain well bid. Post the new threat to try to stop the growing momentum of BRICS countries that are now choosing to denominate more of their trade in currencies that are not the US dollar, a stronger US dollar will certainly help the US importers to mitigate the tariff they would have to pay. On the other hand, what US manufacturer is going to want to reshore to the US with its FX strength.

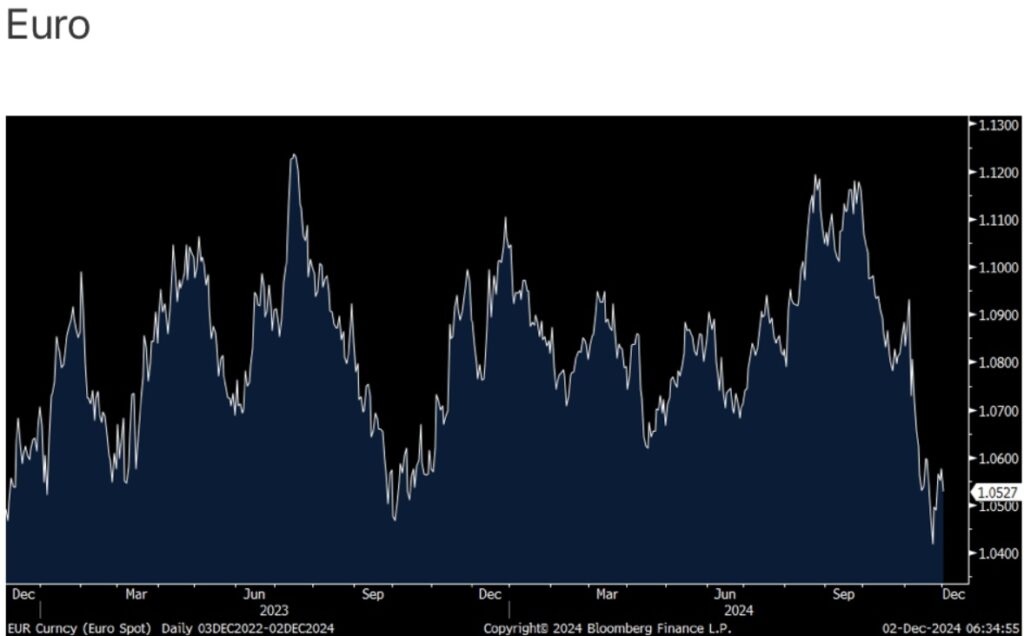

US Dollar Strength Has Pushed Euro Lower

Instead, we’ll continue to get a lot of rearranging of the globalized trade chairs and not rearranged in the US. Instead, I guess any fresh tariffs would then just be used to protect existing US domestically produced industries but the higher costs to its users would be the offset. For example, the aim at defending US steel and aluminum industries that resulted in higher costs for those that use those materials. Nothing is easily done here, nothing is free.

When it comes to the BRICS countries using yuan or rupee for example to trade, nothing will stop that. While we will not likely see a ‘new’ currency from them for many years, if ever, they will continue to use their own currencies in greater numbers in the years to come with trade. For example, China will buy more oil from the Saudi’s in yuan. The Saudi’s will in turn use the yuan to buy EV’s, solar panels, and other goods from China. Rinse, repeat with other emerging countries when it comes to other commodities like China buying soybeans from Brazil in yuan and India buying oil from Russia in rupee.

Hurting the euro in particular is the continued economic stagnation being seen in Europe, particularly in Germany and France and with ECB rate cuts where another is expected next week. Also, now the possibility of early elections being called again in France as Marine Le Pen threatens it in response to the Barnier budget.

Also of note is the move in the yen over the weekend, and this is higher vs the US dollar as BoJ Governor Ueda spoke late last week and opened the possibility of another rate increase this month rather than waiting until January. He spoke Thursday for an interview that was released on Saturday to Nikkei news and said with regards to a hike, “We can say it’s approaching in the sense that economic data are on track to meet our forecasts.” The 10 yr JGB yield rose 3.2 bps overnight to 1.08% as a result. That is just 2 bps from matching the highest level since 2011. The 40 yr yield was unchanged but is at a 16 yr high. What happens in Japan with regards to its liquidity spigot doesn’t stay in Japan as seen in August.

All Hell Is About To Break Loose

To listen to this timely and powerful audio interview with Michael Oliver CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.