Today James Turk told King World News that the price of silver may quickly hit the $50 level.

September 16 (King World News) – James Turk: The outlook for the precious metals just keeps getting brighter, Eric. Gold is leading, and so far silver is following. But that relationship is likely to change soon, with silver taking the lead.

The gold/silver ratio closed Friday at 84, which is better than the 89 level seen recently but still far above its historic 16-to-1 relationship. The current high ratio also stands out when considering that each year about 10-times more silver is mined than gold. So the high gold/silver ratio is an aberration that undervalues silver.

But silver is not only undervalued relative to gold. Silver is one of few things that can be purchased at a fraction of its 1980 high price, while gold is already 3-times its 1980 peak, just like most of life’s basic necessities. This anomaly of a relatively low silver price creates an opportunity for the individual investor.

Institutions with deep pockets are exiting fiat currency by purchasing gold, as evidenced by its rising trend. All of the gold mined throughout history still exists, with nearly all of it held as bars, coins, and high-karat jewellery. So gold is very liquid, and its market is very deep. Not so with silver.

While physical silver is liquid like gold, there is relatively little aboveground stock. Consequently, the silver market is not deep. So it is difficult for an institution to use their deep pockets to make large purchases, which creates the opportunity for individuals because silver is a gold-substitute.

At the current ratio, 84 ounces of physical silver offers same protection from fiat currency crises that gold offers. Owning physical metal puts your purchasing power outside of the financial system – outside of over-leveraged banks and governments on reckless spending sprees with yawning deficits. Huge debts accumulate as a result, eroding the purchasing power of currencies – what we call “inflation”.

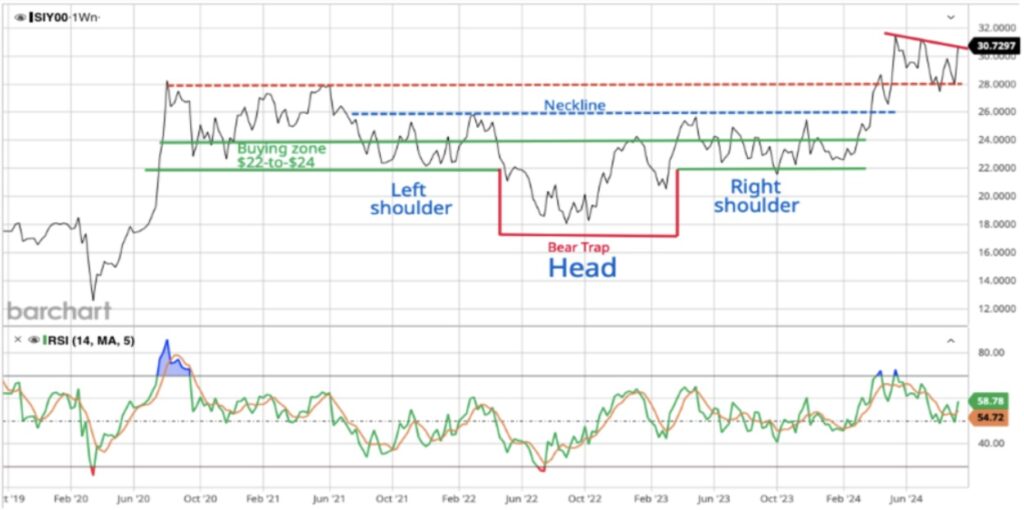

So the case to own some physical silver is compelling, as is its chart. KWN readers are familiar with this weekly silver chart that we’ve been following.

EXPECT SILVER UPSIDE ACCELERATION:

Silver Breaking Out Of Multi-Year Cup & Handle Formation

Silver has been forming a huge base that shows physical silver is being accumulated by strong hands. After the break-out above $28, silver retraced back to the break-out point, which now forms support. This support at $28 has been tested and held.

Silver May See $50 Very Quickly

What we need to watch now is whether silver will do some more back-and-forth filling of the pennant being formed, or whether silver is ready to break out of the pennant to the upside. When it does, I expect the move to $50 will be a quick one – days or weeks, not months.

When silver eventually breaks above $50, its bull market begins. You will recall, Eric, that I’ve been repeating that point since 2011, the last time silver touched $50. Everything since then has been base building, which looks strong enough to finally launch silver into a new bull market.

So far silver has been trading primarily on its industrial demand. When people start seeing silver as a gold-substitute and its monetary demand kicks in, the price rise will be something to behold. But be sure to own physical metal, not any paper representations of silver.

Gold And The Death Of The Dollar!

***To listen to the top trends forecaster in the world discuss gold and the death of the dollar CLICK HERE OR ON THE IMAGE BELOW.

Gold Shorts Squeezed As Gold Hits Record High $2,600+!

***To listen to Alasdair Macleod discuss the short squeeze in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

Stock Market Bubble To Pop!

***To listen to the man who helps oversee $150 billion discuss everything from inflation to global markets, a new launch and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.