There is so much anti-gold propaganda in the mainstream media but here is the truth about the gold market.

August 14 (King World News) – James Turk: Since central banks around the world began raising interest rates, Eric, we’ve been hearing that higher rates are bearish for gold. Let’s put that notion to a test.

In the past year and a half the Fed Funds rate at which banks lend or borrow dollars has jumped at a record pace from 0.2% to 5.1%. Yet gold today is approximately the same as it was in March 2022 when the Federal Reserve began hiking.

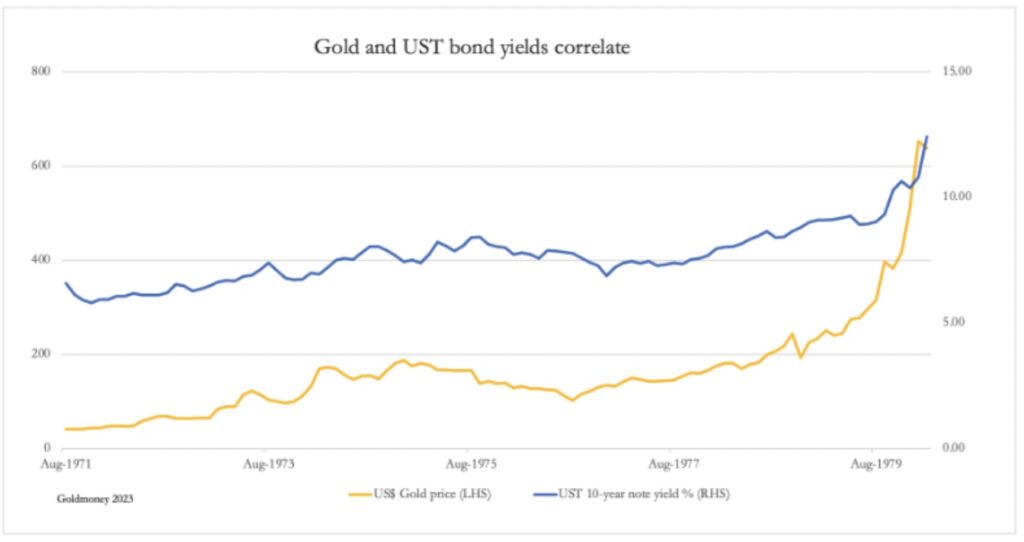

So the initial thought may be that rates haven’t risen far enough to negatively impact gold. But look at this chart of gold and T-bonds from the 1970s that my colleague, Alasdair Macleod, put together.

Gold And Interest Rates Rose Together In The 1970s Bull Market Culminating In The Price Of Gold Spiking To $850

1970s Dual Rise In Interest Rates & Gold

Back in the 1970s gold and interest rates moved together.

The reality is that gold and interest rates are correlated. The reason can be explained by simple accounting.

The dollar and all other national currencies are a liability of banks. So these liabilities that we use as currency have value because they are backed by assets in the banks, of which there are basically two types – gold in the central bank and loans owed to banks.

When interest rates rise, the value of long-term paper in banks falls in price, as we saw with the collapse of Silicon Valley Bank. And as was the case with SVB, the market knew that the value of the paper the bank owned was falling in price even though the bank’s financial accounts were reporting that it was solvent…

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

The market always has a nose that sniffs out and finds true values that represent profit opportunities. The market works on a micro scale – finding individual cases like SVB – and also on a macro scale, which applies to M2, the total quantity of dollars in existence.

These dollars – and all other national currencies – are backed by bank assets, the value of which go up or down depending on whether interest rates are falling or rising.

In the short term, gold can be buffeted by central bank market interventions. These distortions to free markets can have a psychological impact, resulting in an emotional knee-jerk reaction. But central bank interventions need not be long lasting nor have any meaningful long-term impact.

So when you read in the mainstream media or hear some central bank pronouncement about raising interest rates, you can expect higher gold prices. It’s simply a matter of accounting and keeping M2 in balance with bank assets. KWN note: Do not miss one of the most important audio interviews ever with Michael Oliver below regarding the historic setup in the gold market.

ALSO JUST RELEASED: BUCKLE UP: Greyerz – Another Massive Inflation Wave Is About To Be Unleashed CLICK HERE.

ALSO JUST RELEASED: HISTORIC SETUP IN GOLD: Michael Oliver – The Gold Market Is About To Make History CLICK HERE.

To listen to Michael Oliver discuss the historic setup in the gold, silver and mining share markets CLICK HERE OR ON THE IMAGE BELOW.

To listen to Alasdair Macleod discuss what investors need to be doing right now with their money to protect themselves and their families from the coming financial destruction CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.