Stock are struggling as big problems are concerning investors around the world.

Stock Selloff

July 5 (King World News) – Art Cashin, Head of Floor Operations at UBS: A potential full selloff, sparked by fears of a trade war, appears to be morphing into a simple consolidation of the very sharp gains of the last two weeks.

The bears looked like they were going to take control of the day, but cannot seem to hold on and once again, it is the high cap techs, which have become the Cavalry for the bulls in this daily battle that goes on.

So, we will watch the S&P, which is being tugged in two different ways – down by the Dow and up the Nasdaq and we will take that as the yardstick of where we are going. So far, it looks as though some people had stretched the holiday perhaps to finish the week.

Try to stay alert and try to stay awake and safe.

Arthur

What Did We Learn?

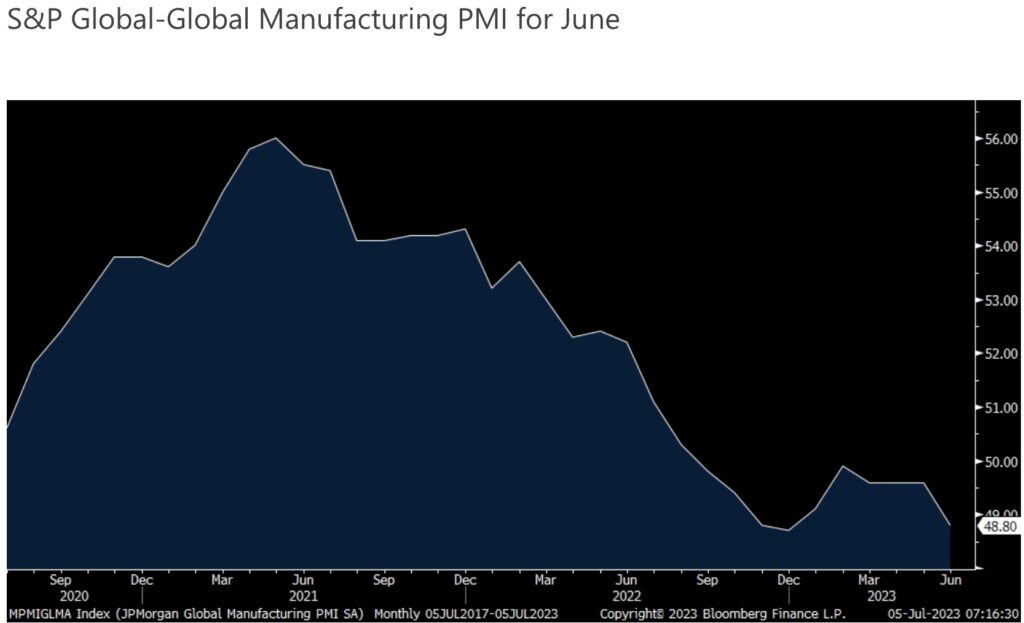

Peter Boockvar: What did we learn over the past few days? Global manufacturing remains in contraction, particularly in the US. The June S&P Global-Global Manufacturing PMI was 48.8, the lowest of the year and below 50 for the 10th straight month. The June US ISM seen Monday was under 50 for the 8th straight month. The ISM said:

“The June composite index reading reflects companies continuing to manage outputs down as softness continues and optimism about the 2nd half of 2023 weakens…Demand remains weak, production is slowing due to lack of work, and suppliers have capacity. There are signs of more employment reduction actions in the near term.”

The Question Now…

The question now is whether this spills over to the service side or service side strength can eventually lift manufacturing. Well, at least in Europe and Asia, the service side is softening. Today’s final read on the Eurozone services PMI was 52 vs the initial print of 52.4 and down from 55.1 in May. That’s the lowest since January. Also, “businesses’ growth expectations for the coming 12 months weakened at the end of the 2nd quarter. Although firms remained optimistic overall, the level of positive sentiment slid to the lowest in the year to date.” Bond yields are lower in response today.

The UK services PMI was left unrevised at 53.7 but that is the weakest since January too. Expectations about future growth were positive but slipping to the lowest since the beginning of the year.

“Survey respondents mostly commented on resilient sales pipelines and expectations of rising customer demand, but there were also a number of reports citing worries about cost of living pressures and the impact of higher interest rates.”

China’s services June PMI from Caixin, focused on their private sector, fell to 53.9 from 57.1 and that was well below the estimate of 56.2. Caixin said;

“The slower rise in business activity was often linked to softer than anticipated demand conditions.”

The bright spot remains travel and leisure as:

“There were a number of reports that the sector continued to benefit from a revival in tourism and travel since the easing of pandemic restrictions.”

Also positively:

“optimism towards the 12 month outlook strengthened in June.”

Meanwhile In China

While the whole world is bearish on China with the bashing of them a daily occurrence, I’m not, notwithstanding the legit geopolitical and economic worries and the authoritarian government which is an impediment to the safety of Taiwan (China doesn’t care about any other country militarily) and faster economic growth. Stocks in China and the region were mostly red…

UPDATE: This Is Now The Premier Gold Exploration Company In Quebec With Massive Upside Potential For Shareholders click here or on the image below.

My friends at the China Beige Book were not as dire either, as they said last week in their Q2 review:

“China’s 2023 rebound isn’t sharp, but it’s also not finished yet.”

They saw an acceleration in retail earnings and sales volumes, also travel:

“and hospitality held its pace even as spending at restaurants faded some after a powerhouse May.”

Also of note:

“On the factory side, manufacturing revenue improved for a 3rd consecutive month.”

It’s export orders that remain soft because of weakness around the world.

Services also moderated in Japan as its PMI fell by 1.9 pts to 54, matching the lowest since January. Australia’s slipped to right above 50 at 50.3 from 52.1 in May.

Bottom Line

Bottom line to the economic data, when I hear people still talking about no landing or even an economic reacceleration, I don’t think there is enough appreciation of the silent killer to economic growth that is a persistent higher cost of capital in a still highly levered economy where any loan coming due is repricing at a dramatically higher rate than what’s maturing. More bankruptcies will take place, more cash flow will be allocated to interest expense, overall more equity is needed and less new business gets done because of the higher cost of debt.

One more thing as we get ready for Q2 earnings reports and where I was reminded by the impasse with the UPS labor talks which would be a logistical mess if not resolved by the end of the month. There were two major drivers of profit margin expansion over the past 15 years outside of the one time base effect of the cut in the US corporate income tax rate. That was low labor costs and very low interest expense paid because of the plunge in interest rates. Both trends have now clearly reversed.

ALSO JUST RELEASED: Stoeferle – Gold, Silver, The Mining Stocks And Where To Invest In A Recession CLICK HERE.

ALSO JUST RELEASED: Greyerz Just Warned A Major Revaluation Of Gold Is Imminent CLICK HERE.

To listen to Michael Oliver discuss the strong move in gold as well the surprising move in silver as well as the mining stocks he expects to unfold CLICK HERE OR ON THE IMAGE BELOW.

To listen to Alasdair Macleod discuss the biggest silver buy signal in the world CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.