Here is the setup ahead of the big Fed decision on interest rates this week, plus the credit crunch is here.

Big Fed Decision

June 12 (King World News) – Peter Boockvar: At this point, whether there is a skip, pause or whatever, I believe what is most relevant is how committed the Fed is to keeping rates higher for a while. I’m thus more interested in where the year end 2023, 2024 and 2025 dot plots end up than whether the Fed is going to hike in July or not. As part of this, what is the REAL fed funds rate the Fed going to target in the coming years? Are the days of negative real rates over during the rest of the Powell tenure?

I’ll say again, just keeping rates at high levels for longer is a continued form of monetary tightening as each day that passes someone’s adjustable rate mortgage resets much higher, someone’s commercial real estate debt is coming due at an interest rate on offer more than double on the loan that is maturing, some businesses debt needs to be refinanced also at a much steeper rate, and some project or business doesn’t get started because more equity is needed because the cost of capital is too high to make the numbers work, each and every day from here. And each time it happens, more cash is allocated to interest expense than something else or some business doesn’t make it. Throw in the ever growing needs of the US government who is now crowding out the private sector and this is a process of tighter money and less financing availability that will take years to play out, again assuming the Fed is committed to keeping rates higher for a while…

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

Zombies Running Out Of Money

To my continued point of the new rate world we’re in and the high costs of it, if you didn’t see the WSJ article over the weekend titled “Startups Struggle to Stay in Business as Funds Dry Up.” The piece said “Fresh capital from venture investors and bank loans is scarce and expensive. Going public is near impossible. Some business models that worked when cash was cheap are unsustainable now. That means venture-backed startups are running out of money and facing hard choices.” https://www.wsj.com/articles/more-startups-throw-in-the-towel-unable-to-raise-money-for-their-ideas-eff8305b?mod=itp_wsj&ru=yahoo

The Credit Crunch Is Here

The credit crunch is here and this will take not quarters, but years to play out if the cost of capital remains high. Understand too that many small and medium sized businesses have to pay an interest rate on a loan that is above 10% if they can even get one. Things in the private economy worked ok at 3-4% interest rates, not so much at 10% as we’re on a whole new economic playing field that I don’t think is being fully appreciated.

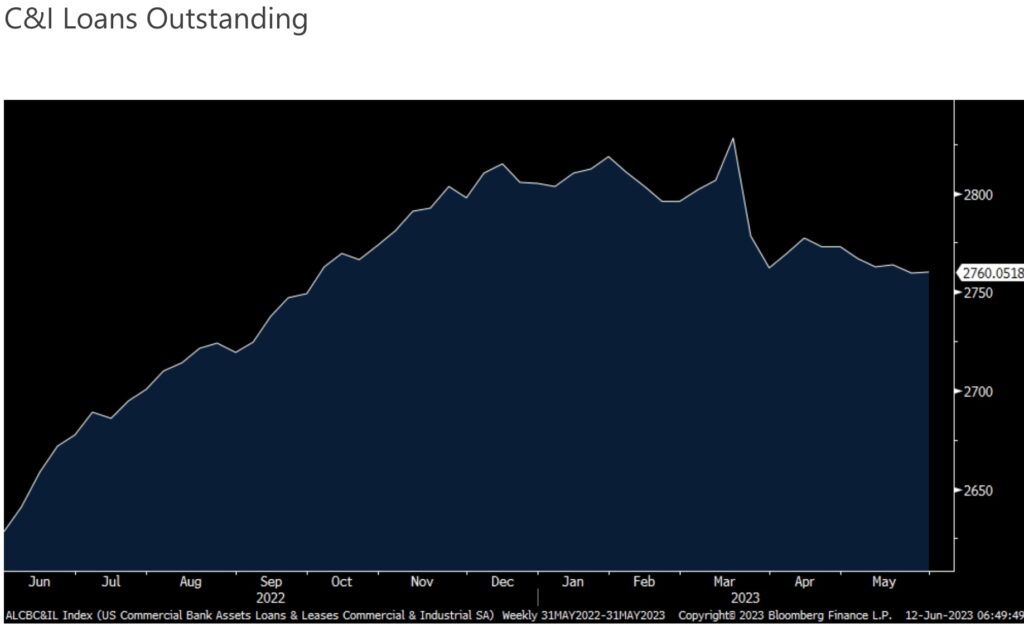

For the week ended May 31st, commercial and industrial loans outstanding were little changed from the previous weeks lowest level since October 2022.

Bank Deposits

Bank deposits did rebound for a 3rd straight week, by $47b which takes it back to the highest since mid March. I’m assuming that banks are stepping up their efforts to raise deposit and CD rates in order to bring back deposits that were lost and to also retain what left they have.

Japanese Inflation

Ahead of the BoJ meeting on Friday where no changes are expected, May PPI for Japan fell .7% m/o/m, more than estimated 2 tenths drop. Wholesale prices gained 5.1% y/o/y vs 5.9% in April. A slight drop in manufacturing prices m/o/m helped but there was also a big drop in utility prices of 8.3%. If there is a central bank that is trapped in an impossible spot, one in which they placed themselves in, it is the BoJ. After jumping to the highest level since 2015, the 10 yr inflation breakeven in Japan fell overnight by 1.6 bps to 1.05%.

ALSO JUST RELEASED: The US Economic Nightmare And The Great Unwind Set To Accelerate CLICK HERE.

ALSO JUST RELEASED: Man Who Predicted The Banking Collapse Three Years Ago Says It Will Get Much Worse CLICK HERE.

***To listen to the timely and powerful audio interview with Gerald Celente where he discusses why investors need to get ready for a major takedown in the economy and global markets CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.