What is happening in the economy is terrifying even as the stock market rally continues and gold attacks the $2,000 level.

A 2000-Like Meltup

June 1 (King World News) – Otavio Costa: The resemblance between the chart below, depicting the Nasdaq 100 during the year 2000, and the current meltup in US equities is indeed striking. However, what if we were to tell you that for the next 2 years, the white line collapsed by 80%?

By no means we are suggesting that history will repeat itself exactly, but the behavior of today’s market appears remarkably similar to the still-early stages of the tech bust. It is difficult to recall a time when investors were more complacent, especially considering that we are already one year into one of the steepest rate hikes in history. This is compounded by the fact that a multitude of significant issues is currently unfolding, presenting a long list of concerns that warrant attention:

- Corporate fundamentals deteriorating;

- More than 90% of the entire Treasury curve already inverted;

- Soft data is mostly at recessionary levels;

- Macro data starting to contract;

- Banks severely tightening their lending standards; and

- M2 money supply now falling the most in 60 years.

Never mind that as soon as these debt ceiling discussions are over, the government will be dumping at least another $1T worth of Treasuries into the market. This comes after a banking crisis triggered by a major decline in the value of these debt instruments. Now, ask yourself:

Are we appropriately pricing risk in this environment?

The Volatility Index (VIX) is at a mere 16, credit spreads are sub 200bps, and stocks have one of their most extreme valuations in history. To be clear, the recent market rally has been almost entirely driven by megacap tech stocks.

A wise market timer once said, “Beware when the generals lead and the soldiers are not following”.

Lack Of Upside Breadth May Signal The Beginning Of The End For Tech

Tech Stocks Are Way Over Extended

The notion that a potential reversal in the Fed policy back to easing mode would help to fuel the technology sector again appears to be broadly misguided. If interest rates were to be significantly lowered again, it would likely occur in a difficult macroeconomic environment where the fundamentals of tech companies would also be under severe pressure. It is worth mentioning that their overall earnings have already started to contract.

From our perspective, the cost of capital for corporations is in the midst of a structural increase that is not transitory. It should result in continued margin pressure making it increasingly challenging to justify today’s highly inflated valuations across the broad market, outside of undervalued resource industries.

Valuations matter, and this idea that tech companies will continue to exponentially improve their fundamentals is a likely false extrapolation of a past trend that is unsustainable, especially considering the remarkable earnings growth witnessed during the 2010s. Investors seem to be valuing businesses as if we are on the cusp of another decade of robust growth and a low-cost capital. We vehemently disagree with this perspective. Furthermore, the conventional thought that the market has already factored in the potential risks of a significant economic downturn is entirely counter to the balance of evidence across our arsenal of macro and fundamental indicators…

ALERT:

Powerhouse merger caught Rio Tinto’s attention and created a huge opportunity in the junior gold & silver space CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

What transpired in 2022 in equity markets was merely the initial duration shock caused by a sharp increase in long-term Treasury yields. We have yet to experience the further decline in prices to reflect worsening corporate fundamentals and significantly rising credit spreads.

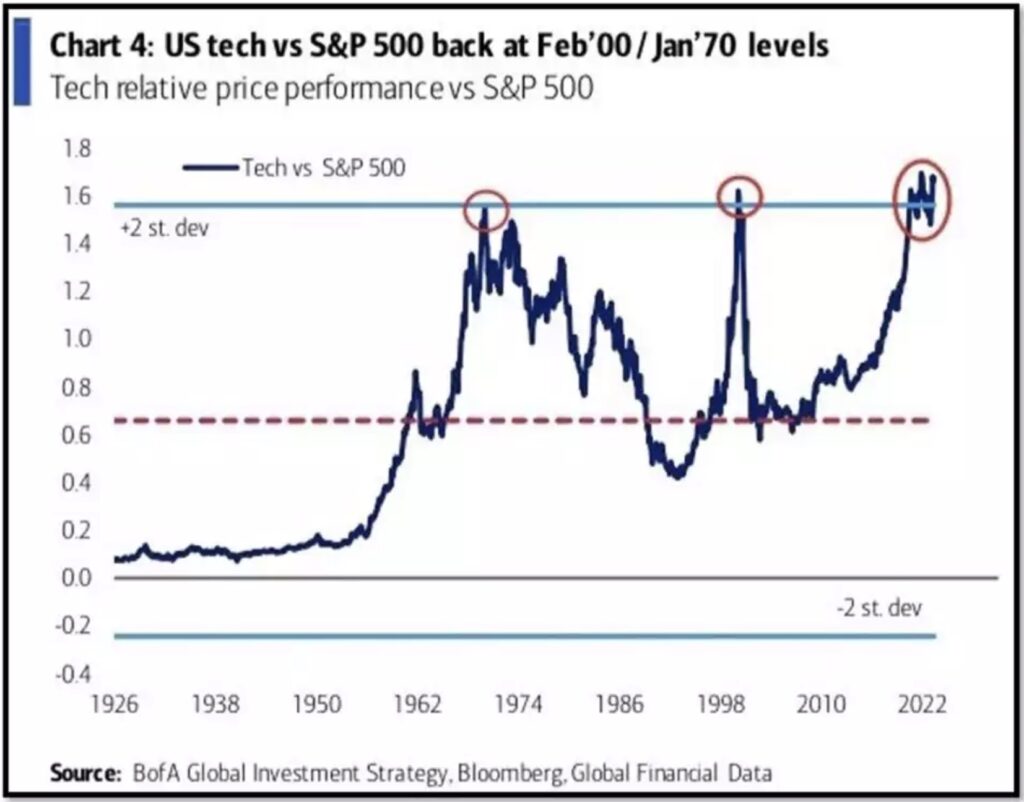

The chart below should be on everyone’s mind. The tech sector’s outperformance compared to the broader market has never been more extreme. As shown in the chart below, the ratio between tech stocks and the S&P 500 is now over two standard deviations above the historical mean. During other times when this indicator also reached such high levels, the tech sector significantly underperformed in the following decade. It’s unlikely that this time will be any different. When discount rates are structurally rising, the significance of valuations becomes more pronounced, especially when the growth rates in these businesses are substantially deteriorating.

Tech Bubble At All-Time Highs, Eclipsing 1972 & 2000 Tech Manias (RED CIRCLES):

Soft Data at Recessionary Levels

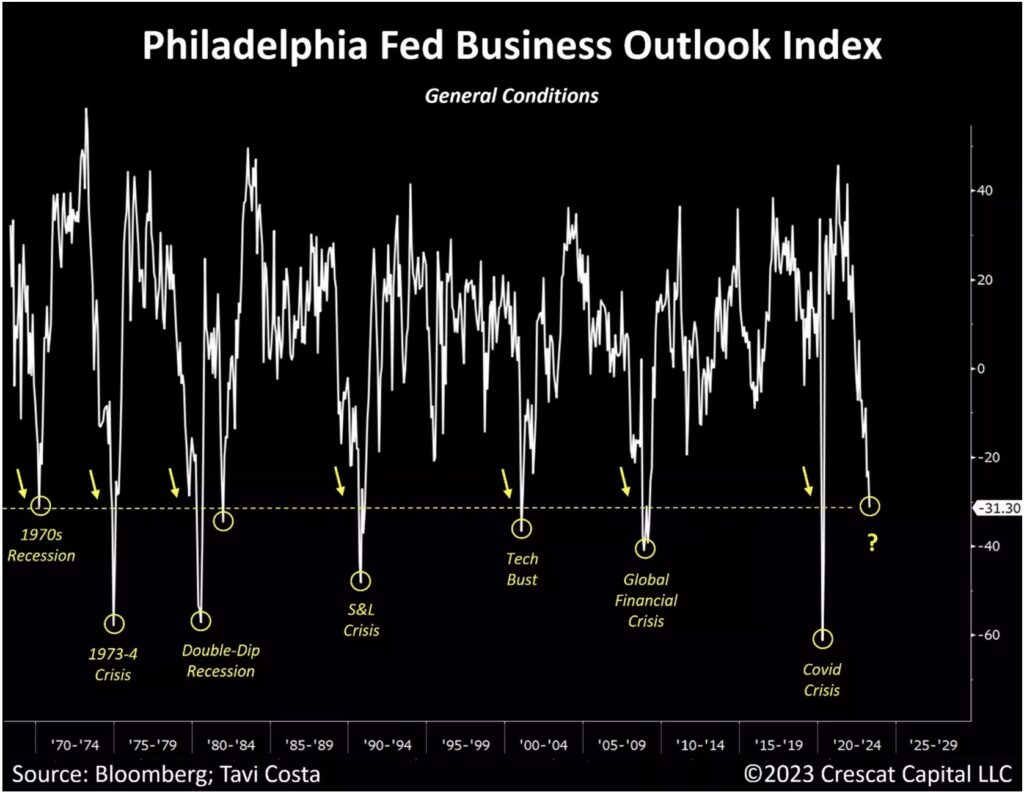

This business outlook index by the Philadelphia Fed clearly deserves more attention. The survey shows another sharp drop-in economic activity, approaching historical lows. This indicator has consistently foreshadowed economic downturns when reaching similarly depressing levels in the past 50 years.

To add, the current tightening of lending conditions among banking institutions is likely to exacerbate the risk of a recession in corporate earnings. Despite this, credit spreads at 2% and VIX below 20% do not accurately reflect the severity of the situation, and both are poised to rise significantly from today’s levels.

Business Outlook Will Continue To Crater

Business Loans Contracting

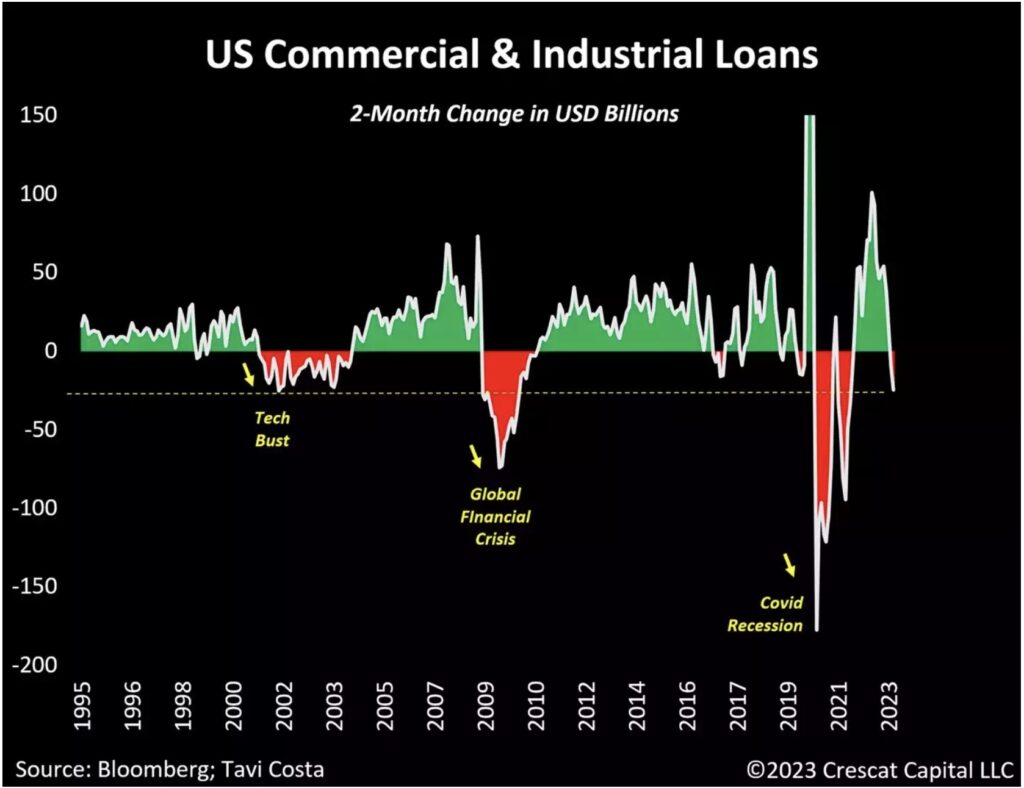

Commercial and industrial loans just had one of their worst 2-month contractions in history. The only other times we have experienced a similar problem was during the three last economic recessions. While the annual growth of business loans remains positive, it’s crucial to emphasize the short-term changes given the developments of the recent banking crisis. At a time when corporate fundamentals are weakening and the risk of a recession is looming, financial institutions are being compelled to tighten their lending conditions.

Let us not forget that the yield curve has been warning us all along. In November, more than 70% of the entire Treasury curve inverted, which is a signal that has never failed in forecasting severe economic downturns.

HOW FAR INTO THE RED WILL THIS GO?

US Commercial & Industrial Loans Will Continue To Collapse

Bank Failures

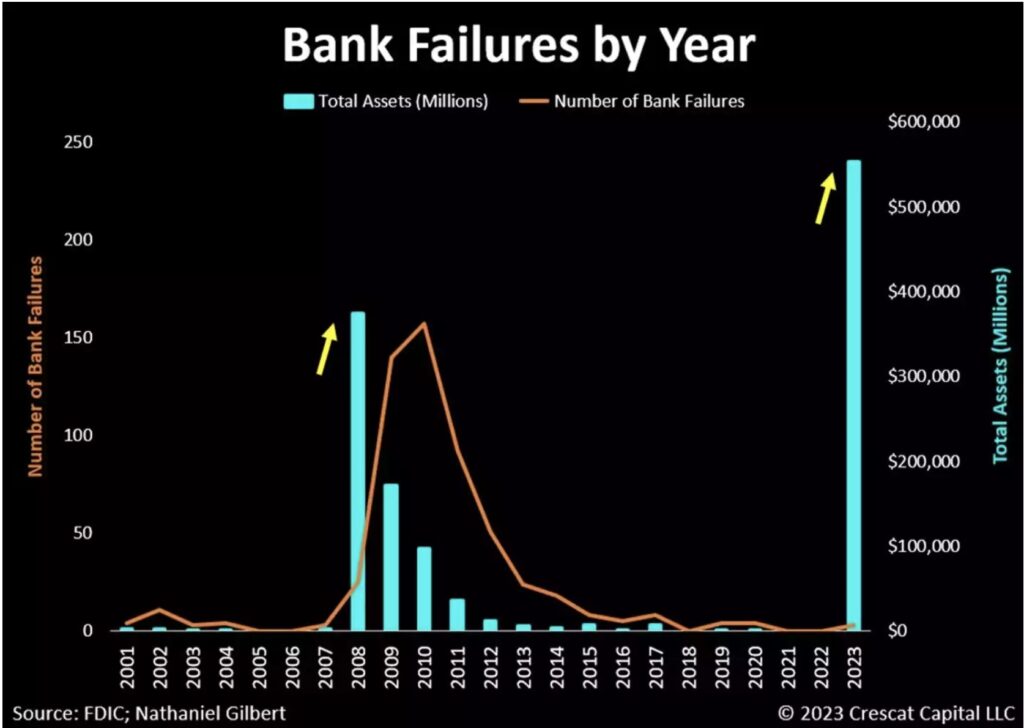

A reminder that back in the Global Financial Crisis over 150 banks went out of business. Today, 4 failures already equate to nearly the entire amount of assets financial institutions held during the banking crisis issue of 2008 and 2009.

If you are asking yourself whether the Fed will allow the same systemic problem to unfold today, look no further than gold prices starting to sniff out future liquidity injections to sustain financial stability.

4 Bank Failures Today Has Exceeded 2008 Collapse When 150 Banks Failed!

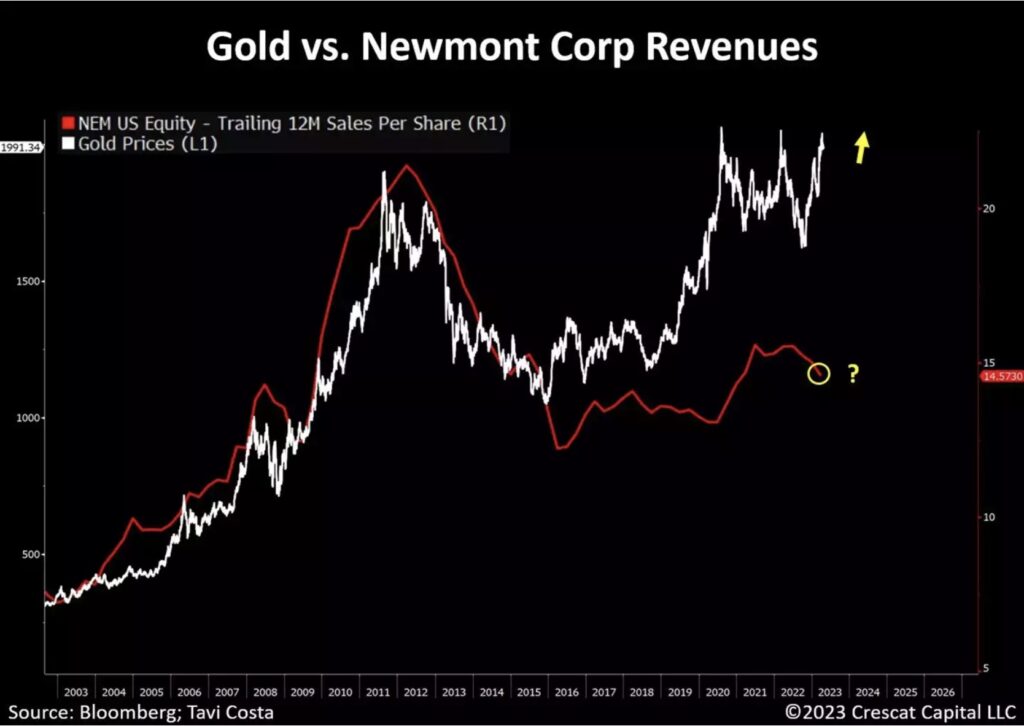

Gold Majors Lack Vision

Newmont reported earnings recently, and despite gold prices approaching new highs their revenues continue to diverge materially. In fact, sales per share are at the same levels they were almost a decade ago. This phenomenon contributes significantly to the persistent underperformance of major gold companies relative to metal prices. The lack of vision among industry leaders is apparent and it’s imperative that investors start demanding these companies to re-direct their focus toward production growth and resource expansion.

This is laying the groundwork for early-stage mining businesses that are well positioned to benefit from the inevitable need from major companies to replenish their aging assets.

SOMETHING’S GOT TO GIVE:

Unprecedented Chasm Between Gold Price (WHITE LINE) And Newmont Revenues (RED LINE)

ALSO JUST RELEASED: THIS WON’T END WELL BUT GOLD WILL SHINE: We Now Have Fewest Stock Market Bears Since January Of 2022 CLICK HERE.

ALSO JUST RELEASED: Look At Who Is Buying Gold Right Now And How This Will Impact The Price CLICK HERE.

ALSO JUST RELEASED: PRELUDE TO FULL-BLOWN PANIC: This Type Of Move Into Gold Has Occurred Only Twice In 50 Years CLICK HERE.

ALSO JUST RELEASED: Turk – Debt Ceiling Deal Suspension Similar To Nixon Taking US Off Gold Standard CLICK HERE.

ALSO RELEASED: BUCKLE UP: The “War On Inflation” Is Creating Even More Inflation CLICK HERE.

Nomi Prins just predicted the price of gold will hit $3,500 next year and also said the US is the biggest Ponzi scheme in the world in this powerful audio interview CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.