Look at this inflation, plus testing time.

Big Inflation

February 14 (King World News) – Unusual Whales: Price changes over last year:

Fuel oil: +27.7%

Gas utilities: +26.7%

Transportation: +14.6%

Electricity: +11.9%

Food at home: +11.3%

Food away from home: +8.2%

Shelter: +7.9%

Overall CPI: +6.4%

New cars: +5.8%

Gasoline: +1.5%

Used cars: -11.6%

High Rates For Some Time

Peter Boockvar: Ahead of CPI, the jobs number a few weeks ago and constant Fed rhetoric since definitely succeeded as of now to convince the Treasury market that the Fed is not done hiking and they will NOT be cutting rates in the back half of this year. That of course is how that market feels today and can always change but for now, only the December 2023/January 2024 fed funds futures contract does a rate below 5% show up and barely. The peak rate is seen in August at 5.19%. I’ll say again, either way, the Fed is still almost done hiking and people need to shift their attention to living with high rates rather than how much higher they’ll go from here. Keeping rates higher for a while is itself a continued form of monetary tightening when you go 15 years with pancake like rates and in one year thereafter they go vertical. And don’t forget QT…

This Is Now The Premier Gold Exploration Company In Quebec With Massive Upside Potential For Shareholders click here or on the image below.

Coca Cola (a stock we own) is following all of its peers where pricing is driving all of their revenue. In their just reported quarter, revenues grew by 15% y/o/y while ‘unit case volume’ fell 1%.

So rather than taking advantage of a below $80 WTI price to restock and cover their short, the Department of Energy is instead pressing their shorts by selling another 26mm barrels of crude oil. After the short term impact it is another reason to be bullish on the price of oil. I’ll ask the DoE, what if the price of WTI never ends up getting to $70, are you going to chase it higher in order to refill the SPR at some point?

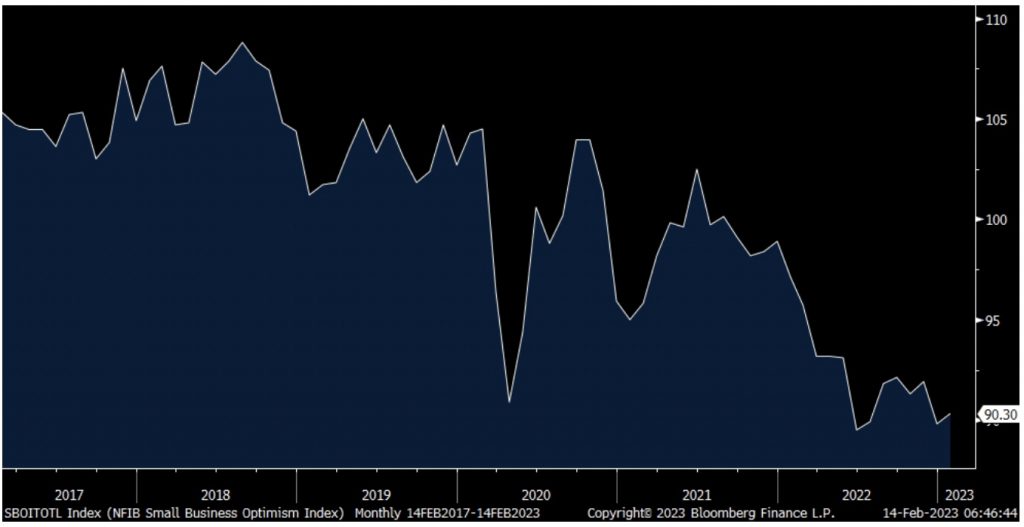

Small Business

The January NFIB small business optimism index rose .5 pt to 89.8 after falling by 2.1 pts in December. The components were pretty mixed though. Plans to Hire rose 2 pts but it’s still tough finding workers as Positions Not Able to Fill rose 4 pts to a 3 month high. Current compensation rose 2 pts to match a 6 month high but compensation plans fell by 5 pts. Those that Expect a Better Economy rose 6 pts after falling by 8 pts last month but those that Expect Higher Sales fell 4 pts to a 5 month low. Of note too, those that plan on Increased Capital Spending dropped by 2 pts to 21%, the least since March 2021 which if it became broad based across the economy would be a big missing leg to the economic stool.

Those that Plan to Increase Inventory declined by 4 pts to the least since 2009 and will be a GDP drag in the 1st half of 2023 after the big build in Q4 2022. Those that plan on Higher Selling Prices fell 1 pt to the lowest since May 2021 but the NFIB said it is “far too high to be consistent with 2% inflation.” The Earnings Trend rose 4 pts after falling by 8 pts last month. Credit access remains tight but 1 pt less so.

The NFIB said:

“While inflation is starting to ease for small businesses, owners remain cynical about future business conditions. Owners have a negative outlook on the small business economy but continue to try to fill open positions and return to a full staff to improve productivity…Count small business owners among the crowd predicting a recession this year.”

And I keep hearing more economists talk about ‘no landing’ or an acceleration in economic growth. So the most aggressive rise in interest rates in a 12 month span is going to result in ‘no landing’? I just don’t think so.

NFIB

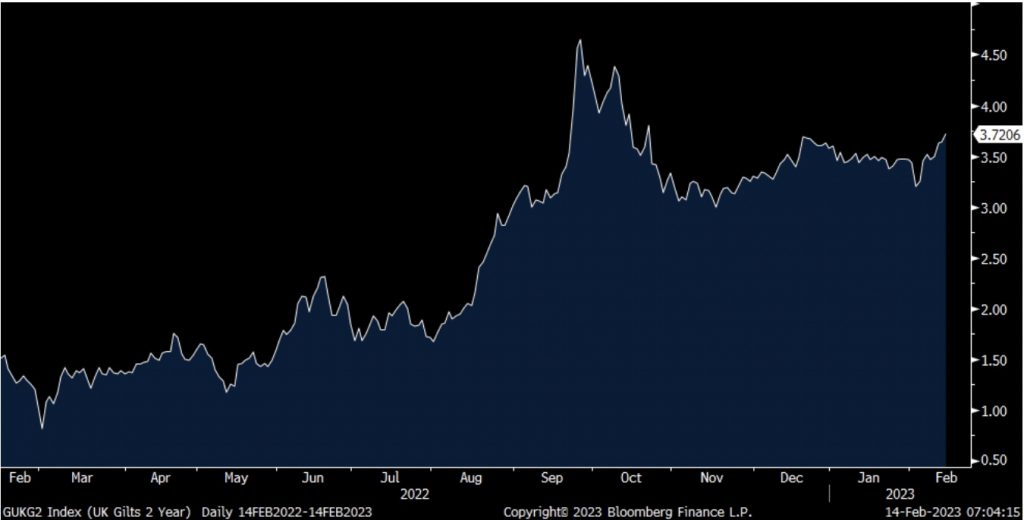

The Bank of England’s job remains tough too after the UK reported a 6.7% y/o/y wage growth ex bonus print for the 3 months ended December. That is the 2nd highest level in at least 20 years that I have data on. While great to see higher wages for UK workers, it still remains well below CPI. Their labor market is tight too with an unemployment rate at just 3.7% after more jobs than expected were added. The January jobless claims figure saw a decline of 12.9k and December was revised to a drop too. In response to the hotter jobs data, gilt yields are higher with the 2 yr yield up 8 bps to 3.72% and that is the highest since October. The 10 yr yield is up by 5 bps to 3.45% and the pound is higher.

2 Year Gilt Yield

Testing Time

Art Cashin, Head of Floor Operations at UBS: As I said earlier to Morgan Brennan on CNBC’s Squawk on the Street, the market is going through a phase of testing and retesting itself. While the CPI number this morning looked “okay”, after a quick rethink, it was recalled that they had reweighted several aspects of the indicator and that raised some questions as to whether it was good or not and we went from being up in equities to losing ground and now they continue to take their own pulse and their own temperature.

As I said to Morgan, the S&P looks at resistance up at 4165 maybe 4170 and on the downside, if we break below 4100, that is important and most particularly, if we break below 4090, that would make it a bit of an outside reversal day.

The short-term cycles, as we told you a couple of days ago, indicate a lean to the downside as we go into the end of the week and actually into the last two weeks of February. So, we will wait to see and, as we further discussed, the balloon and unidentified flying objects are troublesome, but have not yet been a market factor. If they were, we would have felt it much more strongly.

So, keep your eye on the ten-year. Up above 3.75% could put pressure on the market and, if they do spike higher and attack 3.82%, that can be technically critical.

Stay safe.

Arthur

ALSO JUST RELEASED: SPROTT: The Bull Market Nobody Is Watching In Its Early Stages CLICK HERE.

ALSO JUST RELEASED: LOOK AT THIS: The Big Lie About Gold And The US Dollar CLICK HERE.

ALSO JUST RELEASED: Greyerz – There Is A Financial Nuclear Event On The Horizon CLICK HERE.

ALSO JUST RELEASED: THE END OF FIAT CURRENCIES: We Are Going Into A Post-Fiat Currency World CLICK HERE.

ALSO JUST RELEASED: A Monster Rally In Gold And Oil May Be Directly In Front Of Us CLICK HERE.

To listen to James Turk discuss the post-fiat currency world CLICK HERE OR ON THE IMAGE BELOW.

To listen to Alasdair Macleod discuss the big surprise for the gold and oil markets as well as what other surprises are in front of us CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.