On the heels of the announcement that the largest gold producer in the world Newmont Mining and will be merging with the 6th largest gold producer in the world Newcrest, this has many wondering if this will kickoff a golden wave of merger mania in the future because large miners outside of Agnico Eagle do not have growth profiles.

Gold

February 6 (King World News) – Ole Hansen, Head of Commodity Strategy at SaxoBank: Gold trades lower, but so far, the correction is a weak one.

Gold’s long overdue correction accelerated on Friday after stronger than expected US job and ISM reports saw the price tumble below support-turned-resistance at $1900, before bouncing overnight over rising US-China tensions. The trigger being the stronger dollar and higher yields on concerns the Fed would have to maintain its rate hike cycle for longer, while the driver was long liquidation from recently established hedge funds long.

So far, however, given the length gold has travelled since the November low, the correction has been small with gold already finding support below $1870, and if that held it would send a signal about a weak correction within a strong uptrend. Next level of support at $1845 followed by $1828. Bullion-backed ETF holdings meanwhile remain stuck near a 3-year low with no sign of support from long-term investors.

Golden Wave Of Merger Mania

Fred Hickey: Largest gold miner (Newmont) merging with the 6th largest gold producer (Newcrest). Wonder if this deal will kick off another round of acquisitions/consolidation? Pressure to do so. The big gold miners (excluding Agnico Eagle) don’t have growth profiles…

ALERT:

Powerhouse merger caught Rio Tinto’s attention and created a huge opportunity in the junior gold & silver space CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Central Bank Jawboning

Peter Boockvar: After the sharp but somewhat inexplicable rally in European bonds last Thursday on the day of the ECB meeting, ECB members today are talking tough still about the desire to raise interest rates further. This also follows the US jobs report and the jump in yields that followed. The usually hawkish ECB council member Robert Holzmann said “The risk of over tightening seems dwarfed by the risk of doing too little. Monetary policy must continue to show its teeth until we see a credible convergence to our inflation target.” Bostjan Vasle, another council member, said “For the time being, we are firmly determined to continue with the increases…With core inflation persisting at such high levels, it’s clear rates will have to be moved into a restrictive zone.” Finally, Martins Kazaks, a council member as well, said “If the incoming data meets the ECB council’s current expectations then the rates will be raised by 50 bps in March.”

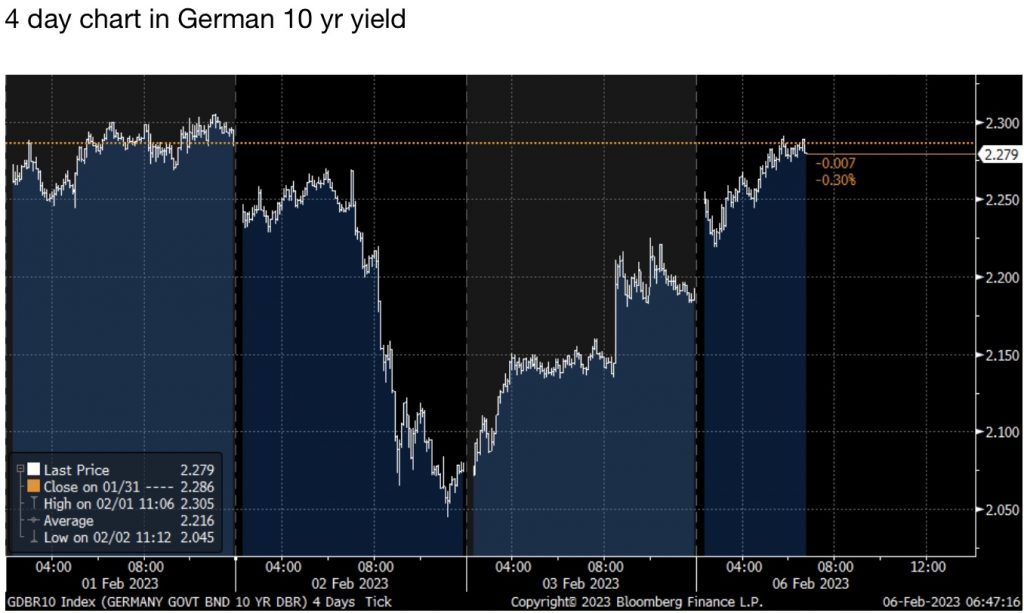

The German 10 year yield which fell 20 bps last Thursday is now up 20 bps between Friday and today. The 2 yr yield is higher by almost 10 bps the past two days after dropping by 18 bps last Thursday.

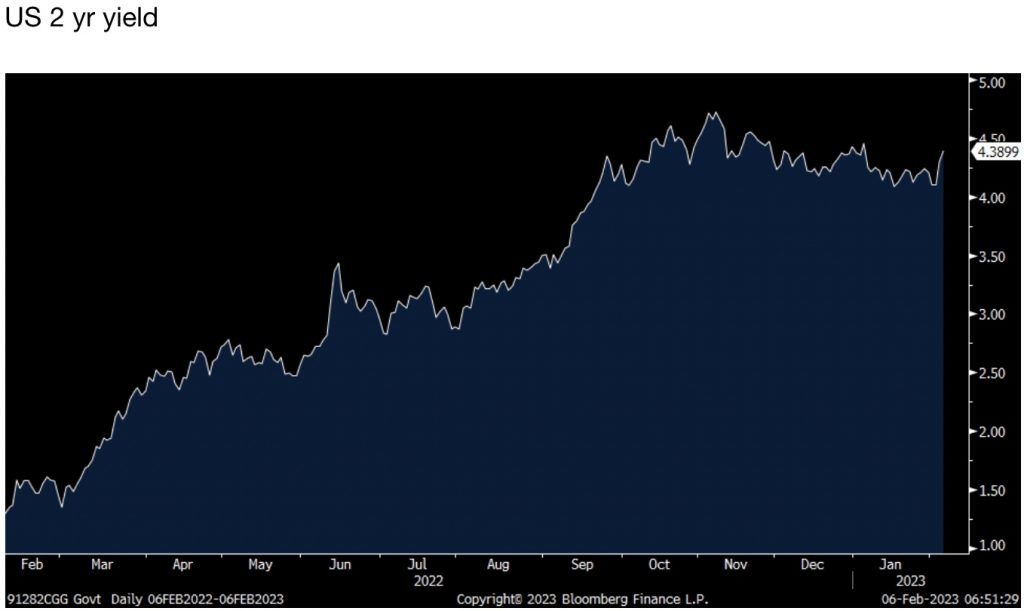

The French 10 yr yield also got back what it lost last Thursday. In turn, US Treasuries are selling off too again with the 10 year yield now up 27 bps off that 200 day moving average I pointed out last week. The 10 yr US yield is quietly at a 4 week high and the 2 yr yield is at a 4 1/2 week high at 4.39%, up 28 bps in 2 days, essentially adding another Fed rate hike. The 2s/10s inversion as a result is at the deepest since mid December at 79 bps.

UK bonds are also selling off after BoE member Catherine Mann talked tough too.

“The consequences of under tightening far outweigh, in my opinion, the alternative. We need to stay the course, and in my view the next step in bank rate is still more likely to be another hike than a cut or hold.”

The 10 yr gilt yield fell 30 bps last Thursday when the BoE hiked and is up by 22 bps since. The 2y yield is up 23 bps Friday and today after falling by a like amount last Thursday. The pound is little changed after Friday’s selloff.

The other central bank news is the story BoJ Deputy Governor Masayoshi Amamiya was asked whether he wants Kuroda’s job. As a fellow dove, it would be an easy pick for the Japanese government but the government is denying they asked Amamiya. The yen is selling off because if Amamiya is appointed, we should not expect a profound change in both yield curve control and negative rate policy as any change would be more gradual. That said, policy is still most likely going to tighten further with another widening of the YCC band likely in April and possibly a move out of NIRP. The 9 yr yield was higher by 3 bps after falling by 6 bps last week. It’s back to .50% as is the 10 yr yield. The 40 yr yield too was up by 3 bps. This situation is important to watch for the world’s bond markets, as you’ve heard me say plenty of times before.

More Higher Wage Pressures

Highlighting again the earnings leverage that blue collar workers have, watch the battle between Disney World and its unions. Disney World wants to give a $1 per hour raise each year for 5 years for the current $15 and there would also be some retroactive pay increases and the combined impact would be an almost 10% raise. The unions want a $3 per hour hike for the 75% of the workers now getting $15 per hour, about a 20% pay raise. The president of the Services Trades Council Union said “I think the workers at Disney World have sent a loud message that $1 is not enough. The company needs to provide a meaningful wage increase that addresses the economic issues that workers are facing.” Unions represent about 32,000 Disney World employees.

And the leverage is not just in the US. The German labor union Verdi wants a 15% wage increase from Deutsche Post.

The mood continues to improve in Europe as measured by the Sentix Investor Confidence index which rose to -8 from -17.5 and much better than the estimate of -13.5. While still below the February 2022 print (thus right before the invasion) of +16, it’s the best since March 2022 when it initially plunged. Sentix said:

“The increase signals that a recession is off the table for the time being. Instead, the scenario of stagnation is gaining in contour.”

A warmer winter and the China reopening are certainly helping the mood.

ALSO JUST RELEASED: The Global Financial System Is Already Doomed And The Collapse Will Be Terrifying CLICK HERE.

To listen to Stephen Leeb discuss Putin, gold, China, the US and what surprises to expect in 2023 CLICK HERE OR ON THE IMAGE BELOW.

To listen to Alasdair Macleod discuss the $100 takedown in the paper gold market and what to expect next CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.