As we near the end of trading in the month of February, one of the greats in the business asked, is deflation bad? Plus a look at what is happening with home prices and inventory.

Deflation Is Bad?

February 26 (King World News) – Peter Boockvar: It bothers me when people just assume the deflation is all bad and something to be avoided at all costs. It’s a big mistake to broadly assume that. It’s bad for someone who has too much debt but it’s great for others who would benefit from lower prices, like consumers. Lower prices raise real wages and increases spending power. Lower prices make things more affordable for more people. Also, deflation in technology is a given and look at the wonders it has created. So when I hear that deflation in China is the bogeyman, it is for those who have too much debt but it is a great thing for the Chinese consumer…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Lower Prices Sparks Buying

In the business section of the NY Times over the weekend, there is an article titled “Low Prices Lure Visitors to China from Hong Kong…Seeking deals on everything from food to dental work in the mainland city nearby.” So when someone tells you that deflation, aka lower prices, delays consumer spending because people will just wait for even lower prices, don’t believe them. Consumers LOVE discounts and are all over them when seen. How do we think Walmart became so successful? Certainly not from ‘Everyday High Prices’ but instead ‘Everyday Low Prices.’ The stock market is the only thing that gets people excited when it says ‘Everyday High Prices’ as the opposite scares everyone out of stocks when it should be the opposite. https://www.nytimes.com/2024/02/20/business/hong-kong-shenzhen-shopping.html

Real Estate

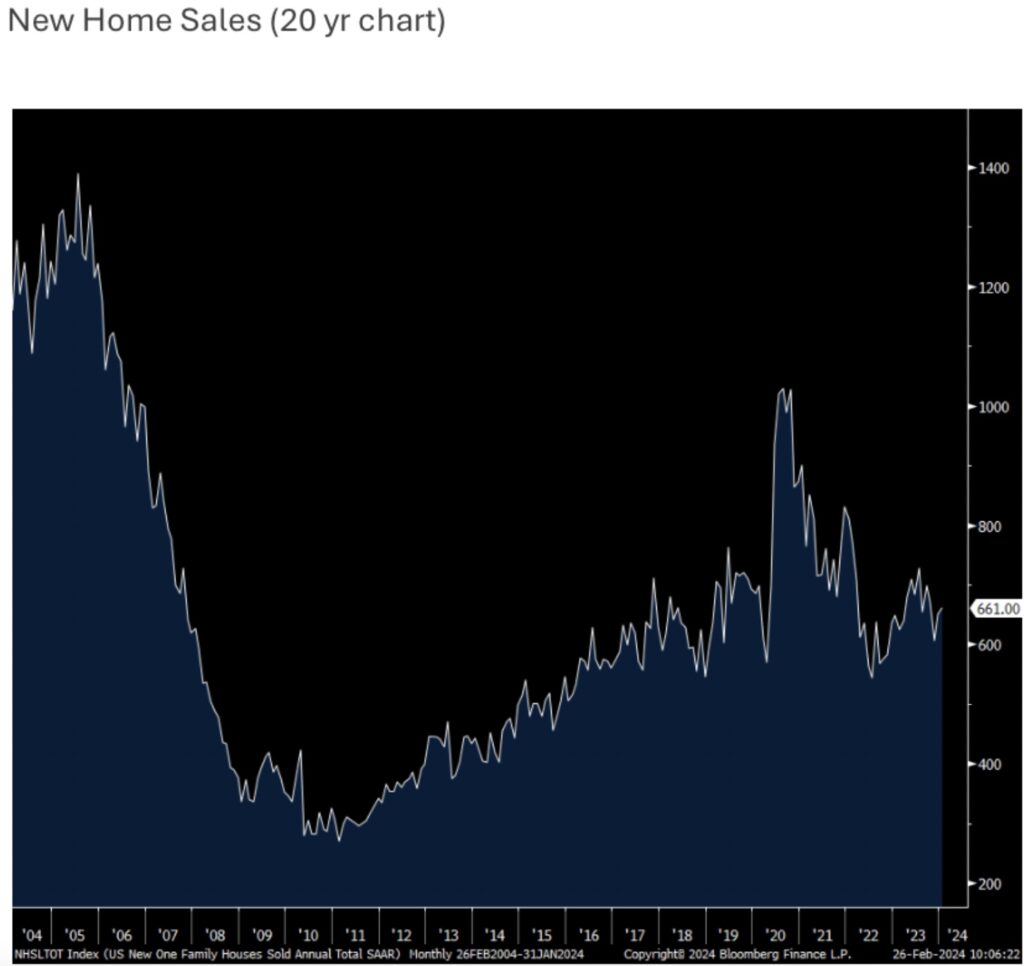

New home sales in January totaled 661k, 23k less than expected and compares with 651k in December, revised lower by 13k.

As this is a volatile data point it’s important to smooth it out. The 3 month average is now 640k vs the 6 month average of 657k and vs the 2023 average of 666k. For further perspective, the 2019 average was 685k and it got over 1mm in mid 2020.

Months’ supply held at 8.3 and the median home price fell 2.6% y/o/y (very influenced by mix).

Bottom Line

Bottom line, a lot is flowing thru here. We have the big home builders that are doing well and filling the need for more inventories but many smaller builders just don’t have the balance sheet in this high cost of capital environment to do the same. Also, the big builders have a better ability to discount and buydown mortgages relative to smaller ones. Lastly, it’s hard to deny the major affordability squeeze on the first time buyer with high home prices and mortgage rates that are double the level pre 2022, even with buydowns.

Big picture, when searching for a real notable increase in the inventory of homes for sale in the coming decade, I see it really only coming from baby boomers who decide to down size.

To listen to Alasdair Macleod discuss what is happening behind the scenes in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.