With the metals off to a good start in 2017, is the price of silver getting ready to rip higher?

By Bill Fleckenstein President Of Fleckenstein Capital

January 18 (King World News) – There has been a fair amount of motion in a lot of markets since the last Rap on Thursday, but I don’t think much has changed from a sentiment standpoint, at least not enough to trigger any new investment implications. However, sentiment has been so lopsided in the stock market and the dollar not much has to change for them to see setbacks, and we have seen a tiny bit of that, particularly regarding the dollar…

IMPORTANT:

To find out which high-grade silver mining company billionaire Eric Sprott just purchased

a nearly 20% stake in and learn why he believes this is one of the most

exciting silver stories in the world – CLICK HERE OR BELOW:

Good But Not Good Enough Overnight equity markets, were uninteresting and the action here saw the indices slightly higher early on. Not much remarkable has yet come out of earnings season, except to say that good news hasn’t really powered stocks that much higher, especially in the financial universe, where J.P. Morgan, Citigroup, and Goldman Sachs have all reported “wins” but their stock prices have been unable to rally. On the other hand, Target reported bad news and was thumped, although some might argue it could have been hit harder. Perhaps we may not know what the market really wants to do until we get past the inauguration on Friday.

In any case the market went nowhere today with the indices mixed and the Nasdaq the strongest (barely). Away from stocks, green paper has recently seen a setback, although today it was considerably higher. Fixed income was very heavy, oil lost 2%, the metals lost about 1% (silver was a bit stronger), and the miners suffered to some degree given their recent run, but on balance held up well. (Obviously, the metals and miners saw a nice bounce while I was traveling while a handful of them have announced production guidance figures, which for the most part have looked inline to slightly better.)

Included below are four questions and answers from the Q&A’s with Bill Fleckenstein.

Bonus Q&A

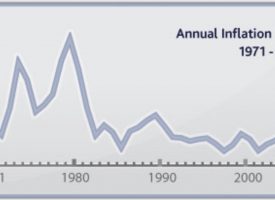

Question: David Rosenberg: “…anyone who thinks one man can reverse on his own the structural forces that led to the multi-year disinflation trend — and I’m talking about excessive debt, globalization, aging demographics and technology — needs to go back to economics school right away…even the mighty Ronald Reagan, despite all the great things he did, fulfilled barely over 50% of his campaign promises. Looking at data compiled by FiveThirtyEight, U.S. presidents historically keep little better than 60% of their promises….”

Question: David Rosenberg: “…anyone who thinks one man can reverse on his own the structural forces that led to the multi-year disinflation trend — and I’m talking about excessive debt, globalization, aging demographics and technology — needs to go back to economics school right away…even the mighty Ronald Reagan, despite all the great things he did, fulfilled barely over 50% of his campaign promises. Looking at data compiled by FiveThirtyEight, U.S. presidents historically keep little better than 60% of their promises….”

(1) In line with the drift of both quotes, you think that U.S. GDP in the next year or so will decline from 2016?

(2) Apparently in contrast to them, you think that U.S. inflation in the next year or so will increase from 2016?

Answer from Fleck: “GDP could be higher due to a low starting point, or not. Too hard to say just yet. Inflation will be higher.”

Question: Finally the market works out the Don wants a weaker dollar. Keep talking Donald, keep talking………..Weakening of the over valued dollar is just the tonic us PM bulls need

Answer from Fleck: “He wants a lot of things both way.. Gonna get pretty bumpy soon.“

Question: Bill, can you make any parallels to today’s seemingly euphoric state to past market tops? CNBC was showing bullet points today on how earnings were going to rise 20+%. WTH is going on?

Answer from Fleck: “I have discussed repeatedly since the election the parallels between now and 1980 with shades of ’99 and ’07 thrown in.”

Is The Price Of Silver Getting Ready To Rip Higher?

Is The Price Of Silver Getting Ready To Rip Higher?

Question: Hi Fleck, It “feels” like silver is getting ready for a decent rip higher soon. Do you and/or your silver friends share that view? Thanks.

Answer from Fleck: “Yes.”

***To subscribe to Bill Fleckenstein’s fascinating Daily Thoughts CLICK HERE.

***KWN has now released the fascinating audio interview with the top trends forecaster in the world, Gerald Celente, who discusses the big surprises ahead in 2017, gold, China, and much more, CLICK HERE OR ON THE IMAGE BELOW.

***ALSO JUST RELEASED: Jamie Dimon Just Warned The Euro Zone May Not Survive CLICK HERE.

***KWN has also recently released the extraordinary audio interview with the man who advises the most prominent sovereign wealth funds, hedge funds, and institutional funds on the planet, Michael Belkin, and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

***KWN also released one of Marc Faber’s greatest audio interviews ever and the overseas line was crystal clear for the recording. Faber covers the great danger facing the financial system in the coming year, what his predictions are in 2017 for global markets, stocks, bonds, gold, silver, mining shares, etc, what investors should be doing with their money right now, what has the wealthy so worried in 2017, how Trump will impact major markets, and much more, and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

© 2017 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.