2025 is setting up to be a big shock for the US dollar and gold.

Mining Shares Are Cheap

January 2 (King World News) – James Turk: Mining shares are an investment, and buying them requires the same care and attention needed for any investment. And investments are fundamentally different from gold and silver, which are money.

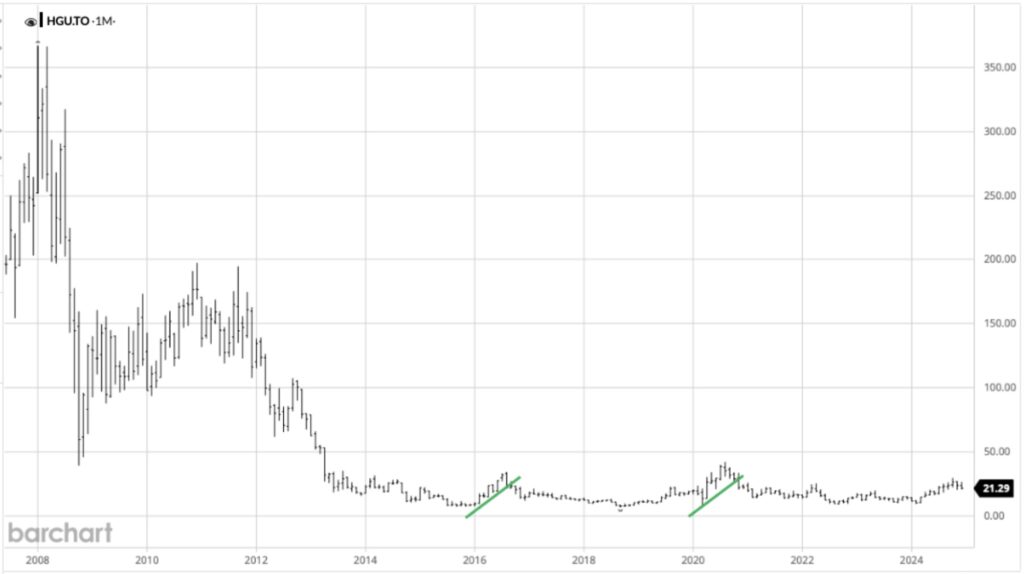

The following is a long-term chart of the BetaPro Gold Miners 2x Bull ETF that trades on the Toronto Stock Exchange. It is comprised of a diversified mix of large and small Canadian listed gold companies.

It is a leveraged ETF, which increases the volatility of shares and highlights the risk, but I’ve chosen it to make my point. The leverage helps accentuate the extreme undervaluation of the mining shares today compared to their bull market that ran higher along with the commodity bull market leading up to the 2008 Great Financial Crisis.

Back then this ETF reached its all-time high of CAD 367.00 (USD 359.45) on January 14, 2008 when gold that day was CAD 920.53 (USD 901.60). On December 31, 2024, gold closed at CAD 3,778.35 (USD 2,627.50), up tenfold in CAD. Nevertheless, this ETF closed 2024 at CAD 20.88 (USD $14.52).

Though up from its record low of CAD 6.74 (USD 5.13) on September 11, 2018, this ETF is a mere 5.7% of its record high in CAD, and an even worse 4.0% in USD. These numbers shout undervaluation.

Note the two green trendlines marking two dead-cat bounces in 2016 and 2020. I expect in 2025 at the very least another similar bounce, but there is always the possibility that this very undervalued sector will come to life like it has before, which makes the precious metal mining sector compelling…

ALERT:

Look at which company has positioned itself to become the next K92 high-grade gold powerhouse! CLICK HERE OR ON THE IMAGE BELOW.

Favorable Risk/Reward For Miners

So I suggest to KWN readers that after their analysis of the precious metal miners and they are prepared to take the risk, the risk/return criteria of this sector looks favourable. We may not see the heights the mining shares enjoyed back in 2008. Regardless, the precious metal miners look undervalued with good upside potential, but keep an eye on energy prices, a major operating expense.

Crude oil and natural gas have been out of favour and are also undervalued. I don’t expect them to remain that way, so a rising cost of energy could put a damper on the earnings of miners if gold and silver prices don’t keep up with rising energy prices in 2025 and beyond.

I’d like to add a word of warning here about bitcoin, Eric. Followers of my work know that about ten years ago I set $100,000 per coin as a bitcoin target, which has now been reached. Further, they also know that I see bitcoin and gold to be complementary. Both offer escape from fiat currency.

However, to achieve the status as an alternative to fiat, bitcoin needs to stop trading like a tech stock. Bitcoin needs to de-couple from them and the overvalued Nasdaq Index.

When comparing bitcoin’s market cap to global purchasing power (i.e., the market cap of gold, silver, and fiat currencies, namely, world M3), bitcoin still looks like relatively good value and could therefore climb higher as purchasing power moves out of fiat into bitcoin, just like it has been doing since 1971 for gold and silver. But if the tech stocks continue to unwind and bitcoin falls with them, one has to consider the possibility that bitcoin has topped out, an outcome the following chart is also suggesting. The pattern looks toppy, suggesting that going forward, gold outperforms bitcoin.

Regarding The US Dollar

I’d like to conclude, Eric, with some comments on the dollar. Few are paying attention to the US government’s dire financial position, which directly impacts the dollar.

The dollar at the moment is riding high because it is seen as a better bet than any other fiat currency, and in the buying frenzy of a 2008-like crisis, the dollar could climb higher. However, the Fed will continue to fund the federal government’s deficits, and that causes inflation, a reality that hits home eventually and probably this year. Circumstances are beyond the stage of just cutting expenses – which is kick-the-can down the road propaganda to give the impression that something is being done to fix the underlying problems, but we are beyond that stage.

Back in April 2010, I coined the term “Havenstein Moment” after the hapless Reichsbank governor who financed the never-ending spending of the federal government of Weimar Germany causing the Reichsmark’s collapse in hyperinflation. The US federal government passed its “Havenstein Moment” back then because instead of ‘tightening its belt’ to put a lid on spending, it turned to a compliant Federal Reserve that to this day continues to ‘print’ just like Herr Havenstein, which brings up one last point, Eric.

In my writings over the years I have been warning that the dollar – which is a unconstitutional creation of the Federal Reserve and not the constitutional gold and silver coin of the US Treasury – is on a dangerous path heading for a cliff. That path is much longer than I expected, but it’s the same path of the Continental currency, America’s first currency. It collapsed in hyperinflation that led to economic chaos. The framers of the Constitution then set out to create a more perfect Union based on gold and silver coin, and so it was until 1913.

That year the Federal Reserve was created and two amendments to the Constitution fundamentally changed its core elements that were necessary and essential checks and balances that gave the States and the American people the tools needed to exert discipline and control over the federal government. We are living with the unfortunate consequences of those changes – soaring federal debt, reckless government spending, greater poverty, income inequality, etc.

The rejection of Keynesian fascism is needed, as is the return to constitutional money before the dollar collapses and creates economic chaos, just like what happened with the Continental’s collapse in America in the 1780s and since the end of World War II, dozens of other countries using fiat currency.

So does the dollar go over the cliff this year? Timing of course can’t be predicted, but we can deduce outcomes from logic as well as history because it is known to repeat. In case it does repeat for the dollar, as I logically expect, we need to be prepared by owning constitutional money, physical gold, and if you believe silver is undervalued, then own some physical silver too.

Best wishes to everyone for a Healthy, Prosperous, and Happy New Year !!

SNEAK PEEK: Top Trends For 2025!

To listen to Gerald Celente discuss the shocking top trends for 2025 CLICK HERE OR ON THE IMAGE BELOW.

Also Just Released!

To listen to Alasdair Macleod discuss the big surprises to expect as we kickoff 2025 next week CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.